Prologis Leads Industrial REITs In Solar Power Deployment

- Prologis is the clear leader in solar energy implementation amongst industrial REITs with 200 MW installed and a 400 MW objective for 2025.

- Commercial-scale solar power shows up to have reached rough expense parity with grid power; the business instance for solar is boosting.

- Market infiltration is really low for both new building and construction and also retrofits; a 15-fold rise for Prologis shows up reasonable.

- LED illumination and also LEED accreditation fostering might offer helpful insight.

Intro

It's evident that business situation for commercial REITs to mount rooftop solar power is not right away compelling today - it is not a default typical function for new stockroom building. A few minutes scrolling around a satellite map shows a great deal of empty stockroom roofing systems and papers the number of past and also existing decisions to not set up photovoltaic panels.

Nevertheless, as costs have decreased, the business instance has ended up being more powerful and also might have gotten to an oblique factor. There go to least 3 elements to business instance for commercial-scale solar energy - price, choice, as well as law:

- Quantifiable reduction in running cost.

- Preference pertaining to environmental qualification as well as efficiency features, independent of price, is perhaps becoming more important to institutional financiers and also to a lot of one of the most desirable renters. This may end up being a significant testing and option requirements for REIT capitalists as well as for commercial room option by renters (marketed as a Green Lease).

- Regulatory needs for energy building efficiency standards might end up being extra common for buildings.

We will certainly additionally briefly think about two associated company choices with comparable service instance criteria - LED lighting as well as LEED qualification - which may provide some understanding on expectations for solar power deployment.

Financial investment Thesis

Prologis (PLD) is the clear leader among industrial REITs in commercial-scale rooftop solar deployment today, determined by variety of installments and by MWhs of power created. It is also first in environmental qualifications. As the largest commercial REIT, PLD brings benefits of scale to this effort.

As business situation for commercial-scale roof solar expands stronger, PLD's experience and also range ought to provide significant advantages. It shows up that company monitoring has actually identified and is moving to maximize this possibility.

Long-term capitalists in commercial property need to examine the benefits that positive as well as methodical administration in this field can yield.

LED Lighting

Business instance for LED lighting has actually ended up being engaging, primarily based on cost. When the oblique point was gotten to, adoption has actually been quick and need to come close to 100% deployment for professionally taken care of (i.e., REIT) storage facility room within a few years.

The Department of Energy just recently reported on LED market penetration here (see especially pages 33-35); ~ 17% for low-high bay illumination by 2018, a 92% rise from 2016. LED illumination is currently a default requirement for new industrial building and construction and is approaching 90% deployment in some commercial REIT profiles.

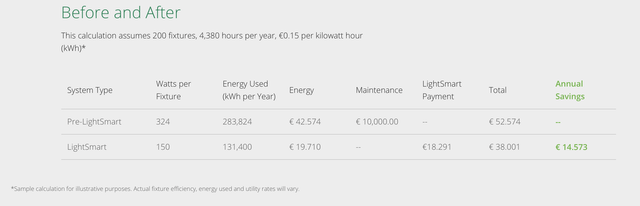

PLD is at 88% in "reliable lights", and has devoted to reaching 100% LED implementation by 2025. To promote this, it presented LightSmart, marketed as Lighting-as-a-Service. PLD will complete installation of new LED components as well as metering to document power usage as well as savings. The firm births the capital expense upgrade expense, and the tenant pays a surcharge.

Right here's an example PLD arise from Italy, revealing a 54% decrease in power use and a 27% lessee lighting cost decrease (after consisting of the lease surcharge for LED).

( Source: PLD Italy).

LEED Certification.

LEED (Leadership in Energy and Environmental Design) is a structure rating system developed by the U.S. Green Building Council. It supplies a system to rate and also accredit a structure's power usage, to name a few ecological efficiency factors. There are several variations and also types of certification. The scores are Certified, Silver, Gold, and Platinum. Although LEED is used worldwide, there are various other regional certification programs.

I would certainly assess business instance for LEED qualification as solid, if not yet fairly compelling, and also based as much or a lot more on preference instead of cost. Layout to LEED standards, if not actual qualification, is coming close to default condition for new building by leading commercial REITs.

Supporters claim reduced operating costs, increased lease, and higher structure value. The available researches appear to be a bit outdated, as well as some verdicts are disputed. Nonetheless, energy price financial savings of as much as 25% are claimed, and rental premiums from 0-17% are reported right here. A 2015 Department of Energy meta-analysis of 50 research studies discovered positive impacts.

PLD worked with the USGBC beginning in 2014 to create a Volume Program for LEED accreditation, resulting in quicker, extra efficient certifications with minimized fees and also costs. The business has actually utilized this program to certify greater than 80 structures worldwide. PLD and Duke Realty (DRE) are business participants of the USGBC.

On-site solar power generation is not needed for LEED accreditation, however it might offer qualification points (see LEED V4 for Building Operations and also Maintenance, e.g. solar roofings on car park structures, temporal load shifting, meeting part of building power requirements with solar power).

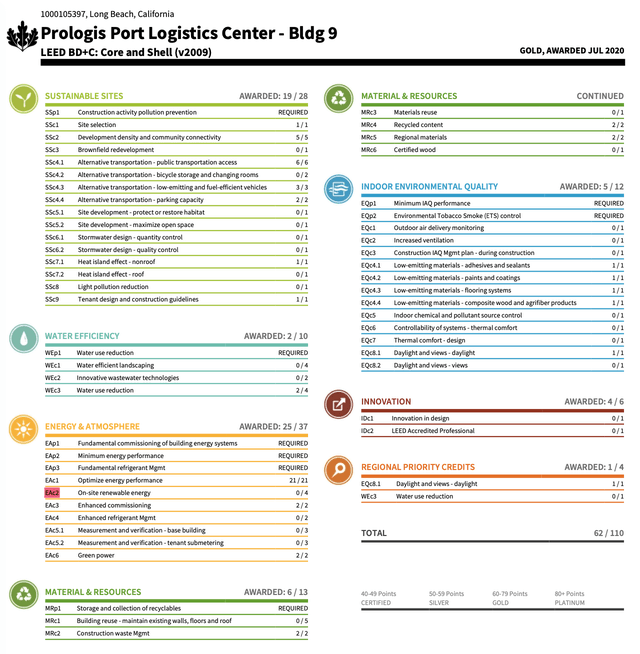

The scorecard below details the results of a Gold accreditation in July 2020 for a PLD storage facility in Long Beach, California. Note the hefty weighting on energy monitoring as well as the highlighted 0/4 score for on-site renewable resource.

( Source: USGBC).

Grid vs. Commercial-Scale Solar - Cost Parity.

Commercial-scale solar energy shows up to have actually reached rough parity with grid power in the United States, however is most likely materially cheaper in California. That's vital to the busines situation, so we'll check out some numbers and a real-world demonstration.

We will certainly see that the estimates are close sufficient, as well as have big adequate arrays, that I believe it's reasonable to state prices go to parity in the majority of states, and the details of a storehouse location, regards to agreement with the neighborhood energy, etc. would certainly be needed to make a case-by-case choice.

Grid Power.

The Energy Information Agency reports that the typical United States cost of grid electrical power for industrial customers has been secure at around 11 cents per kWh. Cost varies by state: 17 cents for California, 9 for Illinois, 8 for Texas, 10 for Georgia, 12 for New Jersey, 9 for Pennsylvania, 14 for New York, to call several of the key locations for industrial space.

We can therefore make an estimate for business grid power costs from $80/MWh to $170/MWh, with a sensible ballpark standard of $110/MWh, except for California at $170/MWh. Actual stockroom power prices may likewise differ by supplier and also regards to usage.

Solar Power.

We estimate the cost of power from commercial-scale solar to be in the range of $75-150/ MWh, with a ball park average of concerning $110/MWh. We look at 3 estimates listed below.

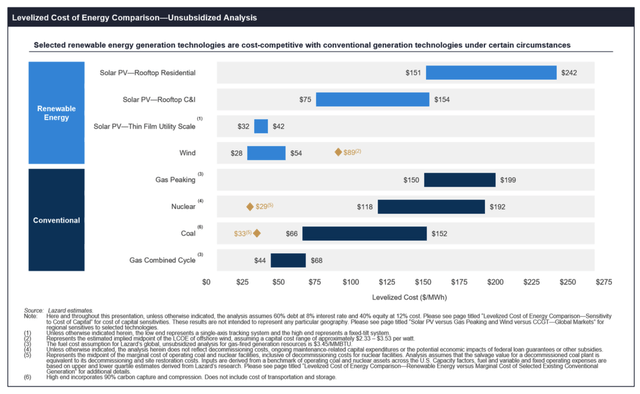

Lazard's report from November 2019 approximates the international levelized expense of commercial-scale solar energy at $75-154/ MWh.

( Source: Lazard 2019 Levelized Cost of Energy).

The Solar Industry Association (SEIA) 2018 whitepaper approximates commercial-scale solar power cost at roughly $60-150/ MWh, based upon a 20-year project lifetime.

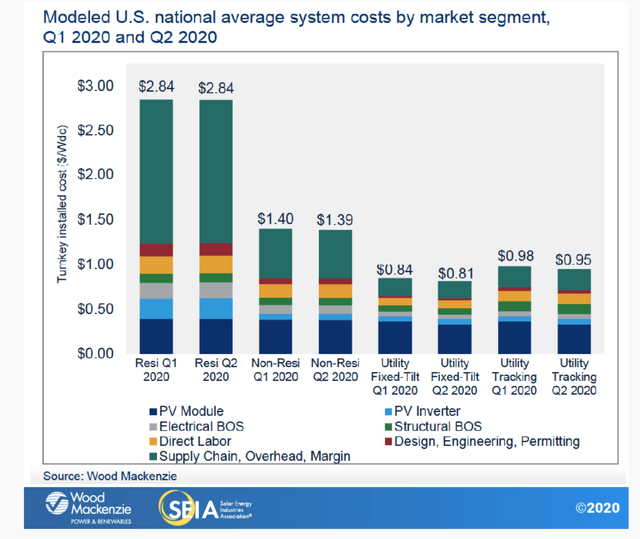

Wood Mackenzie/ SEIA independently give existing nationwide typical information on the turnkey price for non-residential (i.e., commercial-scale) systems in the graphic below - regarding $1.40/ Wdc - which enables us to approximate power price.

( Source: Wood Mackenzie/ SEIA U.S. solar market insight).

With a 15% DC to Air Conditioning loss, we get about $1.64 million/MWac. Capacity element is the proportion in between real and nameplate power, and also SEIA reports a 17.5% experience-based ability element for mounted business planetary systems; we will use 18%. Keep in mind that the capacity factor will be higher in Phoenix than Chicago.

At 18%, the solar energy system is basically "on" at full power regarding 4.3 hrs a day. In a year, we get the equivalent of about 1575 hours of full power. This gives us $1.64 million/ 1575 MWh, or concerning $1016/MWh - for one year.

Overlooking financing prices (which gets much less practical for longer durations), over 8 years we obtain $127/MWh, over 10 years we get about $102/MWh, and for 20 years regarding $51/MWh, approximately regular with the Lazard numbers.

PLD uses an "it depends" conversation of the business economics of placing a solar power system on a storehouse. Nonetheless, the firm does state that the average "breakeven" point is about 8 years, which is consistent with the numbers we determined above.

Economic evaluation for solar energy at each area would certainly likewise require to show federal and also state tax motivations. For instance, under existing legislation, the Federal Investment Tax Credit for commercial systems is 26% in 2020, 22% in 2021, as well as 10% in 2022 and also thereafter.

There are a couple of points to keep in mind below. Initially, the price of PV panels had actually declined a lot that it's no longer the dominant system cost component (see the visuals above). Actually, if panels were free, the expense of commercial-scale systems would just decrease by about a quarter, enhancing the cost benefit of utility-scale solar.

Second, larger is better - or at least cheaper. Utility-scale power is less expensive than commercial-scale power. Likewise, larger commercial-scale projects provide less expensive power than smaller projects. SEIA reports that the ordinary commercial system dimension was 250 kW at the end of 2019. All else equivalent, a million sq. ft. warehouse roof is a better candidate for solar than a 100,000 sq. ft. rooftop.

Target Provides A Demonstration and also Benchmark for Rooftop Solar Power.

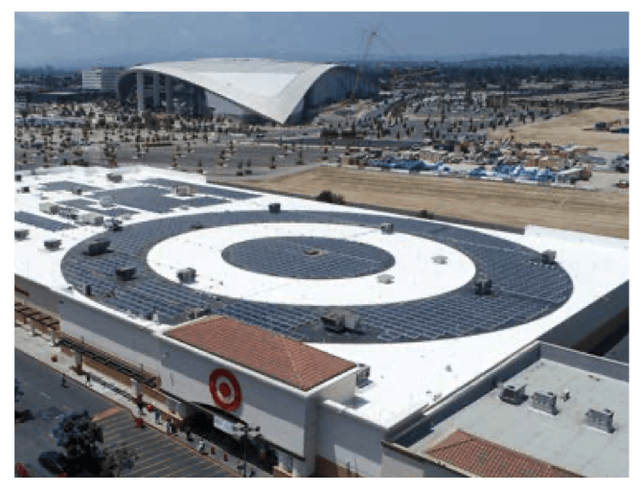

Target (TGT) is placed # 1 amongst U.S. companies for solar energy implementation. It gives both a demo that solar has actually accomplished expense parity or better, and a real-world standard for implementation at scale.

( Source: Target 2020 Corporate Responsibility Report).

By year end 2019, Target had 259 MW of roof photovoltaic panels on 516 stores and distribution centers, conference 15-40% of each centers power requires. That impact covers 27% of its 1,910 stores as well as warehouse, with an average size of 0.5 MW. Target added regarding one setup a week in 2019 - another helpful criteria. Plainly, this is not a token marketing effort.

PLD Leads Among Industrial REITs.

PLD owns or manages about 2852 homes in the U.S. By year-end 2019, PLD has 134 MW of rooftop photovoltaic panels on 64 buildings. Worldwide, over 200 MW is set up.

This impact covers regarding 2.2% of the portfolio in the U.S., with an ordinary size of 2.1 MW.

PLD has announced strategies to dual installed capacity by 2025. Presuming the exact same U.S./ non-U.S. split, as well as the exact same installation size, that would suggest adding solar power at one more 64 homes, regarding one per month in the U.S, and reaching 4.4% market infiltration.

Considered that Target has already accomplished a 27% impact, we can think about a prospective longer-term (i.e., 2030) goal for PLD as being solar energy on 30% of its properties. The 30% objective suggests regarding 800 even more setups. Over 10 years, that would be 80 each year - a rate concerning 50% faster than Target's 2019 price.

Since Q2 2020, PLD has 453 residential properties in Southern California and also 262 in the San Francisco Bay location, facing among the highest grid power rates in the U.S.

It's fascinating to keep in mind the emphasis that PLD put on ESG; it obtains among the lots approximately slides in the business's recent financier slide decks, especially calling attention to its solar power initiatives.

( Source: PLD Investor Presentation, September 2020).

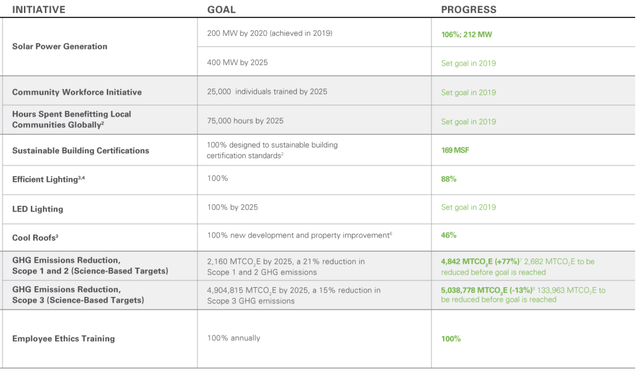

PLD's 2019 ESG report sums up objectives as well as standing on several fronts, highlighting success and also objectives for LEDs, LEED, as well as solar energy.

( Source: PLD 2019 ESG Impact Report).

As of year-end 2018, PLD had 139 million square feet of sustainably licensed (e.g. LEED or comparable) rooms throughout 374 projects in 18 nations. The firm offers data on much of these structures. A number of examples of solar installations on PLD structures, with power outcome, are revealed below.

Ultimately, PLD has experience with a different method; leasing the roof to a 3rd party, as described in Commercial Property Executive below. PLD has actually been doing this given that at the very least 2010, when it rented 4.8 million sq. ft. of rooftop space to Southern California Edison (EIX).

In the Kona solar project, a 3rd party leased 3 PLD storage facility rooftops, mounted as well as owns the solar tools, as well as markets the power to the regional energy. This 1.3 million sq. ft. lease supports 6.2 MW as well as results 9.8 million kWhs annually (i.e., an 18% ability aspect).

Ball park Numbers for a Warehouse.

Finally, we would like to take a short check out ballpark numbers for an actual warehouse. SEIA data quotes storehouse power demand at regarding 5.2 kWh per sq. ft. each year. Food Logistics reports that at 6.1 kWh for non-refrigerated warehouses.

For our ballpark price quote, we will certainly presume 6 kWh per sq. ft. annually. This would be about 66 cents/sq. ft. per year with our ordinary grid power rate, or regarding $1.02/ sq. ft. per year with California grid prices. It's adequate to matter.

A big 1,000,000-sq. ft. storehouse would certainly make use of 6,000 MWhs per year - $660,00 per year at average grid prices, $1,020,000 per year at California prices.

We can also estimate utilizing the numbers over the investment required to create 6,000 MWhs each year of Air Conditioning power - concerning $5.6 million.

Certainly, it's more complex than that. The financially optimal quantity of power generation would certainly depend upon just how the neighborhood energy deals with excess power generated by the storage facility, to name a few points. The stockroom is not grid-independent and will require to buy power from the grid during dusk-to-dawn hours.

The Other Industrial REITs.

None of the other industrial REITs turn up amongst in the rankings for business with solar setups. A review of 2019 10-K and also current investor discussions gives a photo of their activities and also intent (as well as to my mind, highlights the relative maturity of PLD's initiatives).

Duke Realty Corp. (DRE) as well as EastGroup Properties (EGP) are constructing to LEED criteria. Rexford Industrial Realty (REXR), unique among commercial REITs in being 100% in Southern California, provided the only financial analysis of building criteria yet is silent on solar power. STAG Industrial (STAG) has public prepare for solar implementation, with 3 solar rooftops mounted, 4 underway, 5 arranged, and also 15 determined for 2021 or later. Fully carried out, those plans would certainly cover about 6% of their current profile and create 52 MW, concerning 1.9 MW per solar center.

Also read