Energy Transition's Big Dollars and also Big Themes

- Energy transition investment complies with familiar patterns in worldwide capital markets. Large, well-known banks supply thousands of billions of dollars a year to finance construction of long-lived assets using familiar zero-carbon modern technologies-- i.e., deployment. Smaller institutions (some well-established, others quite new) supply tens of billions to fund company development and also the proving-out of brand-new innovations and also company designs-- so technology.

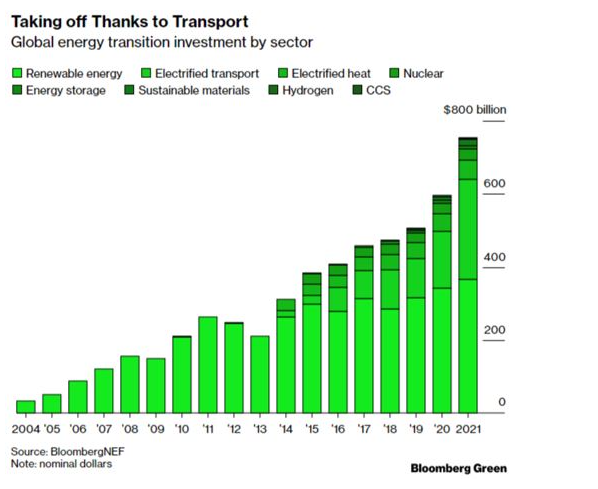

Last year, energy transition and climate tech (renewable energy, energy storage, amazed automobiles and also home heating, hydrogen, nuclear power, sustainable products and the carbon capture) drew in more than $900 billion. Energy transition investment alone got to $755 billion, up by a quarter over 2020 investment, dual what was purchased 2015, as well as a greater than 20-fold boost given that 2004.

A look at this chart reveals something vital. Renewable resource is no longer the investment growth chauffeur it when was. With $366 billion spent last year, renewable energy is still a chauffeur of investment quantity (it is still virtually 50% of all investment). The investment growth difference belongs to electrified transportation, which exceeded $270 billion last year.

A take a look at substance development prices shows these 2 fads very plainly. Amazed transport is expanding at ten times the price of renewable energy-- and if that rate holds for simply one more year, transport will certainly be a larger motorist of energy transition investment than eco-friendly power. It is worth enjoying energy storage's growth price as well, which at more than 30% indicates the field investment doubles in a little over 2 years.

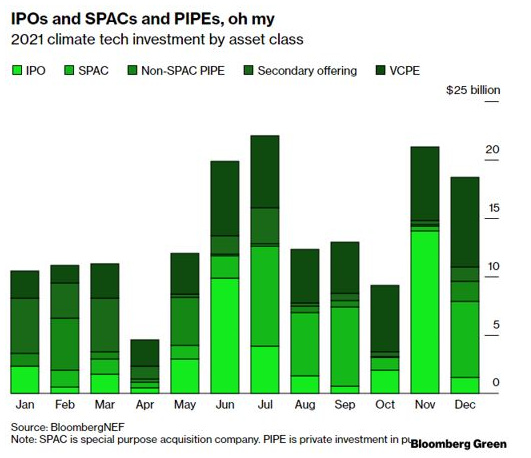

Climate technology financing reached $165 billion in 2021. BloombergNEF tracks climate technology investment by both property class and market, and both reveal important patterns.

Equity capital markets were open for climate tech at every level last year-- the IPO home window was wide open, with companies elevating more than $40 billion listings. Furthermore, the special purpose acquisition company (SPAC) market boomed, with more than $35 billion released by financiers who had elevated capital in hopes of getting climate technology companies. The exclusive placement in public equity, or PIPE, market was likewise liquid, though smaller at simply under $14 billion. Second share sales by already-public companies covered $21 billion as well.

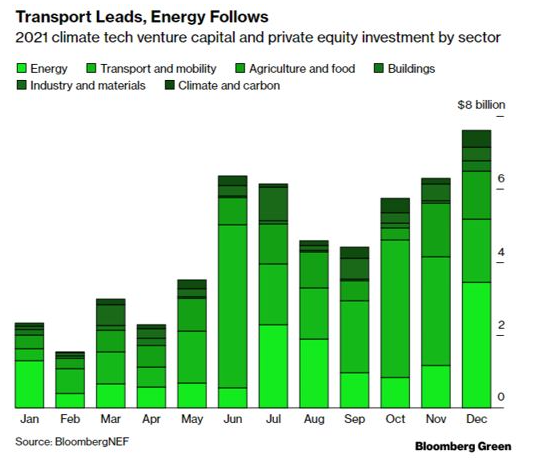

That leaves the final, and largest, property class for climate tech: equity capital and personal equity. VC as well as PE climate tech investment struck nearly $54 billion last year. Importantly also, it was fairly consistent throughout the year, whereas public market activity diminished to near-zero in April and once again in October 2021.

Climate tech VC and PE flowed right into all sorts of fields, but transport (41% of total amount) and also energy (27% of total) took in greater than two-thirds of all early-stage investment dollars. Agriculture was next, complied with by climate and carbon solutions companies. The buildings market delayed far behind, raising just 3% of overall early-stage climate technology dollars last year.

As climate tech companies develop and also move from VC and PE dollars to public markets liquidity, their capital requires increase. Making the relocation from innovation to release is not a matter of degree-- it refers orders of size. Even if only a fraction of companies supported by last year's $54 billion in climate technology VC and also PE be successful at global scale, their capital requires for release will certainly be in the thousands of billions of dollars. Integrate their prospective successes with ongoing step-by-step growth in renewable resource, as well as huge development in amazed transportation, and energy transition investment will hit the $1 trillion annual mark quite soon.

For even more detail on these searchings for, an abridged variation of the 2022 Energy Transition Investment Trends Report can be downloaded from this page. BNEF clients can discover the full report on the customer site and also on the Bloomberg Terminal.

Also read