New solar financial investment drops 12% as COVID-19 dents H1 2020 figures: BNEF

- Investment in new solar ability fell in the initial fifty percent of 2020 by 12% year-on-year to US$ 54.7 billion as the COVID-19 pandemic hit both project funding and also set up public auctions.

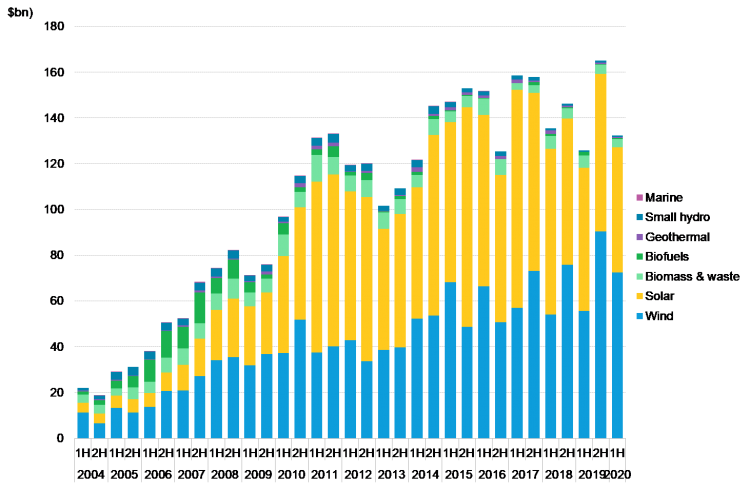

New evaluation from BloombergNEF showed that while total investment in new renewables increased by 5% in H1 2020, this was driven by a four-fold rise in offshore wind financing, which-- at US$ 35 billion-- saw even more investment throughout the very first six months of the year than it did in the entirety of 2019 (US$ 31.9 billion).

Solar investment, while somewhat resilient despite what's been called the largest economic shock to the power market considering that the Great Depression of the 1930s, taped a 12% loss year-on-year. Albert Cheung, head of analysis at BNEF, stated it was expected that the pandemic would impact H1 investments because of hold-ups to the financing procedure of new projects in addition to postponements to particular auctions.

" There are signs of that in both solar and also onshore wind, however the total worldwide figure has verified extremely resilient-- thanks to offshore wind."

Brazil's A-4 public auction, which triggered quotes from virtually 29GW of utility-scale solar, was delayed forever as a result of the pandemic while Portugal pushed back its auction to last month, having originally intended to host the 700MW tender in late March.

There was brighter news for solar in BNEF's evaluation of public markets, however, with both biggest handle H1 2020 being the initial public offerings of JinkoPower Technology and also Trina Solar, which raised US$ 366 million as well as US$ 359 million respectively.

BNEF's evaluation adds to an expanding consensus that while there will be unavoidable influence on tidy energy investment and implementation this year from the pandemic, they are extra short-lived than incurable as well as the market has confirmed resilient.

In May, the International Energy Agency claimed that the dilemma was "hurting however not stopping" renewables as it changed its projections for the year, expecting ~ 90GW of solar to be deployed in 2020 versus an original forecast of 106.4 GW.

Recently Mercom Capital's analysis of business solar financing discovered that it had actually fallen by 25% year-on-year to US$ 4.5 billion in the first half of 2020, nonetheless chief executive Raj Prabhu said the impact "might have been even worse" thinking about the nature of the pandemic and the scale of its impact on worldwide economic situations.

Also read

- MN8 Energy Secures $575M for Solar, Battery Projects

- BNDES Admits Arctech to FINAME, Boosting Solar Trackers Across Brazil

- Huawei, Sungrow Extend Decade-long Lead in Global Inverter Race Again

- Niteroi Starts Work on 2,700-Panel Solar Park, Boosting Sustainability Drive

- Quadoro, EB-SIM Acquire German Solar Parks for QEEE Fund