Hold Your Nerve: Energy Transition Risks as well as Red Herrings in 2022

- Clean energy has actually had a great pandemic. Global wind and solar implementations struck brand-new documents in 2020 and also 2021, as did electric vehicle sales, and COP26 in Glasgow brought progression on a number of crucial fronts. Government net-zero targets currently cover or are readied to cover 90% of global discharges.

At the same time, the global energy and also commodities crisis, the swiftly changing macroeconomic environment, as well as political difficulties all shadow the perspective. It can be hard to determine which of these are actual dangers to the low-carbon transition, as well as which are possibly red herrings.

High input and products prices

For more than 10 years the clean energy industry has been constant in driving prices down, such that tools for renewables plants is as much as 10 times less costly currently. Many individuals operating in renewables have known nothing however dropping expenses for their whole professional lives, and project designers frequently cook assumed expense decreases into project quotes 2, three and also five years in advance.

So the product price boom of the past months has actually been new ground for several. Higher rates for steel, copper, lithium, polysilicon, freight out of Asia and other inputs via 2021 have caused cost increases in an industry used to taking deflation for granted. The effects are rippling with the supply chain. Solar PV component rates were about 27 united state cents per Watt since late 2021, up from 19 cents at the most affordable point in 2020. The rate of wind generators in the second fifty percent of 2021 increased 9% to $930,000 per megawatt, according to BloombergNEF study.

BNEF's levelized price of electricity criteria, or LCOE, for utility-scale tracking solar PV climbed up 7% in the last 6 months of 2021. For onshore wind the gain was 4%. Lithium-ion battery rates did drop about 6% in 2021, but this is expected to reverse in 2022 as agreements enclosed 2021 feed into the information.

These impacts are quantifiable and also new. However a wider consider the energy sector casts them in a much better light. BNEF's LCOE benchmark for gas-fired power generation increased 12% in the second fifty percent of 2021, far more than for renewables, and Brent crude is 49% up since the start of 2021, at the time of writing. With 2021, the cost of running existing gas- and coal-fired power plants in open markets has at the very least doubled. So despite higher prices, renewables are still competitive in markets that represent 91% of the world's power generation.

There are likewise factors to believe the higher costs for renewables will be temporal. The supply of polysilicon, which has actually been the most significant traffic jam for PV in current months, must expand by 39% in 2022, according to BNEF's solar analysts. This, for instance, would alleviate a lot of the market's pain and also bring solar component prices back in accordance with the lasting trend. Products, it holds true, continues to be an unforeseeable aspect.

For batteries, the target is to obtain pack prices down to $100/kWh-- the figure at which EVs are expected to start competing with standard vehicles on an in advance purchase-cost basis, without subsidies. The long-term pattern suggests this will certainly be accomplished around 2024. If we factor in proceeding high input rates the day obtains pushed back simply 2 years to 2026.

So, while the short-term difficulties are real and also contract (re-) settlements will be complicated in the meantime, it feels like the clean energy sector needs to hold its nerve.

Climbing financing expenses

Along with technology-driven price depreciation, expansionary monetary policy has actually been an additional crucial tailwind for the clean energy market. BNEF has asked yourself for some years what to anticipate in renewables investment if and also when rate of interest dealt with upwards, as well as we will possibly learn in 2022-23 as reserve banks want to check inflation. Greater funding prices will surely raise the LCOEs of eco-friendly power, as well as extra so than for completing technologies such as gas, which are less heavy towards capex.

We have actually currently seen this in Brazil, where the central bank elevated its essential benchmark price to 7.75% last October. After considering higher equipment expenses, which brought about a 3% rise in project capex, onshore wind LCOEs have actually increased by 13-27% general.

We have actually previously estimated that the LCOE level of sensitivities of onshore wind and utility-scale PV are around +$ 1-1.5 per megawatt-hour as well as +$ 2/MWh, specifically, for a single percentage factor boost in expenses of capital. This amounts around 2.5% as well as 5% of the particular worldwide expense criteria today.

Anticipate to see these transforming prices reflected in project quotes in time-- however again, there are alleviating elements. The increase of lasting financial obligation, growing appetite for net zero-aligned financial investment chances as well as a thrill in the direction of ESG-focused assets implies that there is even more capital than ever offered for clean energy and also climate-related technologies, a minimum of in developed markets.

The energy crunch and also 'greenflation' worries

As the energy crunch wears on, greater prices will significantly feed through to customers, causing even more soul-searching over whether 'green' policies are the source of the pain. A few of this will certainly originate from well-meaning authorities and also analysts, yet it will be amplified by those intending to slow the low-carbon transition.

There are two notional systems: either green policies are explicitly contributing to the costs of energy using additional charges and carbon costs, and/or they are constricting investment into fossil energy supplies. Regardless, they would certainly be seen as feeding energy destitution and out-of-control inflation.

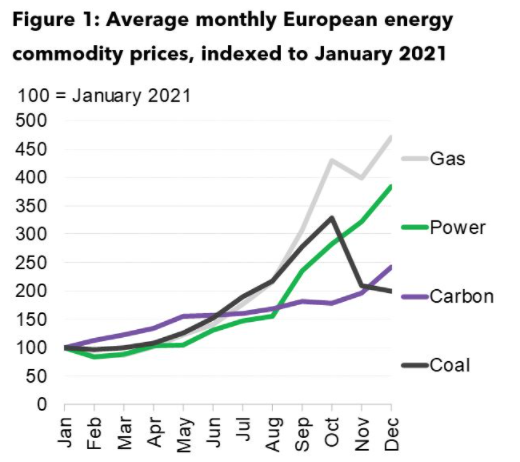

Both mechanisms exist in concept-- and also should be thoroughly thought about for future policymaking-- however neither plays anything greater than a small role in today's fact. Environment-friendly additional charges, consisting of carbon rates, continue to be a tiny (as well as relatively steady) slice of the end user's energy bill, while wholesale energy costs-- the biggest part-- have ballooned. In the very first five months of 2021, a 50% rise in EU carbon rates barely registered any kind of impact on power prices, as displayed in the European asset price graph below. But in the 2nd fifty percent of the year, as gas costs reached for the skies, power costs hitched a ride to about 4 times their beginning factor. As these increases feed through to customer tariffs, they will certainly bring financial discomfort-- but those seeking a green policy bogeyman here will certainly have to look somewhere else.

Without a doubt, power-price level of sensitivity to carbon rates will certainly fall over the coming years as making use of gas and also coal decrease, according to BNEF analysis. This is not to reject that there is a beneficial conversation to be had regarding the financial investment prices of the energy transition, and whether the energy bill is the appropriate location to put them.

As to the 2nd fee, that environment-friendly policies are constricting supplies of needed oil and gas: there is equally little proof of this. What has happened over the last 2 years is that the former 'swing' producers in the U.S. oil spot have actually discovered a brand-new sense of capital technique. As BNEF's Tai Liu has composed, united state oil & gas producers are awaiting several crucial signposts before enhancing their manufacturing, including the return of oil demand development, for OPEC spare capacity to be soaked up out there, as well as for shareholder assistance to boost capital expenditure. Energy transition policies have little to do with this as well as, as a matter of fact, the Biden management has actually clearly mentioned its support for U.S. residential producers to increase manufacturing.

Similarly, the LNG supply problem that has actually compounded the energy crisis has its roots in asset market cyclicality. It takes five years generally to construct an LNG plant, so choices to construct would certainly require to be taken right at the beginning of the brand-new united state shale gas-to-LNG boom. Sponsors would not have actually been convinced, as need projections simply did not show a demand for brand-new capacity up until the mid-2020s.

In the meantime, stars that do have the power to ease the worldwide energy crunch, such as Russia, OPEC and of course, the united state oil and gas industry, can stick around, enjoy superb rewards from the high rates, and also enjoy the view of analysts walking right into the enormous intellectual catch of criticizing climate action for the marketplace turmoil.

The danger right here is that we succumb to it. As BNEF has actually composed elsewhere, there will certainly be volatility right from here to web absolutely no, as supply and demand of oil, gas and various other commodities fall in and out of balance. Energy importers and distributors need to improve at browsing these cycles with lasting agreements and bushes. And also with this volatility, policy makers will certainly require to keep a laser concentrate on demand-side transition policies that chip away at culture's dependence on polluting fuels. 2022 will be the initial large test of this resolve.

Political disorder

Our final danger for the energy transition in 2022 is one of the most serious: that the lofty passions of leaders returning from COP26 struck a political brick wall back residence. This mostly worries the United States, obviously. The stalling of the Build Back Better (BBB) bill in December was a major trouble for President Biden's environment agenda, as that bill would have, among other points, expanded tax obligation credit ratings for countless clean modern technologies that need to be deployed in this decade.

There are positive sides: the passed Infrastructure Bill provides financing for grids, EV charging, hydrogen and carbon capture. Likewise, U.S. states will remain to seek their very own net-zero transitions. But if a brand-new BBB bill with significant climate arrangements can not be passed, it will certainly signal that even in the year 2022, a working political agreement on the low-carbon transition still does not exist in the united state

Worries of 'greenflation' are a variable right here also, with the critical Legislator Joe Manchin having actually expressed problem that U.S. consumers can not pay for to pay the bill for climate activity.

COP26 purchased the globe's climate mediators another year to find back with plans to reach 1.5 levels Celsius of warming, yet there's a real opportunity that the world's second-largest emitter will certainly do the opposite: come back without credible strategy to meet its existing objectives. This would certainly take several of the pressure off countries, specifically creating ones, that are wavering on elevating their very own commitments.

So probably the most significant danger this year comes in the stories we tell about inflation and also the price of living. It is said that nobody will vote to be bad and also chilly, however it holds that the prices of inaction on environment change are more than the prices of action. In a year of economic chaos, we will certainly need to be careful for spurious arguments that intensify the message of climate action hold-up.

Also read

- MN8 Energy Secures $575M for Solar, Battery Projects

- BNDES Admits Arctech to FINAME, Boosting Solar Trackers Across Brazil

- Huawei, Sungrow Extend Decade-long Lead in Global Inverter Race Again

- Niteroi Starts Work on 2,700-Panel Solar Park, Boosting Sustainability Drive

- Quadoro, EB-SIM Acquire German Solar Parks for QEEE Fund