Record 31.1 GW of corporate clean energy PPAs checked in 2021 amidst rise in activity from tech firms

- A record 31.1 GW of clean energy was gotten by corporations through power purchase agreements (PPAs) last year, with innovation business once more the largest buyers, according to research firm BloombergNEF (BNEF).

Representing a 24% jump on the previous year's record of 25.1 GW, 2021's clean energy PPA figures were underpinned by a rise in task from the largest tech firms, which collectively signed over half of the bargains.

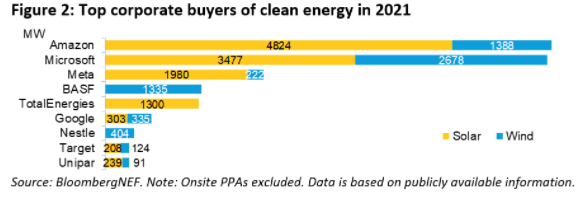

Amazon.com was the biggest buyer internationally for the 2nd year straight, revealing 44 offsite PPAs in nine nations, totalling 6.2 GW. The business said in December it was investing in a host of PV plants in the US and also Europe, having actually authorized its initial renewables PPA in Japan previously in the year.

Amazon.com's complete clean energy PPA capacity is currently 13.9 GW, making its renewables portfolio the 12th biggest around the world amongst all types of business, simply ahead of French utility EDF, according to BNEF.

Revealing its largest-ever renewables PPA deal in July, Microsoft has the next biggest clean energy PPA capacity among corporates, at 8.9 GW. It is complied with by Meta (formerly Facebook), with 8GW, which last year authorized a virtual PPA to obtain power from a floating solar project in Singapore.

" The clean energy portfolios of large tech firms currently rival those of the world's most significant energies," claimed BNEF elderly associate Helen Dewhurst, including that the high boost in tech firms' clean energy volumes purchased reflects mounting pressure from financiers prompting them to decarbonise.

Clean energy agreements were openly introduced by greater than 137 companies in 32 nations in 2021, BNEF's 1H 2022 Corporate Energy Market Outlook reveals, with total signed volumes equal to more than 10% of all the renewables capacity added globally last year.

Beyond of the equation, AES marketed more clean energy to companies than any other programmer globally, at simply under 3GW, according to BNEF. Engie signed more than 2.1 GW of PPAs, while Orsted (1.3 GW), Vattenfall (800MW) and NextEra (700MW) were also claimed to have large years.

By location, the Americas accounted for two-thirds of clean energy PPA activity in 2021, with 20.3 GW of deals revealed, 17GW of which were in the US. BNEF stated that while virtual PPAs remain to dominate the US market, with 12GW of offers, green tariffs with managed energies likewise experienced a record year, at 3.2 GW.

Europe, meanwhile, saw a record 8.7 GW of bargains introduced, with large years from Spain as well as the Nordics. This uptick was regardless of PPA costs increasing in the direction of completion of the year in action to the continent's strengthening energy dilemma

With some developers in Europe aiming to catch high wholesale rates, this has brought about recommendations that the marketplace is presently undertaking a change in the equilibrium of power to the vendor side.

In Asia, simply 2GW of clean energy PPAs were revealed last year, according to BNEF, but both China and also Japan saw record clean energy certificate issuances, while regulations for a corporate PPA version in South Korea was presented in October.

Corporate sustainability commitments are a driving force behind clean energy purchases worldwide, BNEF claimed, with 67 business setting a RE100 target in 2021, promising to balance out 100% of their electrical energy demand with clean energy, bringing the campaign to 355 participants.

BNEF head of sustainability research Kyle Harrison claimed: "A lot more firms are making new sustainability commitments, prices for renewables are plunging as well as regulators around the world are slowly occurring to the fact that clean energy may be a silver bullet in the decarbonisation of the economic sector."

Also read

- Emeren Brings In Boralex Veteran for U.S. Arm, Flags $20 Million Q2 Impairment

- Congress Clears Trump-Backed Bill Slashing Clean-Energy Tax Breaks

- BSR Secures €400M for UK Solar and Storage Expansion

- ARENA Backs Luminous Robots for Solar Innovation Boost

- TotalEnergies Expands Caribbean Renewables, Divests Half Stake of Portuguese Portfolio