Five actions to boost go back to 17% for Indian hybrid projects amidst market volatility

- Equity returns on hybrid solar and wind projects in India could see a 17% rise in the interior price of return (IRR) by applying a few actions, according to a report from the Institute for Energy Economics and Financial Analysis (IEEFA).

Despite current challenges in the solar market in India-- proceeded supply chain issues linked to the pandemic, geopolitical stress in between Russia and Ukraine and the April intro of the standard customs responsibility (BCD) for modules (40%) and cells (25%)-- renewable energy auctions continue to bring in rate of interest from huge developers, according to the IEEFA.

At the same time, a current analysis by Crisil, a S&P Global business, exposed that the above variables had also taken down the return on equity (ROE) for 25GW of India solar projects, with 5GW of those at high threat. Crisil stated these 5GW of projects may see their ROE fall by as long as 140-180 basis indicate around 7%, while the continuing to be 20GW of projects would just observe an autumn of 60-80 basis points.

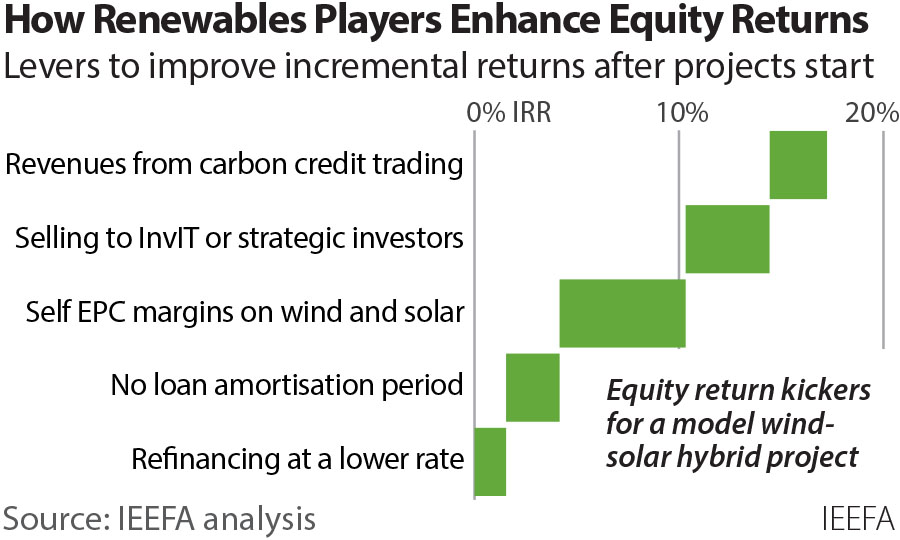

In this context, large renewables programmers can enhance their income and minimize current industry volatility if they were to look to hybrid designs, IEEFA suggested. Its report detailed five choices that would certainly improve equity IRR using an hybrid solar-wind project as a model:

- Refinancing at a 100 basis point lower interest rate might include 2% to a hybrid solar-wind power project's equity IRR.

- Bond market refinancing, which has a non-amortising period of three to five years, could include another 2%.

- In-house engineering, procurement and construction (EPC) divisions might add up to 6%.

- Marketing operational possessions to tactical and monetary capitalists might include 4%.

- And incomes from carbon debt trading, mainly to created economic situations, might include 3%.

This would certainly take the overall upside possibility to 17%, over the present 12% standard returns for solar-wind projects in India.

Up to 17% of equity returns can be attained for hybrid solar-wind projects in India.

Image: IEEFA.

Shantanu Srivastava, energy finance expert at IEEFA, said: "Our team believe India will certainly be able to continue its renewable energy capacity enhancement trajectory since existing supply chain challenges will alleviate in the short-to-medium term, and the sector has sufficient cushion to take in these drawback threats."

BCD making complex estimations

If a developer managed to acquire modules assembled in India while only importing the cells, strained at 25%, it would certainly decrease the reliable landed tax effect of the BCD to 12.5% given cells make up fifty percent of the price of the module, the IEEFA claimed.

As an example, if developers import only cells from China and assemble the modules in India, the cost would be US$ 0.306 c/Wp, according to the IEEFA analysis. However if they determined to import the modules straight from China, encountering the greater BCD tariffs, it would certainly raise costs to US$ 0.339 c/Wp.

Larger programmers at the GW-scale will likely "take the lion's share" provided the shortage of module setting up plants in India at the moment, the report stated. While current solar module price hikes are taken into consideration as "aberrations" and would certainly, in the long term, revert back to less than US$ 0.2/ Wp (before taxes) from the existing price of US$ 0.28/ Wp, the report kept in mind.

In the short-to-medium term, the stockpiling of modules and the local setting up of modules, leading to cell imports or framework arrangements with domestic vendors, would provide a cushion on resources prices as domestic production abilities grows and at some point ends up decreasing residential costs.

At the same time, India has actually been shifting extra in the direction of bifacial modules, causing the automation of operations and maintenance (O&M) and a reducing of the threshold for financial obligation and equity returns.

Also read