Financial debt finance offer will 'increase returns' for Genex's Tesla battery project in Queensland, Australia

- Genex Power has actually received debt authorizations on a AU$ 35 million (US$ 25.26 million) debt money facility for its 50MW/100MWh Bouldercombe battery energy storage system (BESS) project in Queensland, Australia.

The renewables and energy storage developer stated in a news to the Australian Securities Exchange (ASX) that it has actually concurred the financing handle Infradebt, an expert project finance fund management as well as financing firm concentrating on the energy change room.

The debt financing will certainly enable Genex to "retain upside exposure to the appealing economics of energy storage and also maximise the financial returns of the project," the firm's chief executive officer James Harding claimed.

Genex claimed it will certainly now negotiate last terms with Infradebt and also take the project to its monetary close.

Bouldercombe Battery Project (BBP) will certainly be just one of Queensland's very first large-scale standalone BESS facilities. Scheduled to find online in the 2nd fifty percent of 2023, the 12-year regard to the Infradebt loan kicks in as soon as business operations commence.

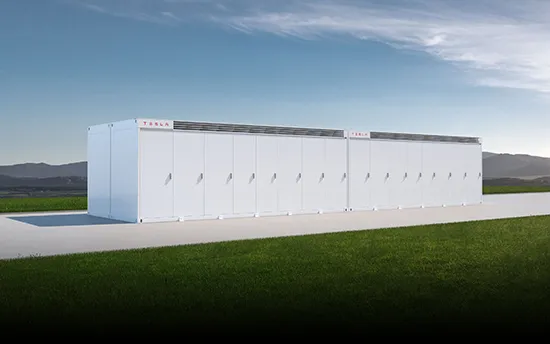

Genex chose technology provider Tesla to supply the complete incorporated battery storage solution to BBP, in the form of 40 of the US-headquartered business's Megapack BESS units which have actually likewise been used at Australia's largest battery project to date, the 300MW/450MWh Victorian Huge Battery, which power manufacturer Neoen lately brought online in the state of Victoria.

Tesla's Autobidder machine finding out algorithm-based bidding system will also operate the BESS' send off as well as trading activities. Genex as well as Tesla authorized an eight-year off-take deal for that, which after the deal expires is anticipated to be renegotiated as a licensing deal.

Along with the AU$ 35 million financial debt finance, Infradebt has actually signed a Cooperation Agreement with Genex to proceed servicing financing other merchant BESS projects in Australia. The monetary leverage that agreement will allow ways Genex will maintain upside from battery storage market business economics, the firm claimed.

Genex is also presently constructing Australia's first new pumped hydro energy storage (PHES) project in virtually 40 years, the 250MW/2,000 MWh Kidston Stage 2 Pumped Hydro Project, also in Queensland.

On Friday, Energy-Storage. news reported that Australian energy store Origin Energy intends to leave coal earlier than initially prepared, provided the competition the fossil fuel faces from renewables as well as energy storage.

Origin said it intended to bring forward the retirement date of its 2,880 MW Eraring coal power station from 2032 to 2025 and also construct a 700MW BESS at the website. The evolution of the National Electricity Market (NEM) is making it harder for baseload coal to keep up, with fast-responding batteries particularly able to capitalise on transforming market frameworks.

According to quarterly data from the Australian Energy Market Operator (AEMO), market revenues battery storage systems make for frequency control ancillary services (FCAS) is climbing, batteries are subduing adverse prices events and the introduction of five-minute settlement (5MS) to change 30-minute settlement in the NEM are among aspects producing that upside Genex referred to.

Also read