Investment estimates for 2020 remain to indicate a record downturn in investing

- Released in May 2020, the IEA's World Energy Investment 2020 pointed to a record downturn in international power financial investment. This write-up offers an upgrade to those figures based on extra recent analysis, showing that capital expenditures throughout the energy market are anticipated to fall by 18% this year to $1.5 trillion.

Introduction

This quote is only decently transformed from the quote we published previously this year, with rather smaller financial tightening as well as far better performance in some clean-energy associated markets, such as eco-friendly power.

Throughout all industries, stress on spending continue because of weakened company annual report and uncertainties over future need. Nevertheless, underlying changes in spending patterns recommend a more distinguished investment photo emerging across power sectors as well as regions. In spite of a weakened need image, the slump in investment is most likely to have major effects for power markets in the years in advance, forming the calculated orientation of companies and financiers, along with raising risks over conference longer-term power protection and sustainability objectives.

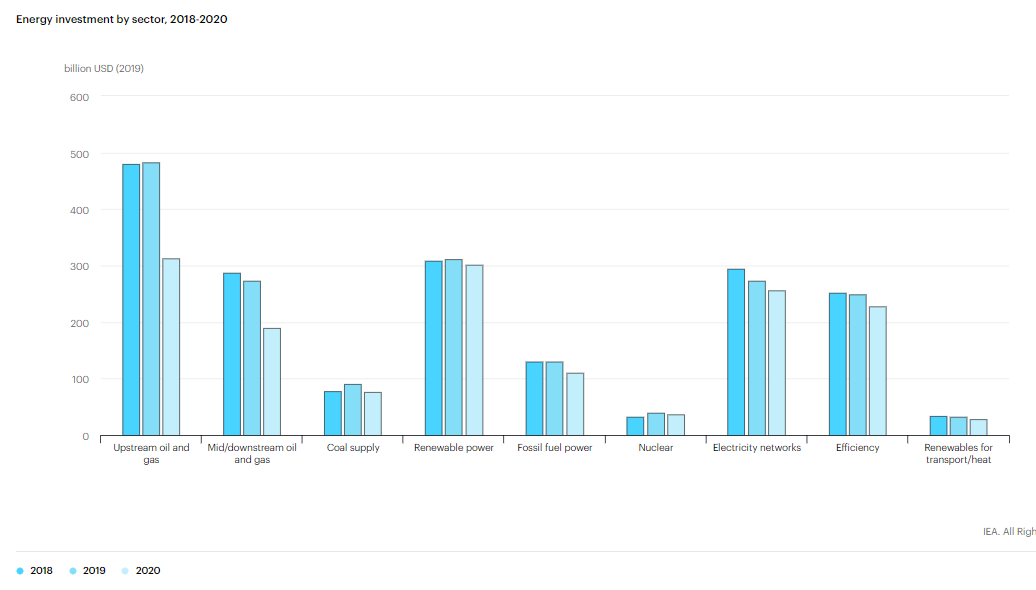

Fuel supply continues to be hardest hit, while clean-energy spending continues to be much more resilient

Investment in fuel supply continues to be struck hardest, with upstream oil as well as gas investing set to decline by 35%. This rather weaker outlook originates from cuts of around 45% by shale business in the United States, which have experienced a rise of personal bankruptcies, discharges and shut-ins, as well as a 50% jump in funding expenses. These problems have actually set the stage for loan consolidation of businesses in the hands of less, better capitalised gamers, exemplified by the recent merger news in between Chevron and Noble Energy and Devon Energy as well as WPX.

Investment by oil and gas majors is down by around one quarter. In spite of convenient borrowing costs, the additional hits to profits from reduced prices and also demand, along with financier stress, are requiring a focus on high value projects with fairly quick capital advantages. National oil business, that make up 55% of manufacturing, have sharply cut financial investment, but generally less than the overall decline.

Spending is better sustained in manufacturer economic climates with some monetary barriers, such as Saudi Arabia and Russia (where firms benefit from money devaluation as well as adaptable tax) compared to those, as an example in Africa, that are under more budgetary stress from heavy reliance on hydrocarbon profits. Nevertheless, economic stress have actually triggered even some fairly solid gamers to count on brand-new funding approaches, such as Adnoc's USD 10 billion sale of its stake in its gas pipelines service.

Some oil and gas business are replying to such stress by stepping up diversity efforts, guided by new lasting exhausts goals. While these differ in scope and also aspiration, numerous European majors have actually raised resources assistance for low-carbon projects. Investment commitments are most visible in sustainable power, where USD 3.5 billion of final financial investment choices (FIDs) have been taken by oil as well as gas business in 2020, two-thirds more than their capital spend outside of core areas in 2019.

Near-term decisions to finance low-carbon fuels and carbon capture are dealing with even more of an uphill struggle, though energy is being supported by sustainability objectives, projects under development (potentially representing over USD 25 billion of CCUS investment to 2030) and also new funding announcements, such as for Norway's Longship project.

Recent years have actually seen a wave of passion in melted natural gas (LNG), consisting of a pivot in the direction of even more equity financing, which has actually accelerated project approving. This fad showed solid demand expectations as well as a sight amongst financiers that this type of financial investment is relatively durable to a lot more ambitious climate circumstances. Yet no FIDs for new projects have actually arised in 2020. That claimed, a record $18 billion of refinancing and acquisitions through August reflects efforts to much better placement this sector for the future.

We currently expect that power generation financial investment is readied to decrease by 7% in 2020, a somewhat more positive assessment compared to the 11% fall envisaged in May, mostly because of much better leads for low-carbon generation. Yearly investing for renewable power is now seen down by only 3% compared to the prior year, sustained by continued advancement of large projects with long preparations, such as overseas wind (where several large North Sea projects recently shut funding) and also hydropower.

A rebound in 2nd quarter FIDs likewise supports more powerful financial investment assumptions for utility-scale solar PV and also onshore wind. The boost is concentrated in sophisticated economic climates, where favourable monetary conditions, boosted innovation maturity and also policies supporting reputable cash flows have actually decreased the cost of resources gradually. Our analysis of utility-scale solar PV suggests the pandemic has raised financing prices in 2020, however with the cost of funding still around 5% in the United States as well as Europe, generation costs associated with FIDs with profits assistance continue to be mainly listed below that for brand-new gas-fired plants. Greater threats to renewables investment continue emerging market and establishing economic climates where state-owned energy counterparties are under economic strain and some markets, such as Brazil, have put off capacity auctions, though project approving has thus far remained fairly durable in India.Some oil and also gas firms are replying to such pressures by stepping up diversity efforts, led by brand-new long-lasting emissions objectives. While these vary in range and also passion, numerous European majors have actually enhanced funding support for low-carbon projects. Investment commitments are most visible in eco-friendly power, where USD 3.5 billion of final investment choices (FIDs) have actually been taken by oil and gas business in 2020, two-thirds higher than their resources invest beyond core areas in 2019.

Near-term choices to fund low-carbon fuels as well as carbon capture are facing more of an uphill struggle, though momentum is being sustained by sustainability goals, projects under growth (possibly standing for over USD 25 billion of CCUS investment to 2030) and also new funding news, such as for Norway's Longship project.

Recent years have seen a wave of rate of interest in melted natural gas (LNG), consisting of a pivot towards even more equity financing, which has actually sped up project approving. This pattern showed strong need expectations and also a sight amongst financiers that this kind of investment is fairly durable to much more ambitious environment situations. But no FIDs for new projects have arised in 2020. That stated, a record $18 billion of refinancing and procurements via August mirrors initiatives to better setting this sector for the future.

We currently anticipate that power generation financial investment is readied to decline by 7% in 2020, a somewhat more optimistic analysis contrasted to the 11% autumn imagined in May, primarily as a result of better potential customers for low-carbon generation. Annual spending for eco-friendly power is currently seen down by just 3% contrasted to the prior year, supported by ongoing growth of huge projects with long preparations, such as overseas wind (where numerous big North Sea projects recently shut funding) as well as hydropower.

A rebound in 2nd quarter FIDs additionally sustains more powerful investment assumptions for utility-scale solar PV and also onshore wind. The increase is focused in innovative economic situations, where favourable monetary problems, enhanced modern technology maturity and also policies sustaining trusted cash flows have reduced the cost of resources gradually. Our evaluation of utility-scale solar PV recommends the pandemic has actually risen funding costs in 2020, but with the price of resources still around 5% in the United States as well as Europe, generation prices associated with FIDs with revenue assistance remain primarily below that for new gas-fired plants. Greater dangers to renewables investment persist in emerging market and establishing economic situations where state-owned energy counterparties are under economic strain as well as some markets, such as Brazil, have actually delayed capacity auctions, though project sanctioning has so far remained relatively durable in India.

Such dangers additionally contribute to proceeded fancy investing on coal-fired power. Despite an uptick in FIDs to over 10 GW in the first fifty percent of 2020 and statements from China of a bigger collection of permitted projects, coal power financial investment seems at its lowest level in over 15 years. Investments in brand-new gas power have come to be less practical in a lower need and also rate environment for wholesale markets. At almost 25 GW in the very first fifty percent of 2020, FIDs stay much higher than those for coal power, however are still trending near decade lows, with a fall-off in the United States.

Investment in power networks is set to decline for a fourth straight year. Greater renewables financial investment and moderate grid costs growth in China through the first 8 months of 2020 support a reasonably improved quote of a 6% decrease compared with the 9% approximated in May. Climbing shares of variable renewables during the pandemic have actually brought system integrity as well as strength more into emphasis. Utilities in innovative economic situations likewise face few difficulties in accessing financing, partially due to the regulative buffer offered by grid possessions. Nonetheless, grid driver profits dipped throughout major economies in the initial half of the year and expanding vulnerabilities for state-owned energies in establishing economies produces threats for prompt future financial investments. Meanwhile, battery storage space financial investment is proceeding at virtually the same rate as in 2019, with a large project pipeline likely to support development next year.

Investing in power effectiveness enhancements is set to decline by around 9% in 2020, compared to an earlier estimate of 12%. Greater assumptions for 2020 economic development have somewhat damped investing declines in China and also innovative economies While sales of new autos are expected to have actually fallen by greater than 10% compared to in 2014, fuel economy targets and zero emissions vehicle requireds are sustaining EVs, whose annual market share is prepared for to reach 3%. The resumption of annual development in industry as well as building and construction task in China since the 2nd quarter buffers these locations, yet international momentum relies on the assimilation of effectiveness steps right into recuperation strategies, such as initiatives under consideration in Europe to use financial instruments as well as efficiency requirements to stimulate prevalent buildings restoration.

At the same time, expanding earnings unpredictabilities are preventing customers from making use of reduced rate of interest for home loans and auto loan in innovative economic situations while progression in expanding efficiency-related financing offerings in establishing economic climates is likely to slow. Refinancing of smaller-scale energy possessions (e.g. reliable real estate, distributed solar PV) with asset-backed protections issuance has been up to its slowest rate in four years, sapping the capability of banks as well as programmers to redeploy limited capital. Reduced power prices have prolonged payback durations for crucial power performance procedures by 10-40%, undermining the instance for treatments by power service business and the monetary health and wellness of independent players. In the near-term, performance costs is much more reliant on direct public financing as well as utility commitments, in addition to on efforts to reduce power intake subsidies.

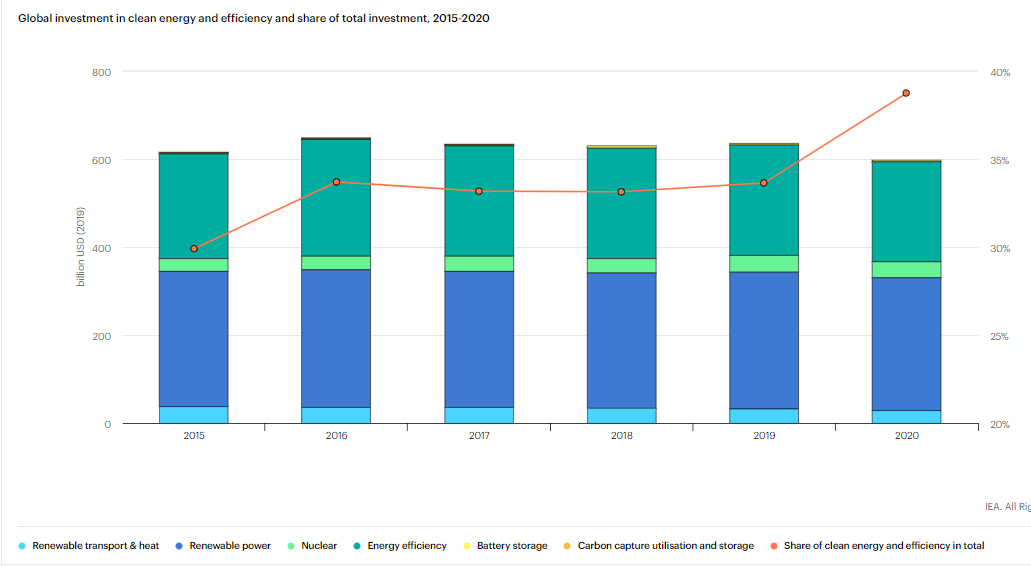

Total capital expenditures for tidy energy have actually continued to be static recently at around $600 billion each year. Falling prices for crucial sustainable innovations have actually placed downward pressure on this number. There are likewise an increasing number of lasting finance efforts and also taxonomies, and proof that associated investments can provide far better risk-adjusted returns for capitalists. However these patterns have yet to make a visible impact in pushing capital investment up. Even though the share of tidy spending is set to jump in 2020, this stems a lot more from weak point in fossil fuel-related financial investments, with degrees much except what would certainly be needed to put the world on a more sustainable pathway, discussed a lot more in detail listed below.

Descending pressures remain intense in regions based on oil as well as gas, and also in creating economic situations.

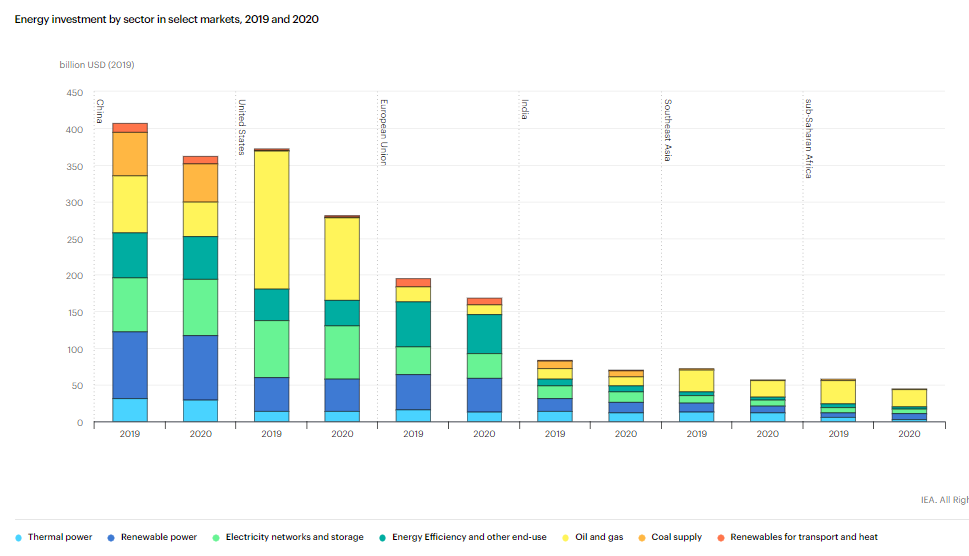

Overall, China remains the largest market for financial investment and also a location where potential customers have improved because May, with possible additional assistance from recent state statements to boost multi-year financial investment in electrical power grids, pipelines, nuclear as well as "calculated emerging sectors", such as battery storage and also EVs. Financial investment problems have likewise improved in Europe, significantly on the back of greater investing expectations for eco-friendly power, power networks and performance, also as the area still registers dual digit percentage decreases in general capital spending. Despite higher assumptions for renewables investment, the United States remains the market with the largest financial investment decrease because of a sharp reduction in oil and also gas financial investment.

Investment leads have intensified in arising market and developing economies, notably India, Latin America, Southeast Asia as well as sub-Saharan Africa. While some pressure on currencies and sovereign bond yields from fast capital outflows during the crisis has subsided, financial dangers and stress on state-owned venture balance sheets, in charge of the mass of power investment, are equating into higher financing costs in these areas. In nations such as South Africa, Indonesia as well as Brazil, modifications in monetary indicators observed in the first-half of 2020 would certainly convert right into a 10-25% boost in generation prices for a measure onshore wind financial investment, depending upon regional problems.

Mobilising exclusive capital to money sustainable recuperations will depend on federal government actions

The slump in power financial investment is most likely to have significant repercussions for energy markets in the coming years, although the economic decline is also putting descending pressure on demand. Based upon the statements made so far, recuperation policies designed to boost investment do not normally have a solid power or sustainability part, with the notable exception of those in Europe, Canada as well as a couple of various other countries. As governments consider means to mobilise private capital, they will certainly require to take into consideration 3 major financial investment concerns.

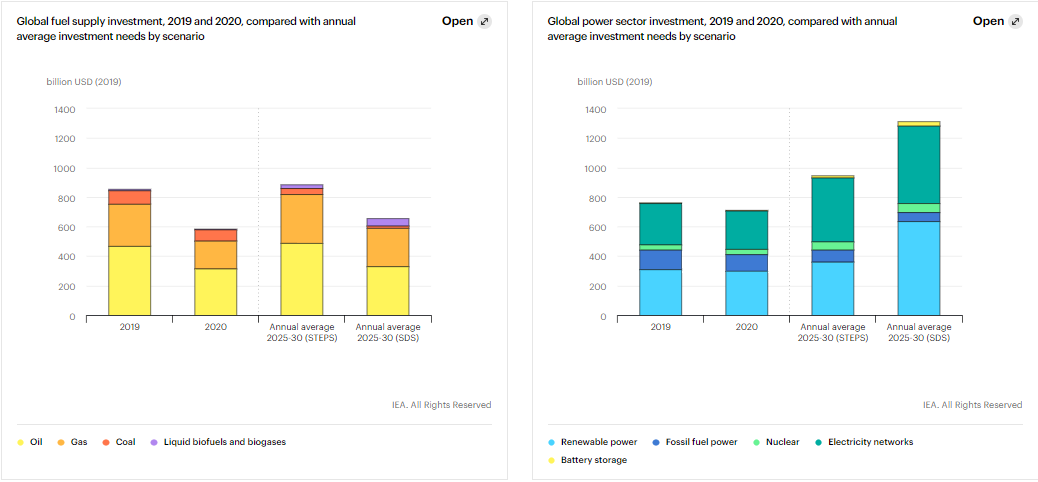

First, the future energy system will need considerably more funding to make sure that supply is both reputable and also ample to satisfy demand. Under the IEA's Stated Policies Scenario, power supply financial investment would certainly rise to nearly $1.9 trillion within 10 years, from $1.3 trillion in 2020, with greater levels required to satisfy the sped up discharges reductions objectives of the Sustainable Development Scenario (SDS).

Second, meeting sustainability objectives would need a significant shift in resources allowance throughout sectors. The share of tidy energy in total investment would certainly require to rise to around two-thirds by 2030, accompanied by a significant scale up in clean power, power grids and demand-side fields.

Third, much higher investment is needed in emerging market as well as establishing economic situations, specifically beyond China. There are creating economic climates with strong records of bring in financial investment in renewables, as highlighted by the surge of solar PV in India. Yet, global financial capital is concentrated in advanced economic situations. Progression depends upon far better connecting resources of sustainable financing with the locations of biggest need, and also straightening these sources with the requirements of business and also properties. Our very first detailed analysis of the funding framework of energy financial investments points to growing needs for both equity and also financial debt, however with a higher level of reliance on debt-based funding in the SDS as a result of the raised emphasis positioned on power projects and spending on demand-side technologies and effectiveness renovations.

While public financing has a crucial function to play, via advancement and environment-friendly financial institutions, greater than 70% of tidy energy-related financial investment in the SDS is likely to find from private sources of resources, incentivised by proper market design, regulative structures and policy motivations. In creating economic climates, specifically, enhancing the bankability of projects and the ability of firms to elevate funds will certainly have a vital part to play in managing the cost of clean power shifts.

Also read