Is JinkoSolar (JKS) A Better Solar Supply To Acquire Than Enphase (ENPH) Energy?

- Solar stocks bounced back strongly on Tuesday’s trading session as investors pile back into companies with strong growth. The stock market’s rise certainly helped lift some of the top solar stocks. But there was news specific to the industry that also helped. Of course, the biggest news was that the bond yields were dropping. Although the drop wasn’t significant, many are optimistic about the way rates are doing after the recent increase. And it appears that is enough to reinvigorate solar stocks in the stock market today.

Should Financiers Think About JinkoSolar (JKS) Supply?

Why does the activity in rate of interest issue, you ask? That's merely since solar installations need significant cash money upfront and take years of tiny cash flows to repay. In a manner, you can say it acts even more like a bond. At greater rates, those future cash flows come to be less important today. Alternatively, reduced prices make the capital worth more. Consequently, solar stocks are taking advantage of a reduction in prices.

Leading photovoltaic panel supplier, JinkoSolar's (NYSE: JKS) supply has had an excellent run in 2020. The business is just one of the globe's biggest solar panel producers as well as a large player in the solar market. JinkoSolar disperses its solar products as well as provides its solutions to a varied international energy, commercial, and residential consumer base. The inquiry right here is, can JKS stock remain to outshine after such a substantial run-up in its stock rate? Let's take a deeper dive to discover.

China's Prospering Photovoltaic Market Makes A Favorable Situation For JKS Stock

JinkoSolar is one of the globe's biggest photovoltaic panel suppliers. It has 7 manufacturing centers in China as well as one each in the U.S. and also Malaysia. Having most of the manufacturings in China provides the firm an edge in terms of lower production prices contrasted to its U.S.-based peers. Looking at China's Thirteenth Five-Year Plan results, the country has boosted its competitiveness in the photovoltaic or pv room. It accomplished its highest extra module delivery as well as cumulative shipment.

For those unfamiliar, JinkoSolar is supposedly constructing a 20GW manufacturing base for large battery pieces in Yunnan provinces. This will end up being the business's largest production base for battery items upon conclusion. Undoubtedly, the extreme rate competitors among other solar firms brought about the decline in solar module rate. That has actually unquestionably dragged JinkoSolar's operating margin over the past few years. While that could spell trouble for the firm and the industry generally, the company has taken care of to navigate the significantly competitive field and appeared more powerful. Below's just how.

Technical Superiority & Production Capacities

Even the greatest doubters can't reject that JinkoSolar gets on solid financial ground. But the business didn't obtain right here doing the exact same with any one of its rivals. Its technical advantages and also production ability play an important function in its solid growth over the last few years. If one feels unconvinced, just check out the company's past quarters in 2020.

Remember that the business continued to publish solid growth amid the worldwide pandemic. Even in one of the most difficult times, JinkoSolar was able to implement. As solar power generation has a lower expense compared with coal power generation, it will certainly come to be the key source of power in the future. With the firm's technical advantages in the performance of its elements as well as new innovation in the items. It's safe to claim that the development runway is much from over.

According to the president of LONGi Solar, 69% of energy will certainly stem from photovoltaic power generation in the future. Considering the global shifts in the direction of environment-friendly energy, it's all-natural that solar companies like JinkoSolar as well as the broader market won't be able to completely satisfy its demand. Consequently, these photovoltaic companies will have to expand their manufacturings in succession. Among these firms, JinkoSolar's manufacturing capacity was ranked in the leading 3 in 2020. As well as there is a good chance the company can maintain its leading position in the future.

Fast Growth & Increasing Productivity

Investors love JinkoSolar due to the fact that it is just one of the fastest-growing solar stocks throughout the years. For contrast functions, the business's sales growth surpasses some of its sector peers including Very first Solar (NASDAQ: FSLR). From 2010 to 2019, JinkoSolar expanded its sales by an average of 22% a year, easily beating First Solar's 2% development. This is definitely a testimony to JinkoSolar's abilities. JinkoSolar's technique to broaden sales, even at a slightly lower margin, might bode well for it.

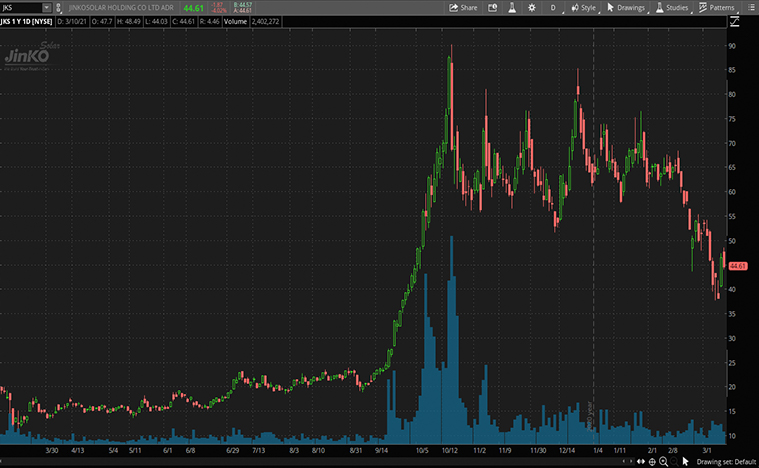

Image: TD Ameritrade TOS

JinkoSolar is currently set up to report its fourth-quarter profits before the opening bell on Thursday, March 11. For the unaware, JinkoSolar has outmatched earnings expectations in 3 of its last four incomes reports. According to the International Renewable Resource Company (IRENA), the worldwide accumulative module delivery volume has kept a climbing fad since 2015 and also is expected to reach 1722.14 GW by 2025.

When compared with other gamers around the world, JinkoSolar's deliveries were still in the leading setting. Although LONGi Solar was rated 1st in 2020 with 20GW shipment, JinkoSolar followed closely with only 18.75 GW. With the higher pace of typical annual development in the past years, I will not be stunned if it might overtake LONGi Solar in the close to term.

Profits On JKS Supply

Altogether, the company's development prospects stay very impressive, as does the expectation for the overall solar-energy market. At once where more people and companies advocate for lasting growth, the photovoltaic market is becoming more encouraging without a doubt.

If we are to value JKS supply compared to its market peers, you would certainly learn that it's trading much more inexpensively than its peers. Probably, it might be because the Chinese company has various reporting requirements and also audit requirements. It would certainly be no surprise if investors believe JKS supply must trade at a discount in comparison with its UNITED STATE peers.

JinkoSolar is growing its focus on its residential market, thanks to support from the Chinese federal government. Nevertheless, it is not all smooth-sailing for the solar market. As a result of the pandemic, governments as well as services may be reassessing their capital spending. Perhaps, several of that will affect renewable energy firms. Nevertheless, JinkoSolar's track record of solid growth may minimize some fears of its ability to stay durable amid a difficult economic atmosphere. Thinking about that, is JKS stock a leading solar stock to purchase for the years to come?

Also read