N-type uptake under Covid-19

- As p-type mono cell performances border closer to their restrictions, n-type cells are increasingly being identified as next-generation technologies, creates PV InfoLink expert Amy Fang. Suppliers have concentrated their research and development initiatives in recent times on the production of commercially practical pathways for heterojunction (HJT) and also tunnel-oxidized passivated get in touch with (TOPCon) cells.

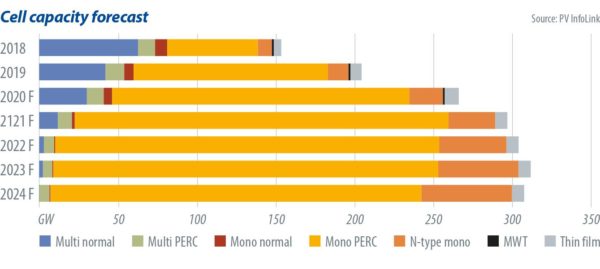

Recalling at 2018 and also 2019, n-type innovation battled to get a footing in the marketplace as p-type PERC (passive emitter rear get in touch with) items offered much better cost efficiency. Subsequently, a lot of producers have postponed their capacity development plans. Nevertheless, with restricted potential customers for enhancement on the p-type side, n-type stays a warm subject. The initial quarter saw greater than 8 GW of n-type ability growth news. As well as the appearance of Chinese n-type devices providers is anticipated to further accelerate n-type's development.

Overseas demand

Chinese n-type suppliers mostly supply utility-scale projects-- assisted by China's Top Runner Program. Although the federal government has quit issuing such setups this year, some ultra-high voltage projects will make use of n-type components to accomplish higher power output. However, as there's just a minor 5-10 W distinction between p- and also n-type modules, end users will certainly choose p-type PERC products, as they offer far better cost performance.

In general, need for n-type items will certainly slow in China this year. Therefore, Chinese n-type manufacturers are considering utility-scale projects in emerging markets like the Middle East as well as Latin America.

Coronavirus downturn

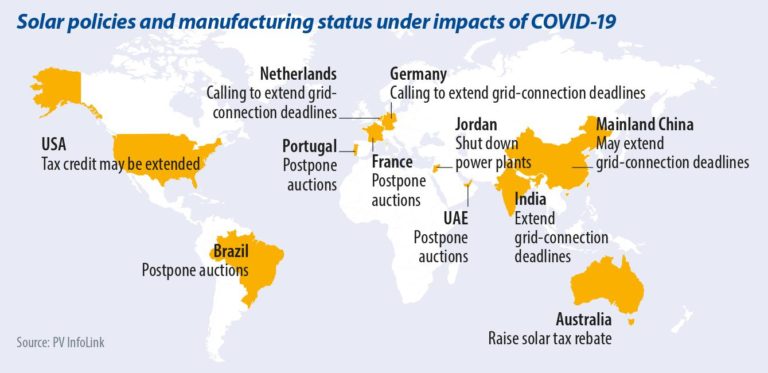

N-type need will primarily originate from non-China markets. As the Covid-19 pandemic remains to intensify, major n-type markets such as the United Arab Emirates as well as Brazil have started to delay auction timelines. Fortunately as of April, building and construction deal with some big tasks is proceeding in these regions. It seems that n-type demand has actually been delayed, but the degree will ultimately remain unchanged after the pandemic. Having stated that, makers that generally supply distributed-generation PV jobs may have to readjust application prices as well as manufacturing quantities, as a number of areas have actually provided stay-at-home orders that will certainly have a larger influence on such jobs.

Existing state

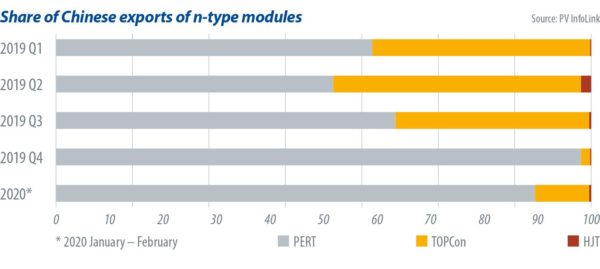

According to China custom-mades data, shipments of n-type components are still rising. Since 2019, n-PERT (passive emitter back completely diffused) and also TOPCon modules accounted for the majority of n-type exports. Compared to p-type PERC cells, PERT does not use a substantial technical advantage, making it hard to increase sales of such cells. Nonetheless, as PERT modern technology has gotten to a higher level of maturity than various other n-type innovations and it could be upgraded to TOPCon, JinkoSolar took the lead on the manufacturing of PERT, suffering the export volume of PERT modules. Given that the performance bottleneck hinders the growth of PERT, many manufacturers will certainly transform their innovation roadmaps toward either HJT or TOPCon.

TOPCon export quantities varied mainly each quarter since they generally fulfil demand from utility-scale projects. Exports of HJT modules, on the other hand, were relatively reduced as a result of higher expenses and also prices.

With Chinese n-type devices vendors arising this year, resources expenses for the innovation are slowly falling. Today, the cost of HJT tools is around 3 to four times the rate of a common p-PERC line, while TOPCon is significantly less pricey at no more than double the investment required for p-PERC. The return rates have actually also been boosted to around 90%, suggesting that the overall manufacturing costs could be lowered.

Several brand-new p-PERC lines have been set aside for an upgrade to TOPCon in the future, recommending that TOPCon may be the fastest-growing n-type ability of the year. It's anticipated that 5-8 GW of TOPCon capability will be added.

The dropping price of HJT tools will certainly also urge some makers to invest in HJT this year. Nevertheless, several ability developments plans have yet to be executed, due to the fact that it takes a longer time to adjust strategies, as well as the majority of these producers are still in the R&D stage.

It is prematurely to inform which n-type innovation will come to be mainstream, although TOPCon and also HJT will certainly both see improvements. The solar field is anticipated to see rising capability and also production of both innovations within one to three years.

Although China's localization of equipment helps reduce n-type prices, its rate of tools price decrease and effectiveness improvement are still not able to compete with p-PERC. As global need is likely to fall below 110 GW this year, potential customers for n-type may turn pessimistic. Taking the financial situation right into account, whether new capacity could be developed, and also tools suppliers will make improvements that will certainly play a key role in the advancement of n-type this year.

Amy Fang, PV InfoLink

About the writer

As an assistant expert at PV InfoLink, Amy Fang focuses on looking into the solar cell sector of the PV supply chain, by providing analysis of market patterns as well as prompt market information. She sustains the group in generating market trend evaluation as well as works throughout price forecast and also production capacity data solutions.

Also read