ReNew sees 25% revenue jump however net losses soar as a result of NASDAQ listing

- Indian independent power manufacturer (IPP) ReNew Power posted a 25.6% jump in revenue for the initial nine months of the fiscal year 2022 (FY22) compared to the very same duration in the 2021 fiscal year, while its net losses soared as a result of its August IPO on the NASDAQ.

ReNew's overall revenue for the first 9 months of FY22 was INR51,581 million (US$ 693 million), an increase of 25.6% on the exact same duration in the FY21. The business claimed the development was to an increase in generation capacity and also greater wind Plant Load Factor (PLF) as a result of enhanced wind sources. The PLF for its solar assets continued to be much the same as last year (22% vs 22.3%).

The company's net loss for the initial nine months of FY22 increased considerably, however, as a result of its NASDAQ listing in August 2021. Net losses got to INR12,573 million (US$ 169 million) compared with INR4,093 million (US$ 55 million) in FY21.

ReNew stated the figure included INR13,158 million (US$ 177 million) of costs "related to noting on Nasdaq Stock Market, issuance of share warrants, noting relevant share-based settlements and others."

Other expenses, such as operations and also maintenance and also general management, were likewise up 30% from the initial nine months of FY21 to INR6,495 million (US$ 87 million).

Meanwhile, in Q3 FY22 the developer commissioned 769MW of solar as well as added 260MW of solar possessions through procurements. For the first three quarters of FY22, it appointed 1,325 MW of solar capacity.

As of December 31, 2021, its total portfolio contained 10,331 MW, consisting of 7.4 GW of commissioned capacity (3,749 MW wind, 3,592 MW solar, and 99 MW hydro) and 2.9 GW committed.

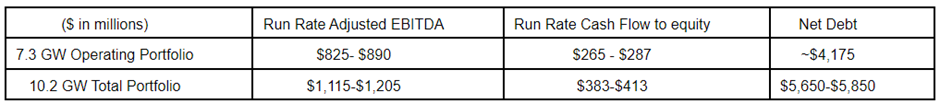

ReNew is reaffirming its run rate changed EBITDA of between US$ 825 to US$ 890 million as well as its cash flow to equity and internet debt advice for its current operating portfolio of 7.3 GW and also total portfolio of 10.2 GW (see table below).

Also read

- Zelestra Clinches $282m Financing for 220-MW Aurora Solar-Storage Hybrid Project

- Enfinity Boosts US Credit Facility to $245m for Solar Growth

- Ellomay Offloads Nearly Half of Italian Solar Portfolio to Clal

- Valeco Secures Solar Power Deal with French SMEs

- Eurowind Energy Commits EUR 175M to Romanian Solar Park