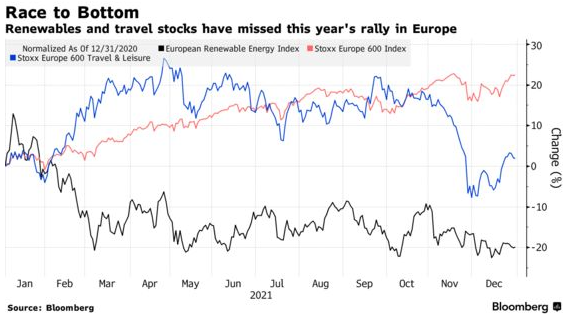

Just How Green Stocks Became Flops in 2021, Delaying Also Airlines

- Renewable resource dropped in 2021, regardless of policy assistance

- More headwinds may lie in advance for industry in the short term

If you assumed making out even worse than an industry pummeled by a once-in-a-century international health and wellness emergency was impossible, look into what's been taking place to renewable resource stocks.

Succeeding flare ups of the pandemic have actually dealt repeated blows to expect a resurgence of flying and tourist. Travel and leisure was the worst-performing field in the Europe Stoxx 600 index this year, losing out on the rally that catapulted equities throughout the region to successive records.

And also yet airlines have actually outperformed green stocks in 2021, in spite of this year's promises by federal governments to reduce greenhouse exhausts as well as spend greatly in clean power. A gauge of the largest as well as most fluid European stocks in the renewable resource market is down 20% in 2021, just as the Stoxx 600 finishes the year floating around record highs.

Deutsche Lufthansa AG has lost concerning a fifth of its worth this year, while British Airways owner International Consolidated Airlines Group is down 12%. Disappointing as they might look, such returns look excellent contrasted to plunges of 37% for Siemens Gamesa Renewable Resource, as well as 33% for offshore wind farm champion Orsted A/S.

After dropping by almost a 3rd this year, Vestas Wind Systems has warned that even more discomfort lies ahead, amid surging commodity rates as well as supply-chain bottlenecks that interfered with manufacturing. Yet the cost of resources is not the only reason criticized for the dull returns.

In a way, green stocks are paying the price of past success, as a rally in 2019 and also 2020 catapulted their assessments right into the air. Now, much of the bright side on government promises to pivot their economic situations towards a low-carbon model is already priced in.

Even after this year's share cost plunge, Siemens Gamesa trades at 52 times its anticipated profits for following year, as well as Vestas at 45 times. That compares to 15.7 times for the Stoxx 600.

While equity planners from BlackRock Inc. to Goldman Sachs Group Inc. and also Societe Generale have claimed that decarbonization provides unprecedented chances to investors, near term headwinds stay.

Appraisals for "green stocks are still raised," Bloomberg Intelligence planners Tim Craighead as well as Laurent Douillet claimed in a note. "Lower sales expectations and also greater steel costs pressure wind-turbine profits."

Also read