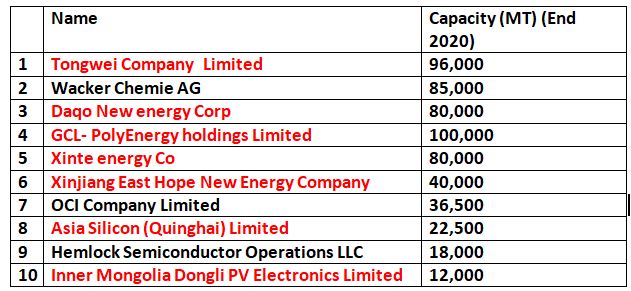

Leading 10 Polysilicon Rankings for 2020- The Future To be 90 Percent China

- German research firm Bernreuter study has actually launched its most recent ranking of Polysilicon suppliers, and the prognosis for non-Chinese makers is not good.

The firm forecasts that the globe's 4 biggest polysilicon suppliers in 2022 will certainly all be based in China.

in 2020, Wacker Chemie, the German firm which was actually no. 1 till 2019, shed its leadership setting to China's Tongwei, which has actually gone up from no. 9 ranking in 2016. With three manufacturing locations in Sichuan province, Inner Mongolia and Yunnan district, Tongwei will get to a total capability of almost 200,000 metric loads (MT) by the end of this year and a most likely 300,000 MT in 2023.

Adhering To Wacker in 3rd spot is Daqo New Energy, which ousted Korea's OCI from the 3rd place. After closing down its solar-grade polysilicon procedures in South Korea last year, OCI went down to number seven in the ranking.

In 2022, Wacker will certainly be up to number five, yet stay the biggest manufacturer of electronic-grade polysilicon for the semiconductor industry and is aiming to obtain further market share in this smaller section. Wacker has taken a mindful call to focus on this section, rather than solar quality polysilicon, which has come to be extremely affordable thanks to the Chinese increase. Bernreuter forecasts Chinese origin market share to tip 90 percent in the coming years.

Three candidates for the top four spots in 2022 after Tongwei-- GCL-Poly, Daqo and Xinte Power-- are running manufacturing facilities with extremely low-cost power from coal-fired power plants in the Xinjiang Uyghur self-governing region in northwestern China.

Amzingly, till 2005, when solar lastly attracted focused attention from Chinese policymakers and producers, the worldwide polysilicon sector put on an entirely different appearance.

An oligopoly of just 7 firms ruled, referred to as the "Seven Sisters".

- Hemlock Semiconductor (USA).

- Wacker Chemie (Germany).

- Advanced Silicon Materials (Currently REC Silicon/USA).

- Tokuyama Corporation (Japan).

- MEMC Electronic Materials (USA and Italy).

- Mitsubishi Materials (Japan and USA) and.

- Osaka Titanium Technologies (formerly Sumitomo Titanium/Japan).

These firms had 10 polysilicon plants throughout the United States, Germany, Italy and Japan. Global capacity till 2004 was a small 29,500 MT tonnes. With virtually none in China. The single Chinese player, Emei, had a puny 100 MT plant in China. From then, to now, has actually been a long, unpleasant trip of being toppled for the quondam titans, as the brand-new Champions from China stepped in.

The Top 10 in 2020

" These reports must be a wake-up call for western federal governments. If their countries don't intend to end up being practically completely dependent on solar products from China for the change to renewable resource, they need to implement an effective and long overdue industrial policy for a non-Chinese solar supply chain, in particular for ingot and wafer production," comments Bernreuter, the eponymous owner of the study firm. "Inexpensive and renewable hydropower in the northwestern USA, Canada, Norway and Malaysia supplies them the possibility to sustain an alternate supply chain without forced labor and a high carbon footprint.".

Especially, Bernreuter hasn't discussed India as a possible source for sourcing polysilicon, something that tels us concerning understanding of producing environment below. Keep in mind that in the coming few years, India has every possibility of remaining power excess, even as it includes much more renewable resource to the grid and goes slow on thermal expansion.

the Chinese domination of polysilicon and ingot manufacturing also underscores the threats for residential manufacturers pursuing higher cell and module production, as they will remain depending on imports for essential components. Something a couple of have actually highlighted too, with Waaree energy's Hitesh Doshi even calling it delusional to expect success on our existing strategy, as seen in recent volatility in polysilicon rates too.

Also read