JinkoSolar cuts 2021 ability growth intends as rates volatility attacks

- JinkoSolar has devalued its 2021 ability growth plans on the rear of dominating supply chain as well as market problems.

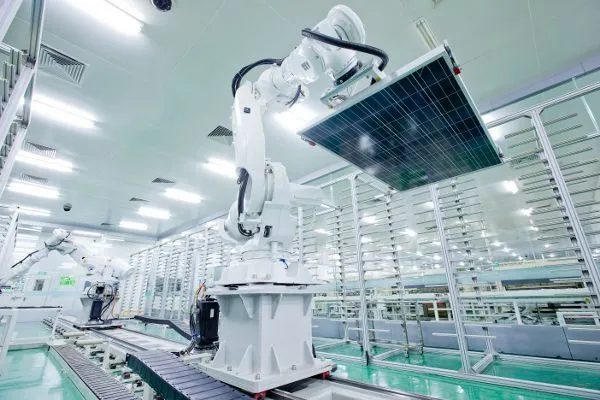

The 'Solar Module Super League' (SMSL) participant disclosed within its Q1 2021 results disclosure that it has modified its capability growth prepare for this year, validating that the manufacturer's solar wafer, cell and module manufacturing capacities stand to get to 30GW, 24GW as well as 32GW by the end of this year specifically.

This is a downwards modification on the forecasted capabilities offered at JinkoSolar's complete year 2020 financial results disclosure. The business formerly expected to finish 2021 with solar wafer, cell and module production capacities of 33GW, 27GW as well as 37GW respectively.

JinkoSolar stated it had changed its capability growth plans for this year after "taking into consideration supply chain as well as market problems", significantly pointing in the direction of spiking polysilicon as well as logistics costs forcing business to boost module prices, wetting end market demand.

The company did, nevertheless, verify it anticipates demand to return in the 2nd fifty percent of this year, as well as has actually declared the module deliveries guidance of 25-- 30GW that it gave at the beginning of the year.

Jinko's gross margin for the reporting period was also higher than projection-- 17.1% as opposed to the 12-- 15% forecast at the start of the year-- however the business still expects full year gross margin to fall within the 12-- 15% array. Nonetheless, Jinko's margins have actually shrunk on current periods: the producer reported a margin of 19.5% in Q1 2020.

JinkoSolar tape-recorded module deliveries of 4,562 MW in the three-month period ended 31 March 2021, up 33.7% year-on-year, with a more 792MW of solar cell and also wafer shipments also tape-recorded in the opening quarter.

This contributed in the direction of revenue of RMB7.94 billion (US$ 1.21 billion), down 6.4% year on year, while gross profit slipped 18% to $207 million, showing the sharp impact raw material rates volatility carried solar makers in the opening three months of the year.

That performance led the company to report a general bottom line of US$ 33.7 million in Q1 2021, down 21.7% year-on-year.

Xiande Li, chairman of the board of directors and also Chief Executive Officer at JinkoSolar, stated it was the firm's technique to handle its supply chain carefully throughout the period, focusing on making improvements to making processes to alleviate pressure on prices.

"Throughout the very first quarter, the discrepancy between polysilicon supply and strong downstream need in addition to several various other factors remained to raise module prices in addition to lots of factors, but our company believe this impact on downstream customers is momentary," he added.

Li also stated the firm would change its manufacturing quantities and delivery framework according to market problems in order to minimize the impact of prices on its success. While Jinko provided no accurate figure for its utilisation rate in either the outcomes disclosure or its analyst phone call, Gener Miao, the business's principal advertising police officer, told experts that whilst the polysilicon cost remains high, it was his expectation that producer utilisation prices across the board would be greater in H2 than in H1.

Meanwhile, JinkoSolar additionally confirmed that it had finished the construction of a high-efficiency laminated flooring perovskite cell technology system that it claimed was expected to create an advancement cell conversion efficiency above 30% within the next year. No even more details were supplied during the presentation, however once again Miao supplied additional colour for analysts, stating his idea that the perovskite cell technology would certainly not be ready for industrial manufacturing for an additional 3 to five years.

Also read