Emerging markets and also development: Twin pillars of the solar tracker market

- International solar tracker deliveries got to brand-new record degrees in 2019, going beyond 31 GW, up 55% year on year. Remarkable need in the United States-- as well as multiple gigawatt markets in Brazil, Mexico, Chile, Spain and also Australia-- helped move the market to new heights, composes Cormac Gilligan, associate director at IHS Markit.

For many tracker distributors energetic in the U.S. market, the stepdown in the investment tax credit score (ITC) and the willingness of designers to safe harbor for jobs yet to be developed has implied that 2020 started really strongly.

Brand-new markets

The provider landscape remained to be exceptionally affordable as leading suppliers expanded right into new markets internationally, with solar tracker innovation coming to be progressively accepted by developers, EPCs as well as the monetary neighborhood. Leading distributors such as Nextracker as well as Array Technologies represented nearly half of international deliveries in 2019. Both of them took pleasure in a strong year as a result of booming utility-scale solar PV markets, and also as developers in the United States safe harbored trackers in order to guard a higher ITC rate.

Solar trackers are distinctly placed to assist with safe harbor as they do not break down contrasted to solar components. Furthermore, prices are much less most likely to reduce relative to various other balance-of-systems components as well as by their nature, the components are fairly robust for storage space while waiting to be set up. Various other distributors such as GameChange Solar, Soltec, Nclave, Convert Italia and also PVH were all energetic in the United States and also some providers obtained significant orders to safe harbor in 2019.

The top 10 provider positions remained to be dominated by providers from United States, Spain, Italy, Germany as well as China as a result of strong domestic demand and willingness to broaden abroad. Need for trackers in fully grown markets such as the United States, Spain and also Australia continued to be solid. Yet in recent years, demand has actually likewise expanded in emerging markets such as Brazil, Mexico, Chile, Argentina, South Africa, Saudi Arabia and also United Arab Emirates.

However, IHS Markit anticipates unstable need for solar trackers in these emerging markets in the following one to 2 years because of the impact of Covid-19 internationally. PV jobs in the pipeline in several of these markets that are not at an innovative phase are anticipated to be delayed over the next year or more. Overall though, these markets will continue to be eye-catching due to the greater irradiation and also the truth that the majority of have big targets for huge utility-scale PV tasks.

Next phase

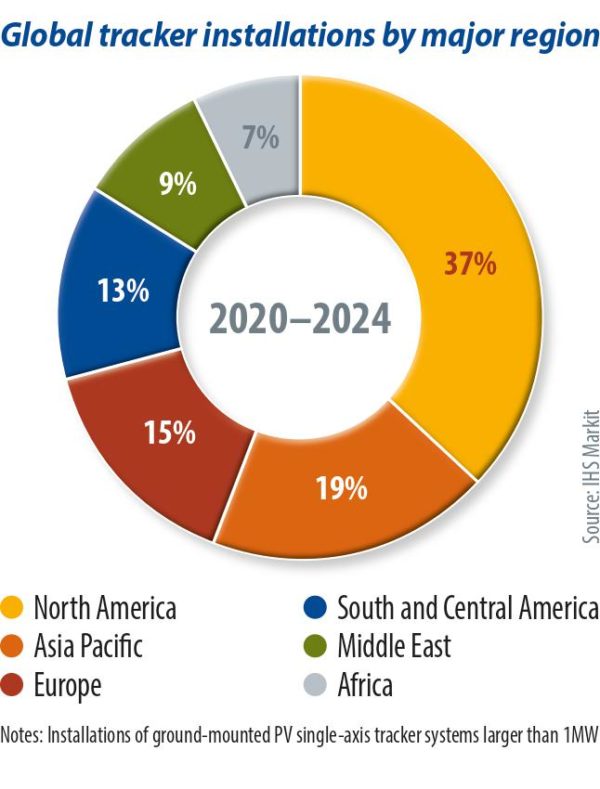

Latin America has been just one of the crucial emerging markets for solar trackers in the last few years, however the Middle East and Africa (MEA) region is anticipated to be progressively attractive in the following five years. Egypt as well as South Africa have actually already embraced solar tracker technology in addition to markets such as Saudi Arabia and the UAE. Inceptive markets such as Oman are anticipated to begin setting up trackers, while markets such as Jordan-- which already has actually a considerable mounted base of tracker tasks-- are expected to maintain using the innovation.

A plethora of African countries with huge utility-scale tasks are supplying a testbed to showcase the included benefits of trackers to a solar job. IHS Markit anticipates that there will be a mix of providers energetic in these markets. Some vendors, such as Pia Solar, have been extremely energetic in South Africa and also are well positioned to expand right into other African markets as they open. Various other vendors-- such as Arctech, Soltec, Convert Italia, Nextracker, PVH as well as Ideematec, that have actually all set up trackers in specific markets throughout the MEA area-- can leverage these real-world examples to display to companions the benefits of their offerings.

In spite of Asia being the largest region for solar setups over the next 5 years, it will certainly be a challenging market for tracker vendors. In general, a lot of the biggest markets-- such as India, China and Japan-- still prefer fixed-tilt frameworks due to weather conditions, website constraints, the accessibility of inexpensive labor, and also level of sensitivity to higher in advance capital expenditure. Australia continues to be the most eye-catching market, as consumers are already extremely comfortable with the technology as well as its included advantages.

Cost competitiveness

Single-axis tracker vendors are riding the waves of quick development underway in the solar component market. Next-generation solar PV modules are progressively being released that are a lot larger both in dimension and also in electrical power terms, and are expected to have higher efficiencies as well. Component providers are additionally increase manufacturing of bifacial solar components so that they can help with an additional power gain of as much as 20%, based on ground conditions that regulate the albedo effect.

Given that solar PV trackers benefit massively from PV component technology, suppliers continue to buy research and development by themselves in order to more effectively capitalize on the advantages of new module development. Tracker suppliers frequently swiftly upgrade torque tubes and also clamps, while likewise conducting thorough wind tests and also structural assessments of all brand-new tracker redesigns when new solar PV components are released on the market.

In general, solar tracker rates are expected to continue to decline on a dollar price per watt basis as power production per component continues to raise. The significant advantages for programmers as well as EPCs below will be the enhanced power return of using higher-powered bifacial solar PV modules together with solar trackers, which is anticipated to greatly improve the levelized cost of electrical energy for utility-scale solar projects and make the technology extra cost competitive with various other forms of energy generation.

Also read