Last AD/CVD decision on Southeast Asian solar cells as well as panels pushed to August

- The Dept. of Commerce has actually pushed the target date to issue a final decision on an antidumping/countervailing duties (AD/CVD) circumvention examination to August 17, 2023. The final decision was initially meant to come following week.

Jose Rivera, International Trade Compliance Analyst, AD/CVD Operations, Office VII, stated in a memo that substantial case and also rebuttal briefs were sent by around 20 interested celebrations, and Commerce requires more time to fully consider everybody's statements.

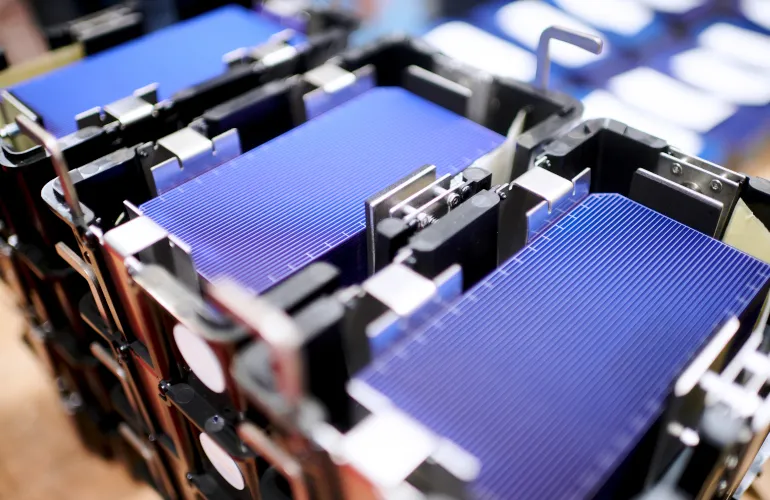

Commerce initial chosen in December 2022 that Chinese solar cell as well as panel manufacturers were working in Cambodia, Malaysia, Thailand and also Vietnam as a way to prevent paying duties on Chinese-made solar goods that have actually been in place since 2012. Commerce at first suggested AD/CVD to crystalline silicon cells making use of Chinese wafers as well as last panels made with Chinese wafers that additionally make use of three of the following Chinese-made products: silver paste, aluminum frames, glass, backsheets, ethylene plastic acetate sheets as well as junction boxes. Wafers created beyond China with Chinese polysilicon are not considered to be wafers produced in China.

The tariffs were suggested for all exports out of the four Southeast Asian nations, except from 4 private business that were investigated and discovered to not be circumventing the tariffs: New East Solar (Cambodia), Hanwha Qcells (Malaysia), JinkoSolar (Malaysia) and Boviet Solar (Vietnam).

Any extended tariffs would not enter into result until after June 6, 2024, therefore President Joe Biden's 2022 exec activity that stopped briefly additional tariffs for 2 years. Congress is attempting to overturn the executive choice via a Congressional Review Act (CRA), yet all info coming from Capitol Hill suggests failure of the Act.

Since the preliminary decision in December, solar panel suppliers have been asking Commerce to clarify the division's new "wafer-forward" ruling. The AD/CVD specifications of 2012 put tariffs on the silicon cell as well as onward to the module. The country point of origin was figured out to be where the p-n joint is activated, which occurs at solar cell growth. The 2022 initial decision shifted the tariff guidelines back one action to the silicon wafer.

Solar Power World previously reported on the uneven solar panel manufacturer support of the extensive tariffs. Auxin Solar is the only silicon solar panel maker on-record for the tariffs. Auxin claimed in its original request to the DOC that Chinese solar manufacturers working in Southeast Asia were unjustly valuing their items to undercut American producers. Auxin stated itself and various other American suppliers were struggling to take on inexpensive imports. The AD/CVD extension's just other supporter is CdTe thin-film producer Initial Solar, whose photovoltaic panel items are not included in the tariff scope. Several American panel suppliers, consisting of Silfab Solar, specified in documents to the DOC that Auxin did not stand for the "passions of the domestic solar market as a whole."

Up until silicon cell manufacturing is developed in the USA (something that only 3 firms have suggested they will start by the end of 2024), all American solar panel assemblers will need to import solar cells that would likely include any kind of Commerce-decided tariffs.

Tariff rates are not consisted of in circumvention examinations, yet Clean Energy Associates previously launched details on just how they may be set:

" For suppliers that likewise have procedures in China, the duty rate on their cells and modules made in the called nations (Cambodia, Malaysia, Thailand and Vietnam) will certainly coincide that they pay for their item exported from China. For companies that do not make cells in China yet make cells in the called countries using Chinese wafers, then duty rates are based upon the rates of the Chinese business that makes the wafer-- if that company has a duty rate. If these cells make use of Chinese wafers from a business that does not have a rate, after that these cells as well as modules will certainly get the "China-wide" anti-dumping rate of 238.95% as well as the "all-others" countervailing-duty rate of 15.24%.".

Also read

- Zelestra Clinches $282m Financing for 220-MW Aurora Solar-Storage Hybrid Project

- Enfinity Boosts US Credit Facility to $245m for Solar Growth

- Ellomay Offloads Nearly Half of Italian Solar Portfolio to Clal

- Valeco Secures Solar Power Deal with French SMEs

- Eurowind Energy Commits EUR 175M to Romanian Solar Park