Out with old inverters, in with the brand-new

- International need for substitute inverters will likely expand by virtually 40% to get to 8.7 GW in 2020, as a huge and also broadening mounted base old solar PV setups drives implementation, creates Miguel De Jesus of IHS Markit.

Need for substitute PV inverters originates from consumers that possess old inverters that are starting to fall short or underperform, or can no more conveniently be serviced with substitute designs or extra components. Need likewise originates from consumers that possess fairly young PV inverters that are underperforming as a result of either inadequate installment, system style, or high quality problems.

Asia picking up speed

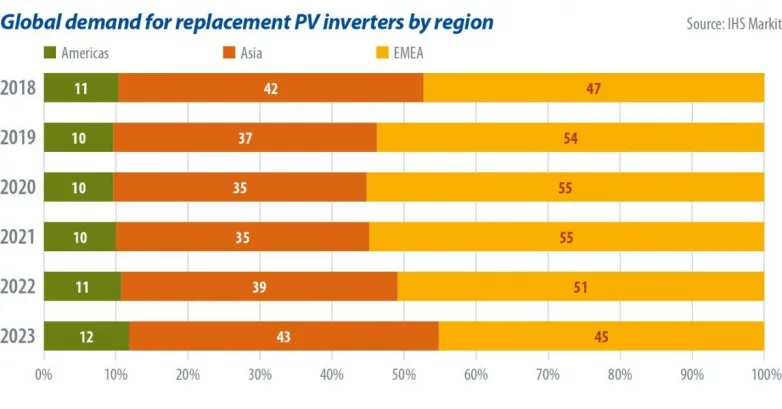

Europe/Middle East/Africa (EMEA) has actually been the biggest area for substitute PV inverter need traditionally, as the area experienced a very early boom in solar in core markets such as Germany, Italy, Spain, Czech Republic, and also Bulgaria, as well as currently has actually the biggest mounted base of PV systems older than 5 years. Substitute need in the EMEA area got to 3.4 GW in 2019, driven mainly by maturing setups in between 10 kW and also 5 MW in dimension. The biggest markets are Germany, Italy and also Spain, which with each other represented greater than 70% of substitute need in the EMEA area.

Asia is the second-largest area for substitute inverters because of older huge PV setups in China and also more-recent huge development, which will certainly remain to sustain need throughout the area. Need for substitute PV inverters is anticipated to find largely from utility-scale (> 5 MW) installments. In Japan, need will certainly likewise be driven by business as well as domestic setups, as the nation experienced very early development in solar as well as currently has actually the biggest mounted base of domestic installments over 5 years of ages on the planet.

Need for substitute PV inverters in the Americas area is anticipated to proliferate, driven largely by the United States, its biggest market. Substitute need in the Americas area is anticipated to expand at a CAGR (2018-- 23) of 130% and also make up 12% of worldwide substitute need in 2023. The United States has actually confirmed to be an unstable affordable landscape for inverter providers, with several having actually gone into as well as left the marketplace. Particular distributors such as Satcon and also Advanced Energy that had a huge market share yet are no more energetic on the market have actually produced a chance for existing distributors to offer substitute inverters.

In addition, advancing technological laws and also import tolls remain to make the United States a difficult setting for vendors to maintain purchasing next-generation item as well as for this reason, might additionally create vendors to leave the marketplace. Nonetheless, in spite of a few of these difficulties, it continues to be a very rewarding market as vendors battle to record a boosting variety of brand-new installments, and also as clients look for methods to change an expanding set up base old systems, especially in the utility-scale section.

Collaborating

Designers, EPCs, O&M carriers, as well as PV inverter vendors are all looking for brand-new methods to make best use of the worth from financial investments in substitute PV inverters. Straight one-to-one substitute of old inverters is presently one of the most usual path that clients take. As an example, an older 1 MW main inverter design is changed with a brand-new, modern-day 1 MW main inverter.

Nevertheless, as inverter modern technology creates, brand-new inverter kinds are being made use of to change older-generation inverters with the objective of making best use of return, streamlining O&M, as well as minimizing the levelized price of power. Consumers are progressively taking into consideration transforming the total system design, as an example, by changing an old main inverter with string inverters or by presenting string-level power optimizers. Generally, contemporary inverters are being developed with a myriad of innovative attributes such as expert system, tracking, as well as self-governing control performance. Advanced software application abilities enable consumers to update their existing systems by changing inverters.

O&M company have actually stepped up to supply solutions to guarantee that clients lower downtime and also make best use of return and also profits from their PV systems by aiding to satisfy the obstacles that included an expanding set up base old PV inverters. To start with, real-time surveillance can enable O&M suppliers to find possible problems with inverters released within a system. In addition to that, anticipating analytics is beginning to aid O&M clients and also companies to prosper of prospective problems. New techniques consisting of thermography and also airborne digital photography are additionally giving brand-new information streams for O&M carriers to examine for prospective inverter concerns.

No matter these innovative approaches of tracking, O&M provider deal with a considerable obstacle concerning the sourcing of substitute inverters as well as extra components. Substitute inverters for older-generation versions might merely not be offered any longer. Extra components might be hard to resource as well as might call for O&M company and also consumers to be imaginative regarding collecting extra parts from deactivated inverters and even various other sorts of power electronic devices tools. O&M company have actually begun to create internal competence devoted to inverter repair service, which entails employing knowledgeable designers and also looking for sophisticated training, in some cases straight from PV inverter distributors, along with warehousing their very own supplies of extra inverters as well as extra components.

For their component, inverter providers have actually likewise started to purchase their very own divisions devoted to resolving the marketplace for substitute PV inverters. As an example, SMA has actually developed its very own replacement/repowering division, which is concentrated on consulting and also offering sets especially for substitute projects. Nonetheless, IHS Markit keeps in mind that this market is still in its early stage as well as inverter vendors that spend time and also sources right into aiding to offer this market can catch substantial chance on their own in the following 5 years, as the marketplace section is readied to proliferate.

Regarding the writer

Miguel De Jesus is a solar market expert with the tidy innovation as well as renewables study group at IHS Markit. He is accountable for study as well as information collection on the international photovoltaic inverter market.

Also read