Global Inflation Ends Era of Ever-Cheaper Clean Energy

- Inflation hits as energy markets face green transition.

The era of ever-cheaper clean power mores than, giving a fresh jolt of uncertainty to global energy markets battered by one supply dilemma after an additional.

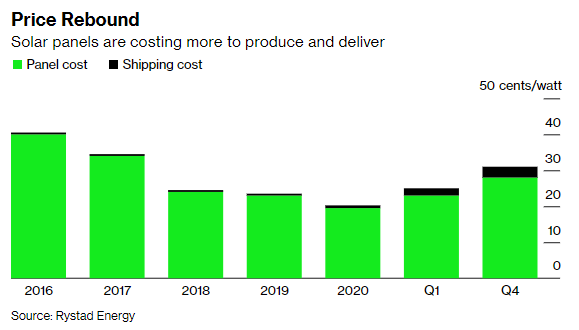

Relentless price decreases over the past decade made renewables the cheapest resources of electrical energy in much of the globe. In the past year, however, costs for solar panels have actually risen greater than 50%. Wind turbines are up 13%, and also battery costs are increasing for the first time ever.

As pandemic-induced supply delays ensnare every little thing from cars to salads, green energy's price hikes may not come as a surprise. However shipping backlogs and commodities shortages are coming at a specifically vulnerable moment for wind and also solar. After years of speedy developments in innovation and production, there are fewer chances entrusted to reduce expenses without sacrificing profits. Instead of perpetually dropping, costs will certainly currently ups and downs based upon the cost of raw materials as well as other market pressures.

For energy markets facing power outages and also severe price volatility in the green transition, clean-power inflation is another wild card. Policy manufacturers, implicated of adding wind as well as solar so rapidly that electrical grids have actually become unsteady, are under pressure to guarantee the whole system is more dependable-- by combining solar with batteries, as an example, or keeping aging nuclear plants competing longer.

" From now on, what's mosting likely to make the distinction around the growth of solar as well as wind is not mosting likely to be prices-- how reduced can you go?-- yet value," claimed Edurne Zoco, executive supervisor of clean technology and also renewables at research study company IHS Markit Ltd

. Greater interest rates are also threatening to boost prices for wind as well as solar projects as central banks consider tighter financial policy to curb inflation, said Julien Dumoulin-Smith, an expert with Bank of America Corp.

" One of the single most important inputs that enter into these very levered projects are prices," he stated. "Interest rates have actually only gone down for a straight decade."

Climate hawks need not fear renewable-energy inflation, nevertheless. Despite having the recent rise in prices, wind and solar have actually developed from pricey, niche resources of power to end up being competitive with fossil fuels. Renewables remain less costly on a family member basis than fossil fuels in much of the globe, as well as costs for oil and natural gas have surged over the past year. Over the long term, prices for wind as well as solar will certainly continue to decline, albeit at a slower pace. That indicates clean-energy installations are expected to maintain proliferating in the coming years.

Still, the market is duke it outing the instant results of supply-chain snarls. Burlington, Vermont-based solar developer Encore Renewable Energy LLC is paying about 35 cents a watt for panels, up from 30 cents in mid-2020, according to Chief Executive Officer Chad Farrell.

Resources now represent 70% of the expense of ended up modules, leaving providers with virtually no area to trim expenses, said David Dixon, an elderly expert with research firm Rystad Energy. A lack of polysilicon, among the crucial materials for the solar batteries that comprise solar panels, raised expenditures last year, and shipping expenses also increased.

Invenergy, an U.S. designer of wind and also solar projects, has been required to delay some projects due to the fact that it can't get panels, said Art Fletcher, the company's exec vice head of state of building and construction. Though delivery expenses are starting to decline after leaping last year, the renewables industry overall is going through an improvement, he claimed.

" I do not think we're ever before going back to where we were two years ago," Fletcher said.

Canadian Solar Inc., among the globe's biggest panel makers, claimed it no longer makes good sense for the sector to constantly reduce costs. "There will be an end for this rate drop," the firm's chairman, Shawn Qu, told a virtual BloombergNEF occasion on Nov. 30. "There's an expense for going green as well as carbon nonpartisanship."

The Solar Power Industries Association as well as Wood Mackenzie Ltd. anticipated last month that united state installations will drop 15% in 2022, regarding 25% below the trade group's September projection.

Supply-chain twists may ease this year as China invests billions on new factories to generate polysilicon. That may cut prices in the short-term, but it's less most likely to result in continual reductions.

" We're reaching the tail end of price declines," stated Dixon. "Commodity prices will be the sole factor of module prices."

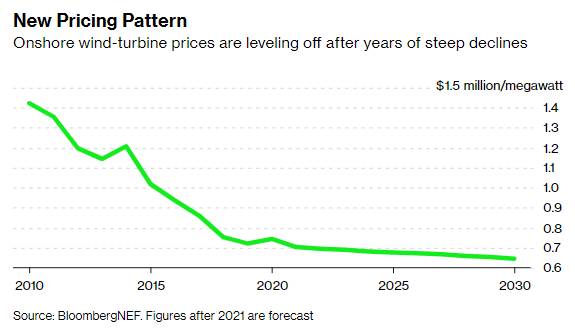

The wind market is undergoing a comparable transition. Rates dove 48% in the decade via 2020, but are now leveling off as well as are anticipated to glide 14% with 2030, according to BloombergNEF.

" That's a sign of the sector maturing," stated BNEF wind expert Oliver Metcalfe.

Makers will certainly continue to decrease per-megawatt costs with bigger installations. However, these enormous turbines-- virtually as tall as the Eiffel Tower-- require even more products, particularly steel, which surged in 2021 and will likely remain costly for the following numerous years. Supply-chain issues enhanced rates for onshore wind turbines 9% in the 2nd half of 2021.

In some regions, programmers have actually already set up turbines in the very best locations and also now are checking out less breezy locations or smaller sites. That implies they may be utilizing turbines created for slower windspeeds or placing smaller orders, both of which result in higher per-megawatt costs.

The world's biggest wind turbine manufacturer, Denmark's Vestas Wind Systems A/S, had to reduce its profit projection last year as it faced climbing costs from vital commodities as well as persistent supply-chain disruptions. Something will require to change for the market to be able to deliver adequate wind power capacity to hit the globe's climate goals, the firm claimed.

" We need to install a warning flag below," stated Morten Dyrholm, elderly vice president at Vestas. "We need to focus on earnings throughout the field."

Battery Prices

Batteries have also been hit by inflation. BNEF said late last year that it anticipated prices for battery packs to climb this year for the first time in data returning to 2010. The 2.3% increase can be criticized on soaring rates for the steels batteries consist of, flourishing need worldwide and stretched supply chains.

However compared to wind and also solar, batteries are a much newer part of the clean-energy landscape. Distributors are still try out new chemistries and ramping up production capacity, which indicates there's still room for even more substantial cost cuts.

Fluence Energy Inc., a grid-scale storage space designer, has actually seen delays as well as enhanced costs to ship batteries from its agreement manufacturing facility in Vietnam, however the firm does not expect that to last.

"This stockpile that has actually been produced is really being worked through," said Chief Financial Officer Dennis Fehr.

While several of the supply-chain concerns bedeviling renewables developers are relieving, George Bilicic, head of global power, energy and also framework for Lazard Ltd., claimed the market is undertaking irreversible adjustments. With no brand-new technical innovations or major consolidation, prices are maintaining.

"The story regarding large cost decreases is that huge expense declines will not be the story anymore," Bilicic claimed.