Record deliveries push worldwide solar PV inverter market past $9 billion in 2019

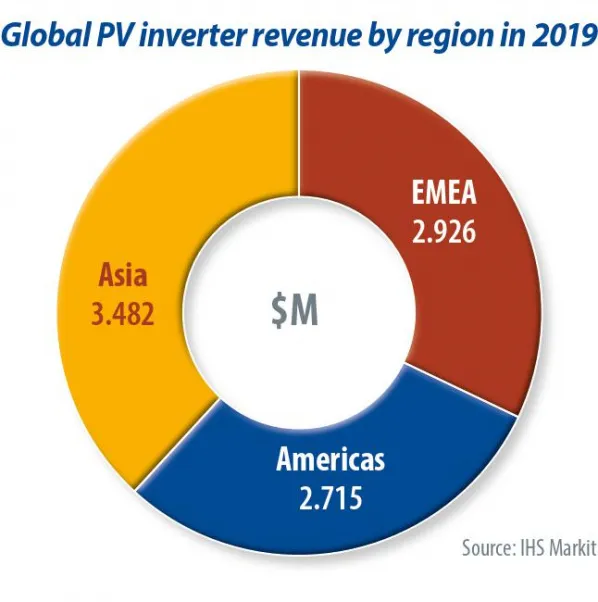

- The PV inverter market accomplished record shipments in 2019, writes IHS Markit's Miguel de Jesus, driven by booming deliveries in crucial markets such as the United States, Spain, Latin America, Ukraine as well as Vietnam. Profits increased rapidly, exceeding the $9 billion mark in 2019 for the very first time.

The international affordable landscape for inverters continues to be fairly consolidated. The leading 10 distributors accounted for greater than 70% of international PV inverter shipments. As the sector continues to appreciate quick development, competitors is expected to intensify amongst PV inverter distributors due to 2 crucial factors: improvements in technology and also the moving balance of global setup development.

Pressing the limits

Several crucial modern technology trends use chances for PV inverter distributors to compete even more boldy in an expanding market. For example, providers remain to release bigger inverters, especially three-phase string as well as main inverters for utility-scale solar PV installments. Over the last couple of years, three-phase string inverter distributors have striven to educate consumers on the values of a dispersed design for massive solar PV systems. Overall, these providers have succeeded, as the infiltration rate of string inverters has actually progressively boosted-- particularly in huge industrial jobs and tiny utility-scale installments. Recently, suppliers have launched string inverters exceeding 200 kW as they begin to compete for larger system sizes as well as bid for extremely cost competitive tasks.

The very same trend is influencing central inverter manufacturers, with leading distributors launching bigger typical sizes. Deliveries of bigger standalone main inverters in between 3 MW and also 4 MW increased by 67% to get to 15.5 GW, making up more than one-third of international main inverter shipments in 2019. IHS Markit expects bigger central inverter deliveries to enhance in the following five years, as central inverter providers aim to complete even more boldy on a cost-per-watt basis, while resisting the infringement of bigger string inverters in utility-scale installments.

As providers continue to press the limits of PV inverter power, they are turning to brand-new products and also software application that can help them make the next leap in innovation. For instance, providers are meticulously keeping an eye on silicon carbide rates, which hold the possibility for inverter developers to build much more effective and also power-dense PV inverters. On the other hand, suppliers throughout the entire balance of systems segment are awaiting signs on a change towards even higher voltages, specifically in utility-scale setups where the requirement has actually swiftly ended up being 1500 V.

Cybersecurity as well as AI

Advanced software application and grid functions such as voltage control, frequency control and also responsive power in the evening have actually ended up being the requirement for inverter providers to be chosen by system proprietors to futureproof their solar financial investments. Advanced software application needs consist of doing operation and also component examinations in real time, such as IV contour diagnostics. These are currently increasingly typical and also offered by leading providers such as Huawei and Sungrow.

As inverters are thought about the minds of solar PV plants, improvements such as artificial intelligence and cybersecurity are taking center stage, because suppliers are trying to include increasing adaptability as well as protection to solar possessions. PV inverter providers acknowledge that solar inverters will progressively connect with the grid from residential level approximately utility-scale systems. Because of this, it will be incumbent on providers to execute the highest levels of cybersecurity to guarantee that energies as well as home owners are safeguarded to the highest standards against any type of harmful attacks to their energy systems.

Residential inverters

The residential PV inverter market was the fastest-growing system kind, enhancing greater than 50% in 2019. Solar inverter distributors offering single-phase as well as three-phase <10kW inverters in their profiles in 2019 were able to make the most of this market chance. Leading module-level power electronic devices (MLPE) suppliers such as SolarEdge and also Enphase-- as well as single-phase distributors such as SMA, Growatt and also Ginlong-- raised shipments to this segment. Key residential markets such as China, United States, the Netherlands, Japan, as well as Australia were instrumental in helping the growth of global residential setups. PV inverter vendors continued to introduce in this section with visually developed products developed to be lighter, smaller sized, extra power-dense, and also with new safety and security features.

Chinese vendors

PV inverter demand lowered for the second year straight in China in 2019 because of decreasing setups. Although China continues to be the biggest solar market on the planet, Chinese suppliers-- which had actually formerly delighted in big development by supplying their domestic market-- have established their sights on international markets to assist limit the influence of a smaller domestic market and also to counter any type of income losses due to ongoing rate stress. China-based distributors boosted their international market share by seven percent points to 38% in 2019.

Specifically, they have actually promptly broadened their visibility across Europe, India, Southeast Asia, and Latin America. Chinese suppliers continue to make considerable financial investments to quickly upgrade their products to satisfy neighborhood grid and also technological needs and established neighborhood sales and solution workplaces. To assist fuel this expansion, some Chinese providers, such as Ginlong and also Sineng, have actually relied on investors by issuing shares in initial public offerings. The outcome is a boost in the variety of the competitive landscape in these areas. Strong growth in brand-new installments in several significant solar markets have actually profited all distributors, consisting of crucial incumbent distributors such as SMA, which has actually kept a historical foothold in its home market in Germany and also across Europe. One more example is Power Electronics, based in Spain, which keeps the leading position in its house market while likewise achieving a dominant placement in catching booming development in utility-scale shipments in the United States.

Overall, an extra diverse group of PV inverter vendors will be competing versus each other in markets throughout the world and also throughout all system kinds, from residential to commercial to utility-scale installations. In the short term, strong cost stress will certainly assist some distributors defend or raise their market share. Long-term, the sector may possibly see further combination, either as vendors triumph and also acquire also greater market shares, or as vendors combine or are gotten to construct corresponding item profiles.

Also read