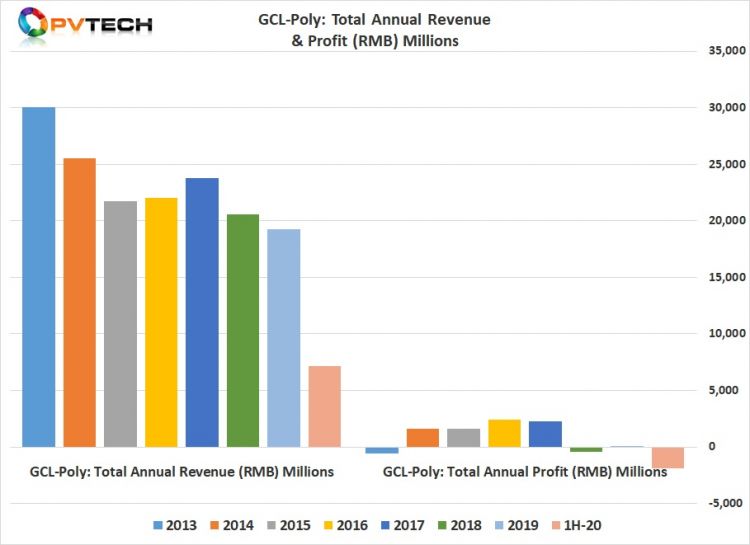

GCL-Poly posts US$ 281 million loss in 1H 2020 as manufacturing shifts effect revenue as well as earnings

- GCL-Poly had just recently alerted capitalists that it anticipated to make a bottom line of at the very least RMB 1.5 billion (US$ 217 million) for the initial fifty percent of 2020 as market need, due to COVID-19 and other issues influenced earnings.

The total loss for the initial half of 2020 was RMB 1,924 million (US$ 281.8 million), with its Solar Material organisation device (polysilicon and also wafers) making losses of RMB 2,023 million (US$ 296.2 million).

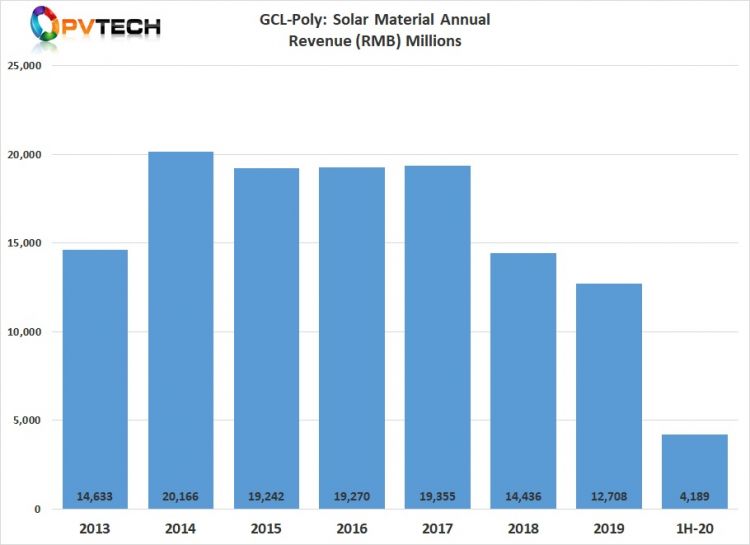

Secret to the considerable losses was GCL-Poly's polysilicon company, because of a 51.1% decrease in actual silicon rod production as the firm took care of a 31.5% equity rate of interest in Xinjiang GCL polysilicon plant with a nameplate capacity of around 50,000( MT) in 2019.

Consequently, the Xinjiang plant supposedly endured a significant occurrence while under annual maintenance that can keep the plant offline for as much as 9 months, which stays highly speculative but has actually restricted high-purity polysilicon supply and created polysilicon prices to double considering that the end of the initial half of 2020.

In the reporting period, GCL-Poly claimed that its annual production capacity of silicon rods at the Group's Xuzhou base switched over to creating 30,000 MT of granular silicon (FBR modern technology) in the next few years, which caused silicon pole ability declining to just 36,000 MT, compared to previous yearly nameplate capacity of 70,000 MT.

As an outcome, GCL-Poly's silicon rod manufacturing in the first half of 2020 was just 17,881 MT, compared to 36,592 MT produced in the previous year period. The business kept in mind that the manufacturing quantity of granular silicon got to 2,442 MT in the reporting duration after the switch of product.

GCL-Poly kept in mind that its Xuzhou center presently has a manufacturing capacity of 6,000 tonnes of granular silicon, which is anticipated to boost to over 10,000 tonnes within the year.

GCL-Poly marketed 17,489 MT of silicon rod polysilicon in the initial half of 2020, compared to 20,731 MT in the prior year period, a 15.6% decrease. Silicon pole polysilicon ASPs were US$ 7.56/ kg in the very first half of 2020, compared to US$ 9.01/ kg in the previous year duration.

The company reported that its yearly wafer production capability enhanced from 35GW to 40GW, mostly to new cutting machines for thinner wafers. However, in the reporting period, GCL-Poly produced 14,328 MW of wafers in accumulation (including 7,288 MW of OEM wafers), standing for a reduction of around 2.3% from 14,658 MW (consisting of 4,006 MW of OEM wafers) in the prior year period, a decrease of 33.9% (leaving out OEM wafers).

Wafer ASPs amounted US$ 0.050/ W, compared to US$ 0.062/ W in the first half of 2019.

GCL-Poly also noted that considering that the end of the 2nd quarter of 2020, polysilicon costs had increased substantially, largely driven primarily by the development in orders backed by emerging international demand for set up capacity.

By the end of 2020, GCL-Poly is expected to possess specialized monocrystalline wafer capacity of at least 10GW. Existing wafer ability is divided between multicrystalline and also cast mono.

Clearly, GCL-Poly is embarking on significant changes to its manufacturing setups for both polysilicon and wafer procedures as the marketplace rapidly moves to p-type as well as n-type monocrystalline demands

Also read

- Huawei, Sungrow Extend Decade-long Lead in Global Inverter Race Again

- Niteroi Starts Work on 2,700-Panel Solar Park, Boosting Sustainability Drive

- Quadoro, EB-SIM Acquire German Solar Parks for QEEE Fund

- RWE extends Markus Krebber’s CEO mandate to 2031

- Poland's Solar Capacity Grows, Faces Grid Challenges