ib vogt Secures PLN 400m Refinancing For Polish Solar Portfolio

- ib vogt refinanced two Polish solar parks totalling 175-MWp with a PLN-400-million facility, freeing capital and extending asset maturities.

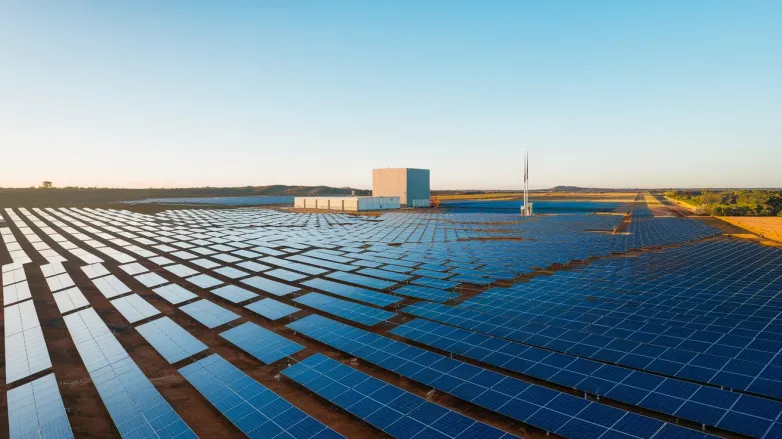

ib vogt has closed a PLN-400-million (about USD 110 million/EUR 94 million) refinancing for two Polish photovoltaic parks totalling 175-MWp, marking another sign that lenders remain comfortable with contracted, grid-integrated solar fleets in Central and Eastern Europe. The transaction replaces construction-phase debt with longer-tenor financing matched to operating cash flows, releasing sponsor capital for new development while lowering the portfolio’s cost of funds.

The assets—built to contemporary standards with high-efficiency modules and utility-grade inverters—operate under revenue frameworks that blend contracts and exposure to Poland’s dynamic wholesale market. A portfolio approach brings scale advantages: unified SCADA and performance analytics, harmonised O&M and spare-parts strategies, and stronger purchasing power for replacement components over the life of the projects. Those efficiencies not only improve availability; they also make lenders more confident in long-run yield assumptions.

Refinancing at this point in the assets’ life cycles is strategic. After the initial production year, operating data reduces uncertainty around degradation, soiling rates and curtailment frequency—key inputs for debt sizing. Extending maturities and locking competitive pricing can lift equity returns without changing the physical assets. It also insulates projects from interest-rate volatility that has complicated greenfield financings across the continent.

Grid-side, Poland continues to strengthen interconnections and distribution capacity to accommodate rapid solar build-out. Battery retrofits—either co-located or at substations—are increasingly evaluated to shift energy into evening hours and to provide ancillary services as renewable penetration grows. Even where storage is not added on day one, prudent owners preserve pad space and transformer headroom to keep that door open.

For host communities, little changes with refinancing: plants keep producing, local taxes continue to flow, and biodiversity measures remain in force. For ib vogt, the facility crystallises operating value and readies the balance sheet for the next tranche of construction—turning an early development bet into durable, income-producing infrastructure.

Also read