Generate Capital safeguards US$ 2bn to purchase lasting facilities

- Lasting framework investment firm Generate Capital has actually raised US$ 2 billion in funding to scale its assistance for industries such as clean power.

The San Francisco-based business builds, owns, runs as well as finances lasting framework, and in the last seven years has actually built up a portfolio of regarding US$ 2 billion of assets across the power, waste, water and transport markets. The brand-new equity will enable it to expand its reach into brand-new industries as well as regions.

The capital raise was led by pension fund AustralianSuper and also Australian investment company QIC, while existing financiers in Generate such as AP2 of Sweden, Railways Pension of the UK and also the Wellcome Trust additionally took part. New capitalists consisted of Harbert Administration Firm, Aware Super and CBRE Caledon.

Defining itself as one-stop buy companies as well as areas aiming to meet their web no objectives with brand-new framework, Generate said its infrastructure-as-a-service model indicates its consumers do not require to make huge capital commitments to fulfill their sustainability objectives.

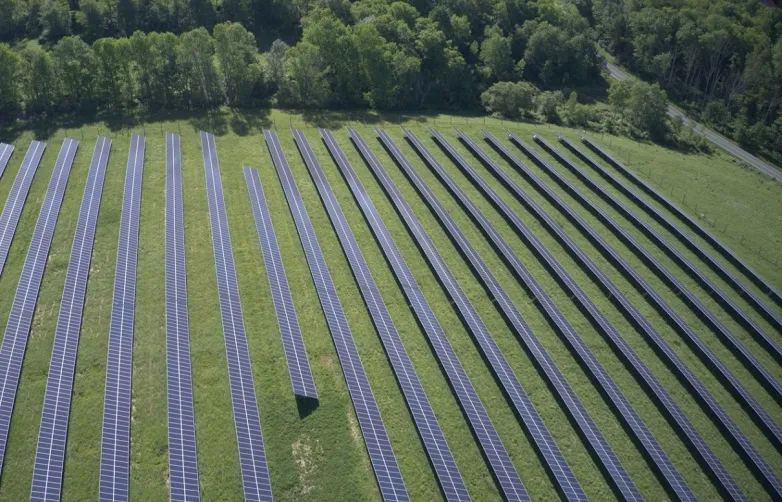

Generate's possession base includes renewable power, community solar, power efficiency, microgrids, energy storage space, electrical movement and also hydrogen. The firm previously this year gave a financial obligation center to utility-scale renewables job programmer Intersect Power.

To satisfy the expanding possibility in lasting infrastructure, Generate has doubled its labor force in the past year and a geographic expansion past The United States and Canada is currently underway.

Scott Jacobs, chief executive and also founder of Generate, stated the funding will certainly make it possible for the company's next phase of development, adding: "The immediate need to deploy tried and tested environment options and get the world to a net absolutely no path has actually never been greater."

Also read