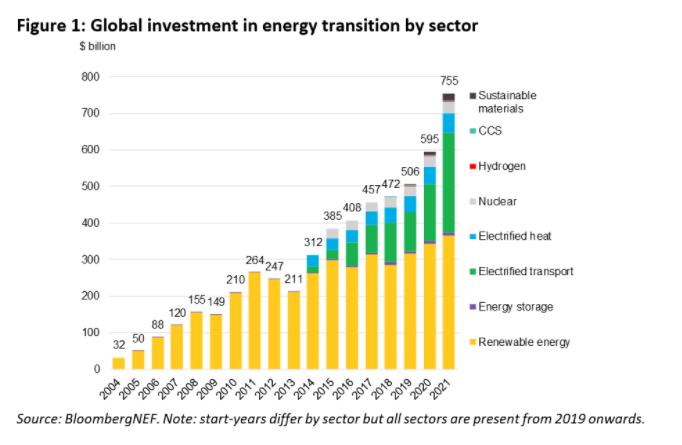

Global Investment in Low-Carbon Energy Transition Hit $755 Billion in 2021

- Global investment in the energy transition completed $755 billion in 2021-- a brand-new record-- off the rear of climbing environment ambition as well as policy action from nations worldwide, according to Energy Transition Investment Trends 2022, a brand-new report released by research study firm BloombergNEF (BNEF).

Investment rose in nearly every industry covered in the report, consisting of renewable energy, energy storage, electrified transport, energized heat, nuclear, hydrogen and also sustainable materials. Only carbon capture and storage (CCS) recorded a dip in investment, though there were lots of new projects introduced in the year.

Energy Transition Investment Trends is BNEF's annual accountancy of how much organizations, banks, federal governments and also end-users are devoting to the low-carbon energy transition. Renewable energy, that includes wind, solar as well as various other renewables, continues to be the largest field in investment terms, accomplishing a brand-new record of $366 billion devoted in 2021, up 6.5% from the year prior. Amazed transport, that includes costs on electric vehicles and linked facilities, was the second-largest market with $273 billion invested. With electrical lorry sales rising, this industry expanded at a breakneck price of 77% in 2021, as well as could surpass renewable resource in buck terms in 2022.

With each other, clean power and electrification (consisting of renewables, nuclear, energy storage, energized transport and also electrified warmth) represented the substantial majority of investment at $731 billion. Hydrogen, carbon capture and also storage and also sustainable materials comprised the remainder, totaling $24 billion.

Albert Cheung, Head of Analysis at BloombergNEF, claimed: "The worldwide products crunch has created new challenges for the clean energy sector, elevating input prices for essential technologies like solar modules, wind generators and battery packs. Against this backdrop, a 27% boost in energy transition investment in 2021 is an encouraging indicator that financiers, governments and organizations are extra committed than ever before to the low-carbon transition, and see it as part of the option for the existing chaos in energy markets."

Regional as well as nation leaders

Record amounts were bought all 3 regions covered in the report: Asia Pacific (APAC), Europe, Middle East & Africa (EMEA), as well as the Americas (AMER). APAC was both the biggest area for investment at $368 billion (nearly half the international total amount), and the area with the greatest growth at 38% in 2021. Energy transition investment in EMEA grew by 16% in 2021, getting to $236 billion, while the Americas saw investment expand by 21% to $150 billion.

China was once more the biggest solitary nation for energy transition investment, devoting $266 billion in 2021. The United States was in second location with $114 billion, though EU participant mentions as a bloc committed extra at $154 billion. Germany, the U.K. and also France rounded out the top 5 countries for energy transition investment in 2021. Asia-Pacific countries now hold 4 of the top 10 locations in regards to energy transition investment degrees, with India and South Korea signing up with China and Japan.

Getting on track for web absolutely no

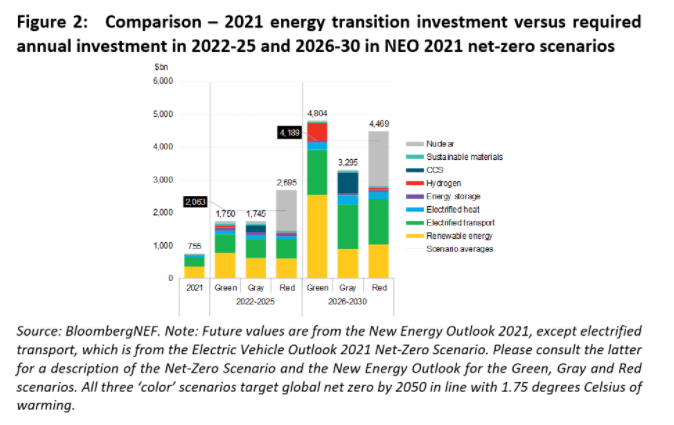

BNEF's 2021 New Energy Outlook (NEO) drawn up 3 alternate situations (referred to as Eco-friendly, Red and Gray) for reaching international web zero by 2050, in accordance with 1.75 degrees of global warming. Today's report, when compared to NEO, reveals that investment degrees need to roughly triple, such that they average $2.1 trillion per annum in between 2022-2025, so as to get on course for any one of those 3 circumstances. They then need to double once again, to approximately $4.2 trillion between 2026 as well as 2030. At current development prices, the electrified transportation field has the most effective opportunity of getting on track for such investment degrees; other sectors look less likely to get on track.

Matthias Kimmel, Head of Energy Economics at BNEF, stated: "The globe is quickly lacking carbon spending plan to satisfy the goals of the Paris Agreement. The energy transition is well in progress, as well as relocating faster than ever before, yet governments will certainly need to mobilize far more financing in the next couple of years if we are to jump on track for net absolutely no by 2050."

Climate-tech corporate financing

The report also discovers that climate-tech corporate money amounted to $165 billion in 2021. This group of investment, not consisted of in the $755 billion, explains brand-new equity funding raised by companies in the climate-tech area, either from public markets or personal financiers. This capital will certainly be made use of in the coming years to scale up these firms' procedures and further develop their technologies. Two-thirds of this funding came from public markets, including SPAC turn around mergings, and also the vast bulk mosted likely to business concentrated on the energy as well as transport industries.

Claire Curry, Head of Technology & Innovation at BNEF, claimed: "There has never been more resources readily available to companies dealing with the hardest elements of the environment challenge. It is true that we have services prepared to deploy today, however there is still the demand for continued innovation. All forms of corporate money will play an important role in aiding establish and scale climate-tech in the coming decade."

An abridged variation of Energy Transition Investment Trends 2022 can be downloaded from this page. BNEF subscribers can find the full report on the client website as well as on the Bloomberg Terminal.

Also read