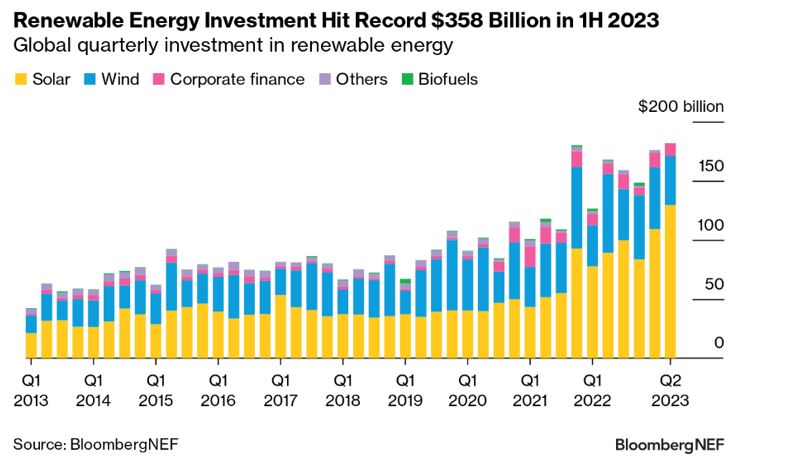

Renewable Energy Investment Hits Record-Breaking $358 Billion in 1H 2023

- Global new investment in renewable energy skyrocketed to $358 billion in the first six months of 2023, a 22% rise compared to the start of last year and an all-time high for any six-month period. This is based on the latest investment data from BloombergNEF’s 2H 2023 Renewable Energy Investment Tracker report, published on August 21, 2023.

Of this total, $335 billion was for project deployment through both asset finance and small-scale solar. This was 14% greater than in the first six months of 2022 and reflects the continuing acceleration of the energy transition as renewable energy scales up.

Renewable energy companies have also had success this year raising equity to support their growth and expansion. Venture capital and private equity expansion commitments to renewable energy companies reached $10.4 billion in 1H 2023, up 25% from 1H 2022. New equity raised on the public markets totaled $12.7 billion during the first six months of the year, up 25% from 1H 2022.

China was again the largest market in 1H 2023, with $177 billion of new investments, up 16% from 1H 2022. The US secured $36 billion, while Germany drew $11.9 billion.

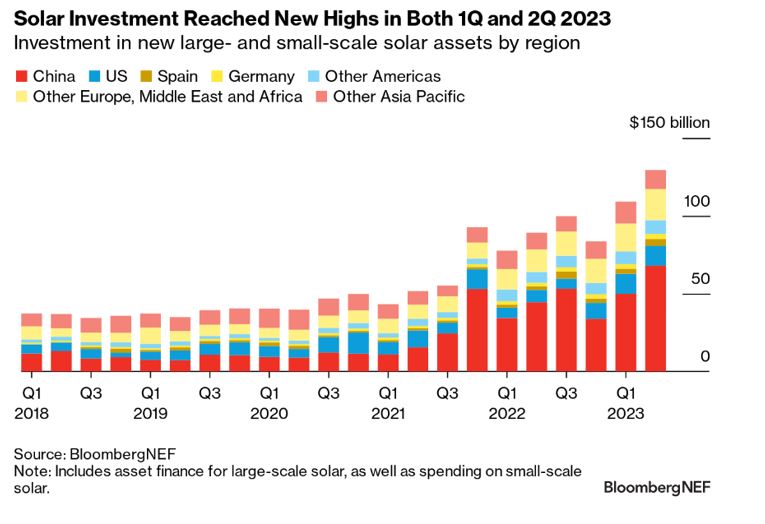

Solar investment keeps breaking records

Solar was the key driver of the stellar 1H 2023 results. A total of $239 billion was invested in large- and small-scale systems, making up two-thirds of total global renewable energy investment over the first six months of the year and marking a staggering 43% rise compared to 1H 2022.

China accounted for roughly half of all large- and small-scale solar investment in 1H 2023. This was mainly driven by lower module prices, a robust rooftop PV market, and the commissioning of the country’s so-called energy megabases, which aim to develop large-scale wind and solar installations mainly in desert areas.

The United States was a distant second, with $25.5 billion invested in large and small-scale solar during 1H 2023. However, this was an all-time record and an impressive 75% increase from 1H 2022 as supply chain constraints eased and clarity grew around the country’s landmark Inflation Reduction Act (IRA).

In the Europe, Middle East and Africa (EMEA) region, multiple countries saw record-breaking investment including Germany, Poland and the Netherlands, with demand driven by Russia’s invasion of Ukraine and the subsequent energy crisis in Europe. South Africa also saw record investment on the back of power blackouts and new tax incentives, while the NEOM PV plant for dedicated hydrogen production contributed to a record six-month period of solar investment in Saudi Arabia.

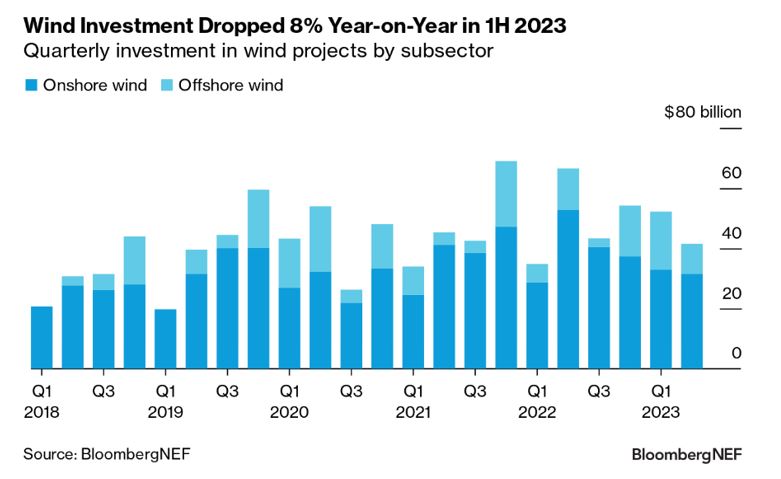

Wind investment takes a hit as development woes catch up to asset financing

In sharp contrast to the growth in solar investment, wind power investment declined 8% compared to 1H 2022, reaching $94 billion over the first half of 2023.

Onshore wind investment has declined for four straight quarters. The sector received $64.5 billion of investment in 1H 2023, a 21% drop compared to the first half of last year. Grid constraints, permitting challenges and faltering policy support in multiple markets are leading to a reduced global pipeline of ready-to-develop projects, which in turn is denting asset financing volumes. China accounted for two-thirds of onshore wind investment, with $38 billion invested in 1H 2023. This marked a 22% decline compared to 1H 2022, as falling equipment costs have allowed each dollar invested to go further and as a smaller share of large megabase projects still awaited financing.

Offshore wind investment posted a strong 47% increase relative to 1H 2022, to $29.2 billion over the first six months of 2023. Europe accounted for the majority of this growth, with $9.4 billion more investment in 1H 2023 than in 1H 2022. Japan and Taiwan also experienced growing offshore wind investments. All the same, rising offshore wind investment was unable to offset the declines in onshore wind at a global level.

Still short of a net-zero path

The rate of spending on renewable energy deployment, across both asset finance and small-scale solar, needs to rise 76% to align with a net-zero pathway.

According to BNEF’s New Energy Outlook, the world needs to spend a total of $8.3 trillion on renewable energy deployment between 2023 and 2030 to align with a global net-zero trajectory by 2050, keeping global warming well below 2°C. This is equivalent to $590 billion being invested via asset finance and small-scale solar per six-month period. The $335 billion spent on such activities in 1H 2023 is therefore well below what is required to get on track for net zero.

Compared to other parts of the economy, spending on renewable energy – especially wind and solar – needs to be frontloaded to align with carbon budgets that keep global warming well below 2°C. This is because clean power is essential to support the decarbonization of other sectors, such as industry and transport, via greater electrification.

Also read