Fail To Remember Fuel Cells, Solar Is a Better Way to Invest in Renewable Energy

- The fast growth of renewables as an energy source has actually rightly captured capitalists' attention. Hydrogen fuel cells, specifically, have handled to amass sensational rate of interest.

Stocks of Plug Power (NASDAQ: PLUG), Bloom Energy (NYSE: BE), and FuelCell Energy (NASDAQ: FCEL) escalated in 2020. Nonetheless, there are a number of functional constraints in the development of hydrogen fuel cells. Comparative, solar power's potential customers look much more encouraging. Let's take a look at why.

Economic practicality

The climbing interest in hydrogen fuel cells is postulated on the fact that it is a cleaner and also carbon-efficient source. While hydrogen originated from renewable sources undoubtedly fulfills these standards, it is not the case with hydrogen produced utilizing fossil fuels. For viewpoint, nearly 95% of hydrogen generated in the U.S. is presently stemmed from gas. What's more, also fossil-fuel-based hydrogen isn't confirming economically practical up until now. Renewables-based hydrogen could set you back two times as much or even more to create, making its financial stability a far-off desire. Therefore, the advancement of hydrogen as a fuel continues to be mainly dependent on governmental motivations.

On the other hand, the prices of lithium-ion batteries-- one of the most typical storage space technology currently-- have fallen by practically 90% in a decade. Therefore, the requirement to create hydrogen storage isn't as pressing for operators lately regarding business economics is worried.

Fuel cells vs. batteries

Besides costs, fuel cells face numerous various other drawbacks. Hydrogen bonds with various other elements easily. Isolating as well as keeping it is an energy-consuming procedure. Fuel cells are presently much less energy efficient than batteries. As a result of their combustible nature, hydrogen fuel-cells are additionally much more harmful.

On the other hand, fuel cells can be charged much faster contrasted to batteries. So, especially for large commercial vehicles such as vehicles, fuel cell innovation could be more appealing.

Fuel cells are mostly seen as a corresponding modern technology for renewable resource generation in the future and also might come to be the preferred selection in some particular niche sectors. While the storage space innovations continue to create, solar is doing a terrific job on the generation front.

Solar's development capacity

The EIA jobs that renewables will contribute virtually fifty percent of the globe's electrical power production by 2050. Amongst eco-friendly sources, solar power's share is expected to expand the fastest. Solar presently accounts for just 3% of global electricity generation. Its share is anticipated to rise to virtually 20% by 2050.

The solar market has currently reached a scale where companies can run profitably. Yearly solar installments worldwide are approximated to go beyond 160 gigawatts in 2021. Additionally, solar power's growth is no longer restricted to a handful of countries. As lots of as 20 nations (contrasted to six in 2016) might have greater than 1 GW of yearly solar demand by 2022.

An essential factor contributing to solar energy's quick growth is a big prospective market that is still mostly unpenetrated. Just 2% of homes in the U.S. presently have solar installments.

Fuel cell versus solar: How companies have gotten on

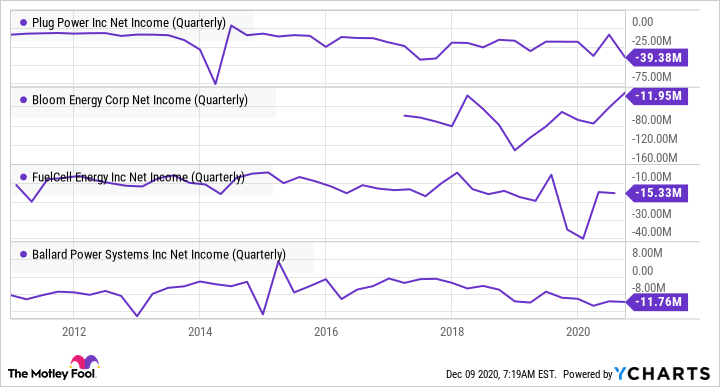

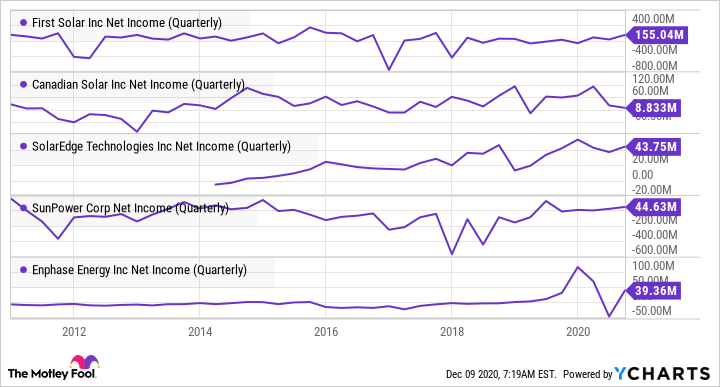

What all of the above mean is that you as an investor will likely do better investing in solar stocks than in fuel cells stocks. Allow's take a look at the sort of profits generated by fuel cell companies in the last couple of years.

As the above graph programs, top fuel cell companies, including Plug Power, Bloom Energy, FuelCell Energy, and also Ballard Power Systems (NASDAQ: BLDP), have actually all been generating losses in the past years. Very little has actually altered to indicate that these will come to be profitable any time soon. By comparison, leading solar stocks have been producing revenues over the exact same duration.

Among solar stocks, Canadian Solar (NASDAQ: CSIQ), Enphase Energy (NASDAQ: ENPH), and SunPower (NASDAQ: SPWR) look specifically encouraging. Canadian Solar's geographically diversified operations, solid revenue margins, headway in the rapidly growing storage space items segment, as well as affordable valuation make it appealing.

Enphase Energy has come a long way from its challenging setting in 2016. The firm published remarkable efficiency in the latest quarter. It is also on track to expand in the storage space items sector. Though the supply looks a bit overvalued today, it is among the leading solar stocks to purchase for the long run.

SunPower's approach of going capital-light by spinning off Maxeon Solar might pay off well. Along with margin renovation, it will certainly permit SunPower to focus on technology advancements. Additionally, SunPower can utilize its significant consumer base to market its storage space products.

Also read