Got $3000? Here Are 2 Solar Stocks to Buy and Hold for the Long Term

- A global push toward cleaner sources of power incorporated with dropping prices is causing continued growth for renewable resource. The U.S. Energy Information Administration projects that, by 2050, renewables will be the world's most-used energy source as well as will certainly create almost half of the world's power.

Additionally, among renewable energy resources, solar power's share is expected to grow the fastest. If you intend to invest in the future of energy manufacturing, right here are two top stocks to acquire to ride on the solar wave.

Canadian Solar

Canadian Solar (NASDAQ: CSIQ) is a geographically varied supplier of solar modules (or solar panels) with operations in 23 nations. Over the last 10 years, the firm has expanded its incomes by an impressive ordinary annual price of more than 20%. Similarly, its margins traditionally have been stronger than its peers.

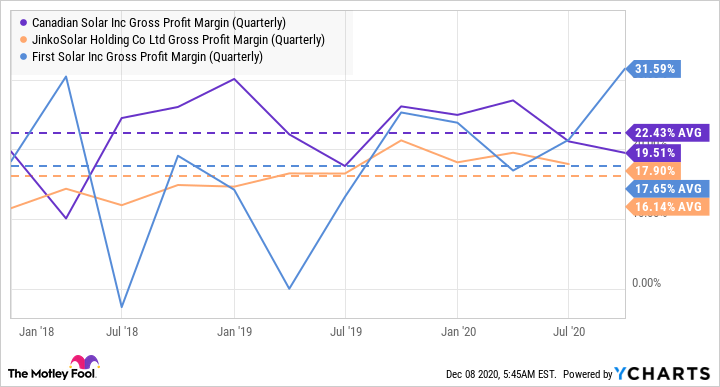

As the above graph programs, Canadian Solar's ordinary gross profit margin over the last three years has actually exceeded its top peers. The business's separated market strategy with a concentrate on costs roof sector provides it valuing power and is a crucial driver of its higher margins.

In July, Canadian Solar introduced its intention to provide its Module and also Systems Solutions subsidiary on the Chinese stock exchange. The intended listing will certainly supply it with an accessibility to additional low-cost resources while not straining its annual report. The business plans to utilize the proceeds for capability expansions as well as enhanced vertical integration.

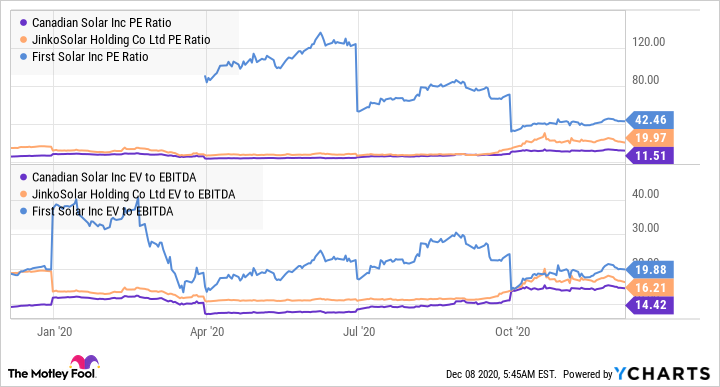

Along with the intended capacity growth and vertical integration efforts, Canadian Solar's significant potential growth motorist is power storage space items. Storage items aid align power demand with supply and are anticipated to substantially boost solar energy's prospects contrasted to traditional energy sources. Because of that, the need for storage items is anticipated to climb substantially over the coming years. With a remarkable storage space projects backlog, Canadian Solar looks readied to benefit from this massive prospective demand. Lastly, the supply is valued less expensively than its peers based upon PE and also EV-to-EBITDA ratios.

Solar module makers encounter intense competitors, especially on rates, which has the potential to squeeze margins. This threat could be one of the factors behind Canadian Solar's reduced assessment. Capitalists might think that the company's peer-leading margins might not last for life. Nevertheless, Canadian Solar has actually fared extremely well up until now in a progressively competitive market. Time will inform whether it can keep that efficiency, although previous efficiency recommends it can.

Solar power definitely has substantial development potential. Nevertheless, the market is quickly advancing as well as the stocks in the field can be quite volatile. Governmental rewards as well as plans can affect solar companies' profitability dramatically, as taken place in 2017 as well as 2018. Considering their erratic performance until now, it's best to take a long-term approach with holdings in your solar portfolio.

SunPower

With a background returning over twenty years, SunPower (NASDAQ: SPWR) has been introducing and trying out long enough to identify what works as well as what doesn't in the solar market. The business has actually done it all-- from producing microinverters to photovoltaic panels to installations to funding. It has actually currently ended that the most effective method to produce higher margins is by providing premium items and also making it hassle-free for customers to purchase them.

In contrast to the prominent strategy of upright integration to reduce expenses, SunPower is relocating to end up being a specialized gamer focused on solar technology. The company's logic is that this will certainly help the business to generate greater margins. In November last year, SunPower revealed its strategy to spin-off Maxeon Solar (NASDAQ: MAXN), which generates solar modules. It completed the spin-off in August this year.

SunPower will remain to source modules from Maxeon, similar to the means it resources microinverters from Enphase Energy. It obtains setups done with its network of dealers as well as sells a major chunk of its items with lending or cash money sales rather than funding them itself. This capital-light strategy of sourcing, rather than generating on its own, puts a minimum stress on SunPower's balance sheet as well as allows the company to concentrate on developments. SunPower has published decent outcomes up until now in 2020, with enhanced margins regardless of lower earnings due to COVID-19 and the Maxeon spin-off.

SunPower's essential toughness is its massive client base, which it can also take advantage of to offer storage space items. The storage products market stays underpenetrated, and also the possibility for development is massive. The business is making great development in the storage services section with its item SunVault. SunPower expects SunVault to produce $100 million in revenue in 2021. The company expects greater than 25% of all its household sales as well as 30% of its business sales in 2021 to likewise include storage items. That would certainly be significantly higher than 2020, when simply 11% of its modules had storage products attached.

Typically, storage items contribute $0.16/ watt of margin. The business's blended ordinary margins for property and also business products, simply 11% of which had storage space products, was around $0.31/ watt in 2020. Therefore, storage space products are anticipated to boost SunPower's margins meaningfully.

SunPower is the leading solar service provider in the business sector. The firm is poised to take advantage of significant development in the untapped property market as well. Only 2% of homes in the U.S. currently have solar installments. New residences provide another prospective growth possibility. Solar ability on brand-new homes in California, which has the highest solar adoption in the U.S., is expected to three-way by 2025. SunPower has a market share of more than 50% in California's brand-new homes market.

Also read