JinkoSolar provides variety item deliveries support for 2021

- Significant 'Solar Module Super Organization' (SMSL) member JinkoSolar has guided 2021 total product deliveries (wafers, solar cells and modules) to be in the range of 25GW to 30GW.

The wide range-- a 5GW spread-- is raw in comparison to JinkoSolar's preliminary annual shipment advice range for the previous year (2020 ), which included only PV module shipments and was directed to be in the range of 18GW to 20GW, a spread of 2GW.

Monitoring had actually kept in mind in providing 4th quarter as well as full-year 2020 financial results that it had actually been a very tough year as a result of the COVID-19 global pandemic, while likewise keeping in mind the challenges in the mismatch between material supply (polysilicon and solar flat glass) and also solid residential and also worldwide downstream need in the 2nd half of 2020.

Xiande Li, JinkoSolar's chairman of the Board of Supervisors as well as Chief Executive Officer claimed, "2020 was a really tough year for the solar industry as international markets were shrouded in uncertainty because of the COVID-19 pandemic."

"Since the fourth quarter of 2020, the inequality in between supply and also need remained to drive volatility upstream and downstream. We forecast this circumstance will continue right into the second quarter of this year. While there are still supply shortages, there suffices polysilicon to support over 180GW of module manufacturing and also supply is sufficient in many sectors of the supply chain. As global installment levels are still most likely to raise this year, need for modules will restore as soon as market value are stabilized," Li stated.

Monitoring noted in its latest earnings call with monetary experts that although the firm had protected adequate materials and items to satisfy its 2021 support array, it was still taking care of high material rates that consequently meant PV module pricing would certainly have a negative effect of downstream markets until the supply and demand metrics rebalanced.

As lots of significant PV manufacturers are facing, elevating costs is practically inescapable as margin stress accelerates as a result of high product demand.

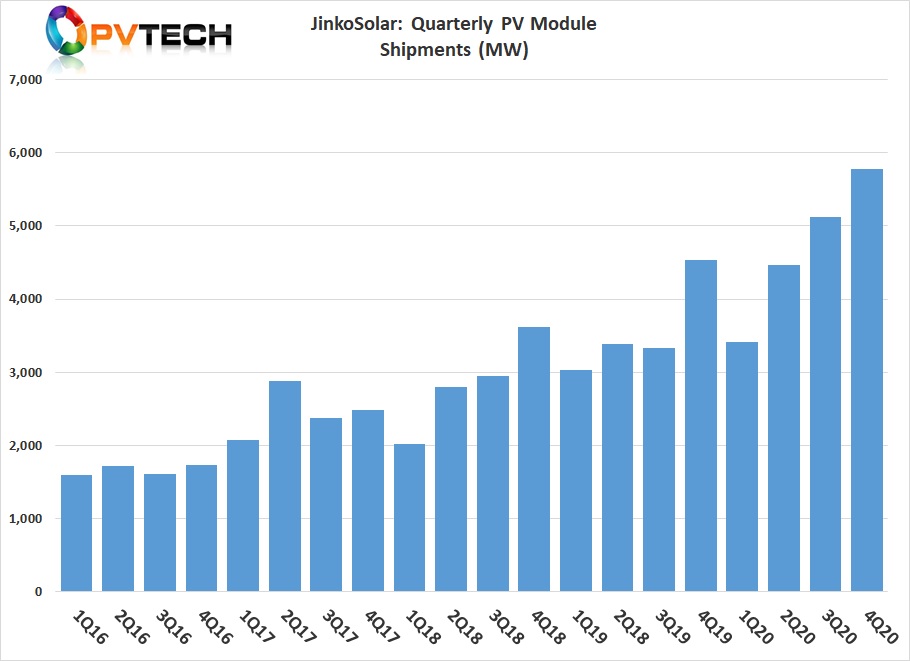

JinkoSolar reported strong fourth quarter 2020 shipments of 5,774 MW, up 27.2% year-on-year.

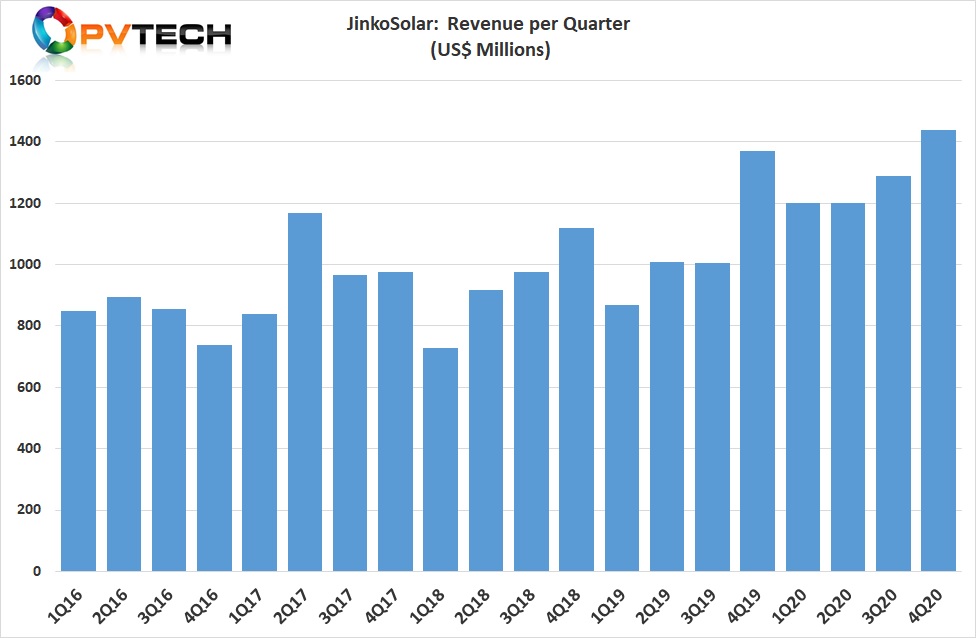

4th quarter profits was US$ 1.44 billion, contrasted to US$ 1.37 billion in the previous year period, a 5% rise.

Although the business reported a gross profit in the quarter of US$ 230.9 million, which was down 12.9% from the previous year period, JinkoSolar reported revenue from procedures of US$ 11.0 million, down 88%, year-on-year.

JinkoSolar additionally reported a net loss of US$ 57.8 million that was attributable to the business's ordinary shareholders in the 4th quarter, due to US$ 65.5 million loss of modification in reasonable worth of convertible elderly notes and call alternative, according to the business, which was as a result of the sharp increase in its stock rate throughout the quarter.

Not surprisingly, gross margin has been declining. In the fourth quarter, gross margin was 16.0%, compared with 17.0% in Q3 2020 and 18.2% in Q4 2019.

The business guided gross margin in the initial quarter of 2021 to be between 12% and also 15%.

On the whole, JinkoSolar's shipments in 2020 reached a business document of 18,771 MW, up 31.4% year-year, and also caused total income of US$ 5.38 billion, up 18.1%, year-on-year, another company document. Gross profit was US$ 945.8 million in 2020, up 13.6% from the previous year.

The wide delivery array for 2021 would certainly appear to be credited to the complexities of the upstream supply and also product expense dynamics, coupled to strong downstream demand that could oscillate hugely as the downstream is very sensitive to PV module average selling prices.

Also read