Like Solar Energy? Then You'll Love These 3 Dividend Stocks

- Renewable energy and returns are a match made in paradise.

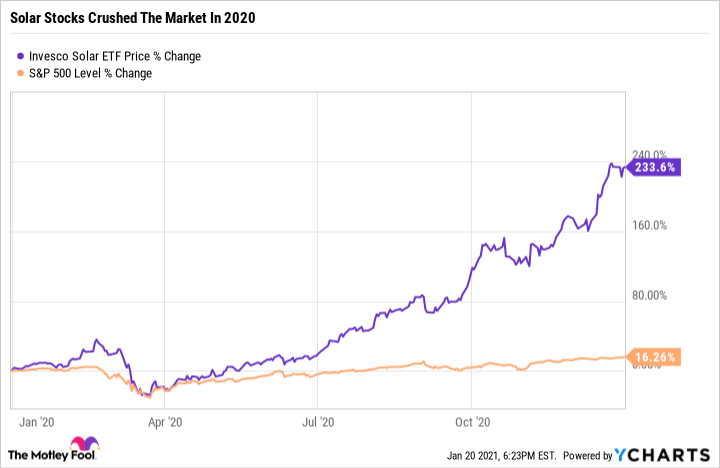

It's easy to like a market when it returns 14 times the market. That's precisely what took place in 2020 when the typical supply in the Invesco Solar ETF (NYSEMKT: TAN) rose over 230% contrasted to the market's 16% return. Nonetheless, a number of the pure-play solar stocks in charge of the ETF's speedy increase are now trading at high valuations-- making now the excellent time to believe outside package.

We asked a few of our factors for their ideal solar stocks to buy now. They determined 3 reward stocks: utility gigantic NextEra Energy (NYSE: NEE), copper mining authority Southern Copper Corporation (NYSE: SCCO), and renewable energy driver Clearway Energy (NYSE: CWEN) (NYSE: CWEN-A). Here's why these three reward supplies are an excellent way to purchase solar energy today.

Getting solar and wind energy on a substantial scale

Daniel Foelber (NextEra Energy): Increasing income and incomes. A secure as well as expanding returns. Industry tailwinds. NextEra Energy has it all. The world's largest distributor of solar and also wind power has actually been ramping its renewable spending. Its existing renewable capability is 28 gigawatts (GW)-- including its signed backlog. The company is designating as high as $28 billion towards new renewable projects in between 2019 and 2022. The result has mored than 6.5 million new photovoltaic panels in the last three years and 30 million planned panel installations by 2030. Yet that's not all. NextEra is a huge gamer in wind energy too. In fact, brand-new wind energy projects make up over half of the company's sustainable stockpile. They represented over 80% of its renewable agreements in 2019 and also 2020 (as of completion of the third quarter of 2020).

In spite of record-high investing, NextEra continues to supply outstanding results. The firm's main 2 organizations are Florida Power & Light (FPL) and Gulf Power. They created over 70% of NextEra's profits for the nine months finished Sept. 30 2020. NextEra Energy Resources (NEER) is the firm's tidy energy section as well as is purchasing solar and also wind projects throughout America. Between the fourth quarter of 2020 and also 2024, NEER's renewable investments are expected to cover $8 billion. But around 80% of this costs is expected to happen by the end of 2021. Being the largest utility in Florida is pricey. But this year, NextEra plans on spending more money on renewables than it sets you back to preserve Florida Power & Light's existing properties. Reduced costs from 2022 to 2024 must help drive profits. NextEra is anticipating 2021 incomes per share of around $2.47 and then growing profits at 6% to 8% per year in 2022 and also 2023.

Even during this period of high costs, NextEra has consistently elevated its dividend. The company is now a Dividend Aristocrat, a notable achievement offered to participants of the S&P 500 that have raised their yearly dividends for a minimum of 25 successive years. In sum, NextEra Energy is a balanced way to purchase the long-term development of solar and also wind energy while collecting quarterly rewards.

Much more renewable energy implies extra copper

Lee Samaha (Southern Copper Corporation): If you like renewable energy, as well as specifically solar energy, then opportunities are you will certainly such as copper, too. Widely known as one of the most financially delicate product, copper is used across the commercial economy, yet it's the 27% of need that originates from electric networking that is interesting below.

Put simply, a lot more electrical power generation from wind and also solar energy implies more need for copper for usage in the transmission, circulation, as well as storage space of electrical power. Additionally, new renewable resource projects will require copper circuitry in order to attach to the grid. According to the Copper Development Association, creating electrical power from renewable energy "has a copper use strength that is normally 4 to six times greater than it is for nonrenewable fuel sources."

That's music to the ears of a copper miner like Southern Copper and likewise great news for capitalists brought in to its current 2.9% reward yield. To be clear, Southern Copper's returns payout isn't uncompromising; instead, it's a function of the business's cash money placement and money generation. Simply put, it's most likely to fluctuate mainly in concert with the rate of copper.

Therefore, purchasing the supply for its returns is basically taking a view on greater copper costs and also demand in the future. That may an advantage in a world progressively willing to buy renewable resource.

Here comes the sun-centric supply you've been waiting for

Scott Levine (Clearway Energy): It's little surprise that financiers are turning their focus to solar supplies these days thinking about just how the marketplace welcomed them in 2020. In addition, with the beneficial therapy that the solar market obtained in the recent stimulus costs and President Joe Biden making good on his assurance to rejoin the Paris Agreement today, there seems prevalent enthusiasm for renewable resource. Thus, lots of people think solar supplies are positioned for even better gains in the coming years. Pair this idea with the understanding that dividend-paying stocks often surpass non-dividend-paying stocks, and also it appears that Clearway Energy is an optimal choice for investors seeking to order some yield while waiting for the solar sector to flourish.

While Clearway Energy's profile consists of a selection of possession kinds, solar power stands out. It represents 1.32 GW of capacity, or 21% of the firm's total capability, as of completion of Q3 2020. And also it appears that solar will inhabit a significantly vital function in the future. Of the 9.4 GW of projects in the company's pipe, solar projects (including dispersed and utility range) represent about 4.4 GW, or 47%.

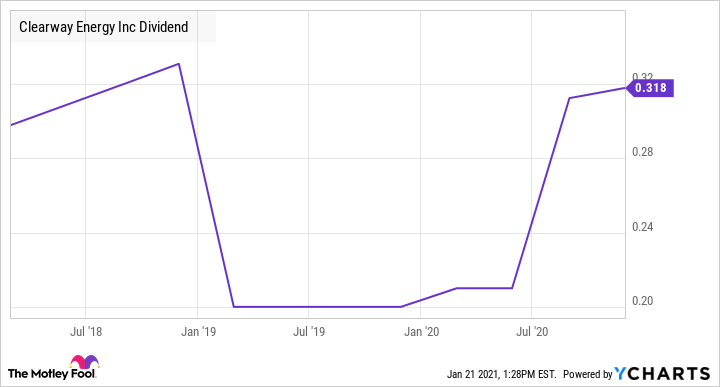

In response to the PG&E personal bankruptcy and the associated threats to Clearway Energy, the firm minimized its reward in February 2019 in order to guarantee its economic wellness.

Over the past year, however, Clearway has actually returned its focus to satisfying shareholders. Most lately, the business had actually raised its quarterly payment 1.8% to $0.318 per share for the fourth quarter, and forecasting a sunny 2021, administration noted on the Q3 2020 teleconference that it "remains to see dividend per share growth at the top end of our 5% to 8% lasting development price via 2021."

The extension of tax credit reports from the recent stimulus bill and President Biden's rejoining of the Paris Agreement are merely two elements contributing to the idea that the solar sector is poised for considerable development-- something where Clearway Energy and also its investors might undoubtedly thrive.

Should you invest $1,000 in NextEra Energy, Inc. now?

Prior to you take into consideration NextEra Energy, Inc., you'll wish to hear this.

Spending tales and Motley Fool Co-founders David as well as Tom Gardner simply disclosed what they believe are the 10 finest stocks for financiers to buy today ... and NextEra Energy, Inc. had not been one of them.

The on-line investing solution they've run for almost two decades, Motley Fool Stock Advisor, has actually beaten the securities market by over 4X. * And right now, they assume there are 10 supplies that are much better purchases.