Infracapital invests ₤ 200m in Gridserve

- EV infrastructure designer working on solar energy version for billing fleet

Infracapital, the infrastructure equity financial investment arm of M&G Plc, has actually made a preliminary ₤ 200m (EUR237m) financial investment in electrical vehicle infrastructure designer Gridserve.

The investment support Gridserve's plans to create power for its UK billing fleet through development of hybrid solar farms.

This energy will certainly be distributed with a nationwide charging network of Electric Forecourts and also Electric Hubs, and also accelerating the uptake of electrical vehicles with renting a large range of the most up to date electrical vehicles.

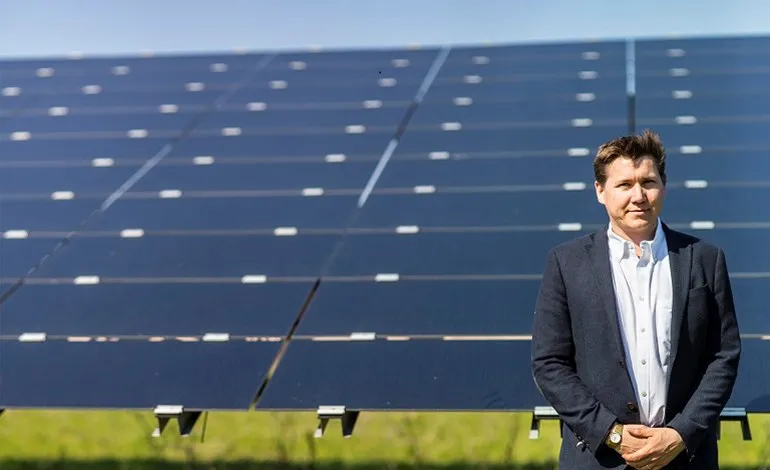

Gridserve president Toddington Harper (imagined) claimed: "Through this investment partnership with Infracapital, we're excited that our strategies can speed up, and also it's evident we currently have the momentum we require.

" They are the perfect companions to join our business as we transfer to the following level as a firm.

" Their commitment to clean tech, infrastructure, and also ESG provides our cumulative organisations deep-rooted synergies around a common objective.

" Investment in the future of our earth has never ever been so important as well as the IPCC's most current dire warnings strengthen the fact that we are in last chance territory, and also we consequently need to take action as quickly as possible.

" This investment collaboration will allow Gridserve to continue to rise to this difficulty and also provide maximum impact immediately."

Infracapital, which signs up with Gridserve's existing investors Mitsubishi HC Capital UK Plc as well as TPG Rise, was encouraged on the transaction by RBC Capital Markets (monetary) as well as Clifford Chance (lawful).

Gridserve was suggested by Nomura Greentech (financial), White & Case (lawful) and also PWC.

Also read