Norwegian thermal battery team seals EUR110m financial investment

- The new deal makes Infracapital the largest investor in EnergyNest

Norwegian thermal battery pioneer EnergyNest has actually authorized a financial investment contract with Infracapital amounting to EUR110m to make it possible for further development as well as money for complete energy storage services for commercial clients.

Infracapital, the infrastructure equity investment arm of the FTSE100-listed M&G, will certainly be the largest shareholder in EnergyNest.

EnergyNest has a market-ready battery as well as has jobs in execution, including for Norwegian chemical giant Yara and Italian energy firm Eni, where installment is anticipated to happen in the second quarter of this year, the business said.

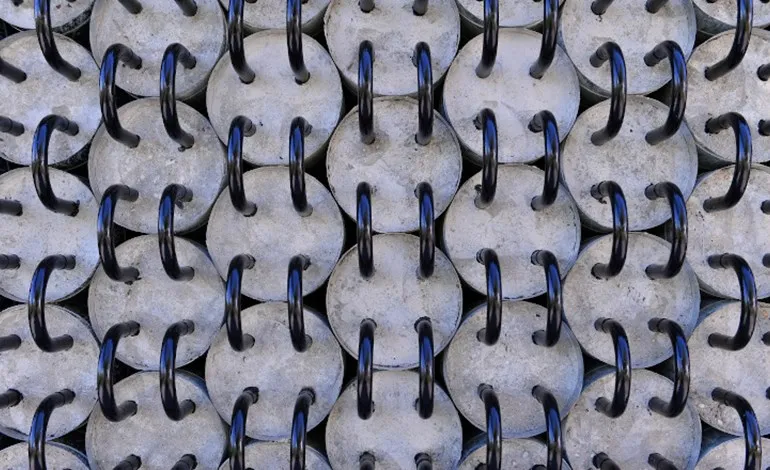

The added financing will certainly allow the scaling of the deployment of EnergyNest's thermal batteries, that are developed to store energy in the form of warmth and assistance decarbonise commercial warm procedures.

EnergyNest president Christian Thiel claimed: "Together with Infracapital we can provide CO2 as well as energy cost savings to even more clients from the first day.

" With our fully-financed turnkey options we make it much easier for market gamers to adjust our environment pleasant technology at zero in advance financial investment expenses.

" Infracapital are the optimal partner for us to grow EnergyNest internationally, with their very useful experience as well as network."

Infracapital head of greenfield Andy Matthews said: "We are delighted to introduce this partnership with EnergyNest.

" Its technology is offering innovative ecological and also financial advantages.

" With federal governments all over the world established ambitious carbon reduction targets, we see wonderful potential for development.

" We are delighted to contribute in offering a service to store and also decarbonise power whilst developing long-lasting value for our financiers."

Also read