Much Better Buy: First Solar vs. Canadian Solar

- Both top solar firms, First Solar (NASDAQ: FSLR) and Canadian Solar (NASDAQ: CSIQ), have several things in common. Both detailed on the general public markets at around the exact same time. Each company created yearly income of about $3 billion last year. In addition, both companies primarily market solar components, develop as well as operate solar power systems, as well as offer relevant solutions. Let's take a look at why, regardless of these similarities, one supplies a better financial investment possibility than the various other.

Diversity

Canadian Solar has procedures in 23 nations. In 2019, the firm earned 44% of its profits from the Americas, 32% from Asia, and 24% from Europe and also various other regions. By contrast, First Solar gained 87% of its 2019 income from the U.S. Clearly, Canadian Solar is a lot more geographically varied than First Solar. That must make Canadian Solar's profits reasonably stable if any type of one market deals with headwinds. It additionally offers Canadian Solar a benefit in brand-new markets where it has already advanced.

In addition to geographic diversity, Canadian Solar is additionally dealing with diversifying its product or services. It has an early moving company advantage in the swiftly growing power storage services market. Energy storage solutions enable better positioning of energy shipment with need, as well as therefore enhance a system's general worth. This boosts solar energy's potential customers contrasted to conventional means of power generation, which can be easily readjusted based on need.

Canadian Solar has a storage space projects backlog of 1,201 megawatt-hours (MWh), in addition to a pipeline of 3,482 MWh. So, Canadian Solar shows up to have an edge over First Solar in terms of diversification.

Efficiency

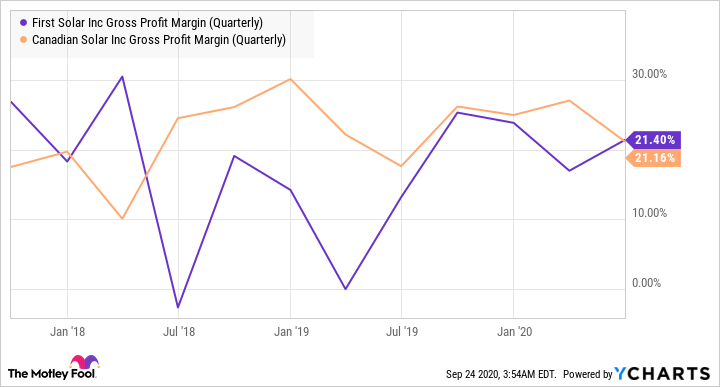

Over 10 years, First Solar's revenues expanded at a compound annual development rate (CAGR) of 4%. That's a lot reduced contrasted to Canadian Solar's CAGR of 18%. In Addition, Canadian Solar handled to preserve a little higher and much more steady gross margins compared to First Solar in the last numerous quarters.

Both firms fared fairly well in the second quarter, considering the effects of the coronavirus on international power demand. While both have withdrawn their particular economic assistance for 2020 because of coronavirus-related unpredictabilities, they have actually given production support for the year. Canadian Solar expects its module shipments to increase 28% to 40% in 2020, while First Solar anticipates its manufacturing to rise 4%.

Balance sheet

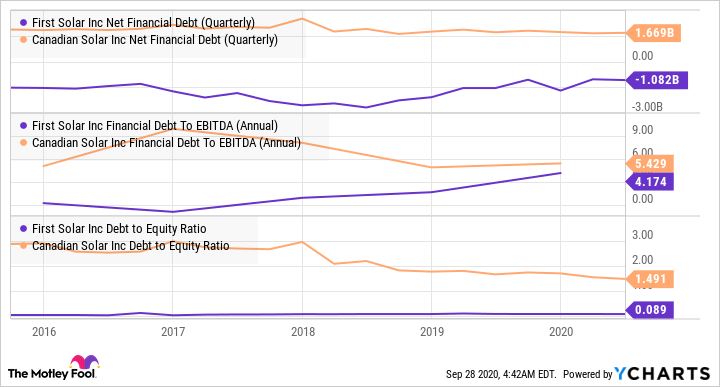

When it concerns balance sheet strength, though, First Solar wins pass on. The company is much less leveraged than Canadian Solar.

As the above chart shows, Canadian Solar's debt-to-EBITDA of 5.4 times is greater than First Solar's 4.2 times. And that's after Canadian Solar's efforts for many years to decrease its utilize. Additionally, First Solar is sitting on a mountain of money. At the end of Q2, First Solar had $1.5 billion in money as well as valuable protections, contrasted to $578 million for Canadian Solar. So, on a web basis, First Solar has $1 billion in cash money reserve as opposed to $1.7 billion in internet debt for Canadian Solar. Still, Canadian Solar's progression so far on this front is considerable.

Even More, Canadian Solar strategies to grow by accessing low-cost resources from the Chinese securities market with an IPO. It intends to use the funding to broaden its capacity and also raise the degree of upright integration. That should, consequently, aid Canadian Solar improve its prices power as well as increase its international market share.

Generally, Canadian Solar's global procedures, quick growth for many years supported by financial debt, and intended listing in China all tip towards its somewhat hostile development technique compared to First Solar. However, the financial debt degree presently is not worrying and also the earnings development for many years is impressive.

Appraisal

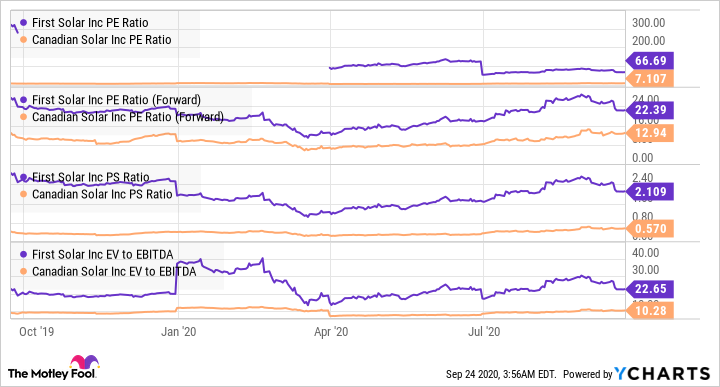

Making use of any type of metric, Canadian Solar is trading at a much cheaper appraisal contrasted to First Solar.

At a forward PE ratio of around 13 times, Canadian Solar looks magnificently valued. The supply certain appears to have some capacity for multiple growth to load the assessment gap, as seen in the chart above.

And the far better buy is ...

While the longer-term possibility for solar energy is undeniable, solar supplies face tight competitors that might result in a fall in market shares and also boosted pressure on margins. Though both the business have actually executed well in an open market, Canadian Solar's diversity, growth throughout the years, development plans, and less expensive valuation make it a far better buy than First Solar today.