Key 2020 United States Solar PV Cost Trends and also a Look Ahead

- Project sizes are boosting, larger-format modules are leading of mind, as well as locating brand-new price performances is a priority for companies across all market segments.

UNITED STATE solar PV system costs dropped throughout all market sectors from 2019 to 2020 as module prices continued to drive down system expenses. While scarcities of glass as well as ethylene-vinyl acetate laminate triggered solar module prices to boost at the end of 2020, they still fell on an overall year-on-year basis.

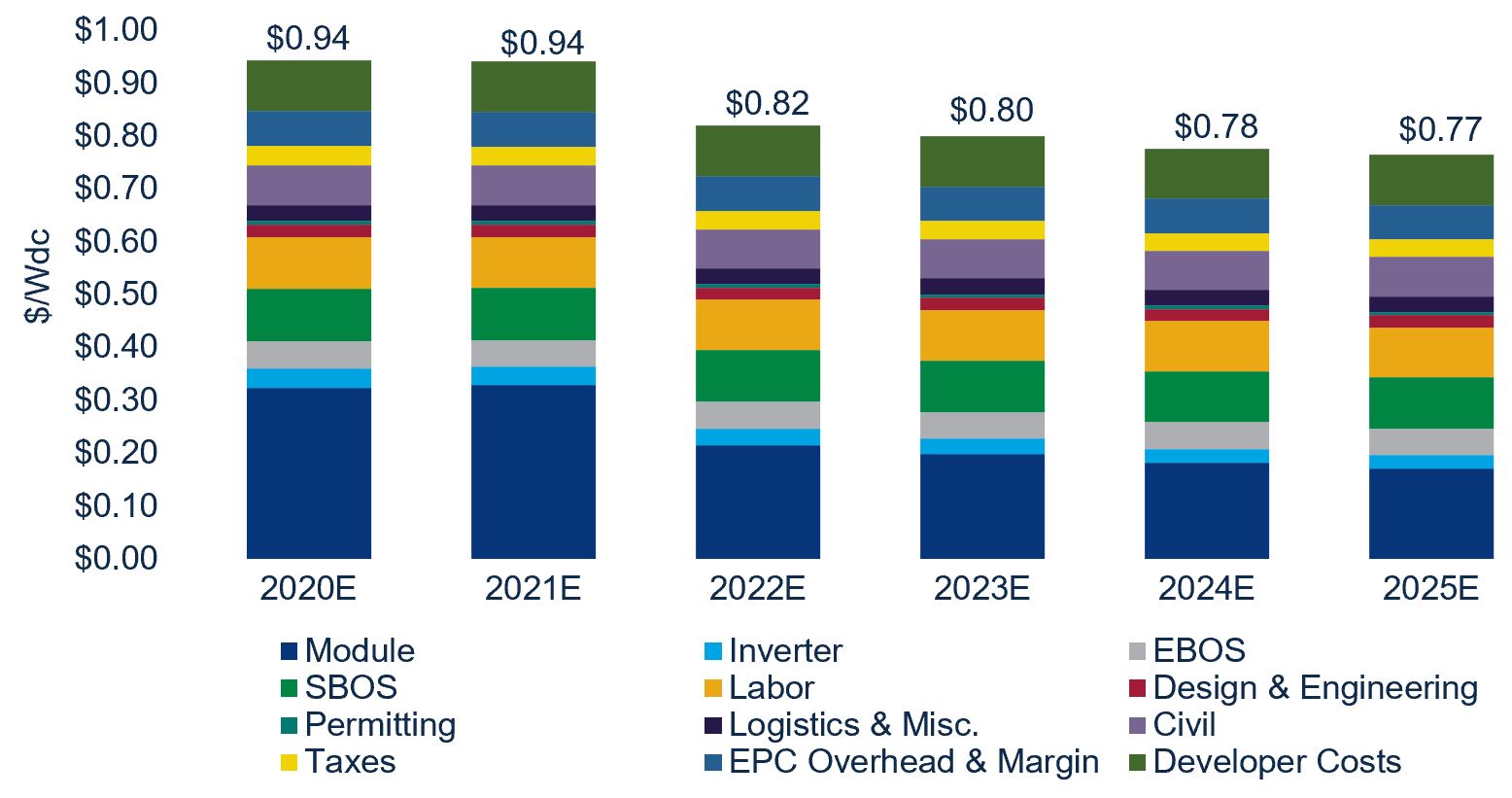

According to Wood Mackenzie's recently released U.S. Solar PV System Price report, ordinary 100-megawatt utility-scale system expenses in 2020 are $0.94/ W, with the possible to fall 19% by 2025 (all watt numbers shown are DC). These prices will certainly drop 13% from 2021 to 2022, driven by module rate decrease as Section 201 tariffs are expected to eliminate for imported products.

Average U.S. utility-scale 100 MW single-axis tracker all-in PV system costs with bifacial modules as well as 1,500-volt central inverter

Source: Wood Mackenzie's U.S. Solar PV System Pricing: H2 2020

Note: This expense forecast does not assume a Section 201 expansion or increase circumstance.

Average commercial roof system sets you back in 2020 are $1.65/ W and also expected to drop 16% by 2025, according to Wood Mackenzie, thinking a 500-kilowatt level roof covering system with string inverters and also monofacial, monocrystalline passivated emitter and back contact (PERC) solar modules. In the household section, ordinary system rates are $3.10/ W in 2020, based on the presumed use microinverters and also monofacial, monocrystalline PERC solar modules.

System costs can vary by as long as 40% to 50% in between states within each market section, driven by labor-cost differences, affiliation prices, permitting procedures as well as various other factors.

Tariffs on imported items continue to effect system expenses. Area 201 tariffs for bifacial solar cell and module imports right into the U.S. have actually been restored as of November 2020. The prices of bifacial monocrystalline PERC solar modules imported from Southeast Asia to the U.S. were lower than monofacial, monocrystalline PERC rates in 2020, while bifacial modules were exempt from these tariffs. Nevertheless, without the bifacial exemption, these module costs are about 8% higher than monofacial, monocrystalline PERC prices.

Some inverter prices raised in 2020 as a result of recurring Section 301 tariff impacts. These tariffs influence all inverters imported from China to the United States, and also the rate was enhanced from 10% to 25% in 2019. While this mostly created inverter cost hikes in 2019, there were even more increases in rates in the domestic section in 2020. Single-phase string inverter and microinverter prices saw additional rises in 2020, which maintained average residential system rates from falling as promptly as they otherwise might have.

With the current surge in COVID-19 instances in the U.S., all market sections are likely to be able to deal with the implications better than when the pandemic first hit the nation in very early 2020. Certainly, this presumes solar PV construction will be enabled to proceed regardless of any type of new shelter-in-place orders that might be imposed. In the residential section, which has shorter project cycles compared to the industrial and utility-scale sections, online client procurement and also permitting processes are more recognized and structured currently.

More influences from COVID-19, as well as the fate of the government Investment Tax Credit, will certainly determine how much lower customer-acquisition costs can go with property solar, yet there is possibility for these prices to decline much more swiftly than originally forecast, specifically for firms that have had much more costly procedures in position.

As of now, these expenses compose roughly one-quarter of complete household system prices, however if any type of effectiveness found out in 2020 verify to be successful, there is capacity for these costs to stand for a smaller sized part of general system costs. Soft-cost reduction continues to be a leading concern for firms running in all market sectors, and also a decrease in customer-acquisition prices can generate more competitive system costs.

Project capabilities climb and larger-format modules gain traction

Project capacities are raising, specifically for large-scale ground-mount centers in the utility-scale area. With bigger projects come economic climates of scale advantages. The ordinary cost of a 100 MW single-axis tracker system in the U.S. was as high as 8% less than that of a 10 MW system in 2020.

Nonetheless, purchase methods and soft-cost optimization will establish just how much costs can be reduced on a dollar-per-installed-watt basis with more megawatts mounted. Hardware costs can only go so reduced. Reductions in prices such as project administration, due persistance and labor can produce much more cost-per-watt advantages.

Solar module power classes will remain to raise, specifically as larger-format wafers come onto the scene. These modules will certainly be literally larger as well as heavier yet with higher power rankings. Consequently, developers and also engineering, purchase and building and construction providers are evaluating their cost stacks to comprehend the complete savings possible and also figure out exactly how labor prices could be influenced.

Also read

- Aave’s Trillion-Dollar Bet: Finance Abundance Onchain

- India Slashes Solar GST, Developers Eye Cheaper Tariffs And Restarts

- U.S. Tariffs Deepen India’s Solar Glut, Exports Face Squeeze Today

- ABO Energy wins tariffs for first Polish solar park in latest RES auctions

- Trump Clampdown Tightens Rules on Wind and Solar Tax Credits