Renewable Energy Sector Defies Supply Chain Challenges to Hit a Record First-Half For New Investment

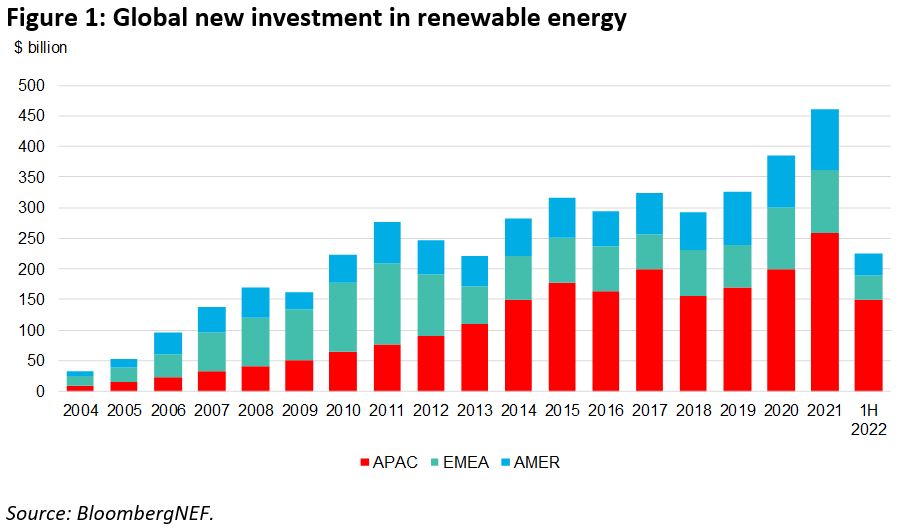

- Global investment in renewable energy amounted to $226 billion in the first half of 2022, establishing a new record for the initial 6 months of a year.

The uptick in investment reflects an acceleration sought after for clean energy materials to take on the continuous global power and climate situations, according to Renewable Energy Investment Tracker 2H 2022, a new report released by study firm BloombergNEF (BNEF).

Investment in new large- and small-scale solar projects rose to a record-breaking $120 billion, up 33% from the initial half of 2021. Wind project funding was up 16% from 1H 2021, at $84 billion. Both sectors have been challenged recently by increasing input prices for key materials such as steel and polysilicon, in addition to supply chain disturbances as well as rising financing expenses. Yet, today's numbers suggest that investor cravings is more powerful than ever, in part because of the really high power costs currently being seen in numerous markets around the globe.

The Renewable Energy Investment Tracker summarizes BloombergNEF's monitoring of international investment in renewable energy approximately as well as including 1H 2022, and also covers both project investments and business fundraising. Along with seeing thriving project investments, the very first fifty percent additionally saw an all-time record for equity capital as well as private equity investments right into renewables as well as energy storage space, with $9.6 billion raised-- up 63% on the previous year.

One category that saw falling investment was public equity issuances. After a very strong very first half in 2021, public market issuances for renewable energy business went down 65% in 1H 2022, completing $10.5 billion. The 2Q figure, at $3.9 billion increased, is the most affordable quarterly overall because 2Q 2020.

Albert Cheung, head of analysis at BloombergNEF, claimed: "Policy makers are increasingly identifying that renewable energy is the vital to unlocking energy safety and security objectives and also reducing reliance on unpredictable energy commodities. Regardless of the headwinds provided by ongoing cost inflation and supply chain challenges, need for clean energy resources has never been greater, and also we expect that the worldwide energy dilemma will continue to serve as an accelerant for the clean power shift."

China published exceptional investment growth in both wind and solar project financing. The country's large-scale solar investments completed $41 billion in 1H 2022, up 173% from the year prior to. It also spent $58 billion in new wind projects, up 107% year-on-year. Nannan Kou, BNEF's head of China analysis, stated: "Green infrastructure is one of the most vital investment location that China is relying on to improve its weak economic climate in the second fifty percent of 2022. The investment growth fad complies with China's strategy to develop new renewable generation capacity to make sure that it can change its existing coal fleet. China is well on the right track to hit its 1,200 gigawatt wind and also solar capacity target by 2030."

Offshore wind was another sector that saw a raw boost, with investment up 52% from the previous year, to $32 billion. Chelsea Jean-Michel, offshore wind analyst at BNEF said: "Investments in 2022 will certainly flow into projects coming online in the following couple of years as the offshore wind set up base is set to expand significantly from 53GW in 2021 to 504GW in 2035. Offshore wind projects enable companies and also governments to make progress in the direction of their decarbonization goals at range. The United Kingdom, France as well as Germany are just a few of the countries that have increased their offshore wind targets in the very first fifty percent of 2022, signifying more assistance for investment in the technology."

Also read