Off-grid solar attracted record US$ 450m investment last year

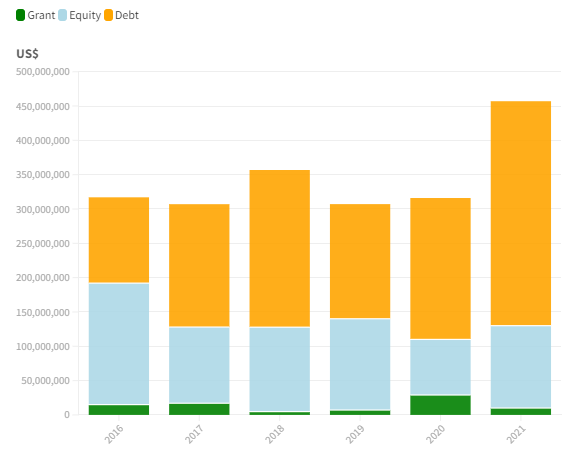

- Financial investment in the off-grid solar industry hit a record US$ 450 million in 2021, according to the latest report from the Global Off-grid Lighting Association (GOGLA).

In what comprises a go back to growth for the sector post-pandemic, financial investment soared by more than 40% after years of topping out around the US$ 300 million mark.

Regardless of record high investment in 2021, firms in the onset of development have been the most influenced by the impacts of the pandemic and had much more difficulties in attracting equity capital, according to the report.

A growth in the amount of financial obligation elevated in 2021-- which, at US$ 326 million, stood for more than every one of the capital expense raised in 2020-- was mostly driven by big financial debt bargains safeguarded by bigger operators in the space.

Referred to within the report as 'The Large 7', which includes the similarity d.light and also Sun King, attracted extra resources this year, with the abovementioned drivers securing financial debt centers for development in recognized off-grid solar markets such as Kenya.

Climate-focused financiers have been keen on going into the off-grid market, the report wraps up, offered its alignment with investment approaches. The report kept in mind in particular Sun King's recent equity raising of US$ 260 million earlier this year.

Laura Fortes, senior project supervisor at GOGLA, stated: "The all-time high financial investment in 2021 is a significant success for the sector and gives reason for positive outlook. It reveals that the sector is durable and also has maintained the confidence of a wide variety of investors."

Record US$ 450m investment in off-grid solar last year

Debt funding in 2021 attracted even more funding than every one of 2020

Startups negatively affected by the pandemic

While financial obligation financial investment right into startups practically doubled year-on-year to US$ 52 million, it has yet to recuperate to pre-pandemic degrees. In 2019 and also 2018 debt given to startups was more detailed to the US$ 80 million mark.

Give funding to startups additionally more than halved last year, falling from a record high of US$ 24 million in 2020 to US$ 9.1 million. Nevertheless 2020's result was guided by around two-thirds of gives stemming from a single funder.

Around three-quarters of venture building funding was concentrated at earlier-stage business, with around half of funding going to locally-owned businesses in the space.

Meanwhile there is some temporary concern within the investment community after around 25% declared that their off-grid portfolio had underperformed in 2021, increasing from the 15% which proclaimed as such last year. Nonetheless greater than 70% said that underperformance seems short-lived, anticipating economic efficiency in line with expectations this year.

Also read

- MN8 Energy Secures $575M for Solar, Battery Projects

- BNDES Admits Arctech to FINAME, Boosting Solar Trackers Across Brazil

- Huawei, Sungrow Extend Decade-long Lead in Global Inverter Race Again

- Niteroi Starts Work on 2,700-Panel Solar Park, Boosting Sustainability Drive

- Quadoro, EB-SIM Acquire German Solar Parks for QEEE Fund