Export analysis

Nov 1, 2019 01:00 PM ET

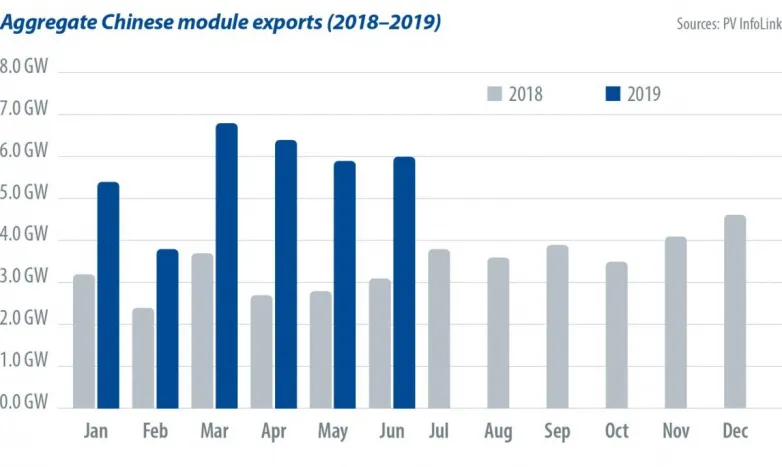

- PV InfoLink analyzed the key markets of China’s big module manufacturers, as well as product trends, based on export statistics. According to trade figures, the nation’s module exports totaled 34.2 GW in the first half of 2019, up by more than 90% from the corresponding period of 2018. In a nutshell, overseas demand has been strong in 2019.

As of the first half of 2019, JinkoSolar, JA Solar, Trina Solar, Canadian Solar and Risen Energy maintained their positions as the top five module makers, dominating 50% of total exports. There have been steady exports for Jinko and JA Solar, as they reached 5.1 GW and 3.4 GW this year.

Trina, which was in the doldrums last year, moved up one position this year with 3.1 GW of module exports in the first half. Risen and Canadian each exported 2.7 GW of modules in the first half of the year. It’s worth noting that Longi has strengthened its foothold in overseas markets, where its share increased 3% from 2018.

Europe surpasses APAC

Listed in order of export volume, China’s top 10 export destinations from January to June 2019 were the Netherlands, Vietnam, Japan, India, Australia, Spain, Ukraine, Mexico, Brazil and Germany. China had exported 4.6 GW of modules to the Netherlands, a key distribution location, where most modules were then delivered to countries across Europe. Over the first six months of the year, China had exported 4 GW of modules to Vietnam, 2.9 GW to Japan, 2.8 GW to India and 2.5 GW to Australia, as well as more than 1 GW of exports each to Spain, Ukraine, Mexico, Brazil and Germany.

With supportive policies implemented in Spain, Ukraine, Germany and Portugal – not to mention the end of the minimum import price (MIP) – demand in Europe has grown significantly. Chinese module exports to Europe reached 11.7 GW in the first half. Under the MIP framework, export volume stood at only 1.5 GW during the same period last year. Since May, China’s monthly exports to Europe have surpassed those to the Asia-Pacific region and by the end of June, Europe accounted for 34.1% of total exports.

Mono PERC exports

Driven by European demand for high-efficiency modules, mono-Si exports have steadily gained share, with the export volumes of mono PERC having exceeded conventional multi-Si modules since May. Although conventional multi-Si modules made up a higher percentage of Chinese module exports in the first half, at 47.3%, this was a big drop compared to last year’s 71.1%.

Since the beginning of this year, exports of half-cut modules with MBB design have jumped. Most of them have been multi PERC modules shipped by Canadian Solar. The market also saw growing adoption of modules which feature more than 60 cells, which offer improved power output. So far, Longi is the largest supplier of such modules, followed by Suntech, Trina and Jolywood, which exported small volumes.

China remains the biggest market for the much-discussed bifacial modules. So far export volumes are low, with only a few manufacturers dominating share. In the first half, Longi was the largest supplier of bifacial modules, with 306 MW shipped to Mexico and Egypt. Jinko mainly supplied bifacial modules to El Salvador, whereas JA Solar fulfilled demand from Japan, the Middle East, Europe, Southeast Asia and South America.

The market has weakened since July, when Vietnam and Australia cooled down on installations after experiencing strong overseas demand throughout the first six months of the year.

The slowdown will continue until anticipated demand picks up at the beginning of the fourth quarter. As Chinese demand is expected to rise, manufacturers will reduce production capacity allocated to overseas markets. PV InfoLink projects that global module demand will hit 120 GW this year, with non-China markets accounting for 72% of total demand. European demand, which has been strong this year, is expected to surpass 20 GW.

The significant improvement in cell efficiency and yield rates have made half-cut the standard in new production lines. Manufacturing capacity that can accommodate half-cut and MBB techniques has increased sharply this year. With several leading companies due to complete upgrades by the end of the year, the production of traditional full-cell modules will be decreasing from 2020.

Some manufacturers have started gearing up or expanding capacity for superposition welding and paving – two techniques that are different from shingled with conductive adhesive. Moreover, patent rights for shingled technologies obtained by SunPower in China may accelerate manufacturers’ R&D efforts in high-density modules. Although superposition welding, narrowed-spacing, and paving techniques require lower costs and entail no patent issues or the use of conductive adhesive, the methods are still in the initial stages of development, so manufacturers need time to develop a roadmap. If these technologies are developed, they may start taking the market share of shingled modules from 2021.

Also read