Dropping power rates can profit mega-sized solar as well as wind projects

- The Covid-19 pandemic will certainly produce a "ideal tornado" for Australia's wholesale power market, as reduced need integrates with reduced gas rates as well as the appointing of large solar as well as wind projects to dispirit power rates, according to a record by Melbourne-based working as a consultant RepuTex.

Wholesale power costs in Australia's National Electricity Market (NEM) are anticipated to drop 20% over the following 2 years because of the effect of a "excellent tornado" entailing Covid-19 need cuts, reduced residential gas costs, as well as the appointing of huge renewable resource projects, according to brand-new study from power market experts RepuTex. Such situations are most likely to move sands in renewable resource financial investment.

While electrical power usage quantities are not yet showing a high decrease-- such as those seen in Europe and also the United States-- the experts think a decrease in need over April as well as May, as commercial centers remain to decrease or shut intake, with constraints alleviated by July 2020 as well as a go back to 'regular' power usage degrees 12 months later on. Just how much costs really drop will certainly depend upon the level and also period of lockdown limitations. According to RepuTex, the across the country lockdown is anticipated to result in a 10% to 40% cut in electrical power intake.

This could be seen in the heavy typical NEM wholesale cost of "around AU$ 69 (US$ 43.91)/ MWh for 2019-20, decreasing towards AU$ 55/MWh over the following 2 years prior to recouping back over AU$ 60/MWh, a little more than present futures rates," the working as a consultant stated.

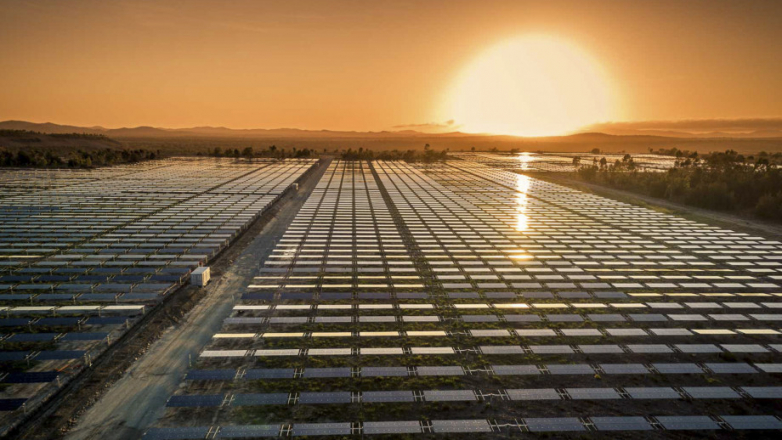

On the supply side, around 1.6 GW of solar as well as wind capability has actually been appointed in monetary 2019-20, RepuTex kept in mind. "Although we anticipate utility-scale solar and also wind appointing might hibernate for the following one to 2 quarters because of Covid-19 interruptions, we remain to anticipate an overall of 6.1 GW of solar as well as wind to be appointed over the following 2 years, together with the payment of one more 1.2 GW of brand-new roof PV," it claimed.

Nevertheless, the brand-new scenarios will certainly not have a consistent influence throughout the renewable resource market, with smaller sized capability projects most likely to be a lot more negatively impacted. "Impacts are most likely to be really felt at the reduced end of the marketplace, with smaller sized projects a lot more detrimentally influenced by unfavorable elements such as the reduced Australian buck as well as connected greater supply chain expenses, with the reduced wholesale electrical power rate setting to possibly interrupt the business economics of these projects," RepuTex claimed.

According to Norwegian working as a consultant Rystad Energy, the Covid-19 pandemic can result in the post ponement or termination of monetary close on some 3 GW of solar and also wind project ability, as the dropping Australian buck makes projects wasteful. Given that capital investment expenses have actually raised in current months-- with increasing equipment expenses commonly valued in United States bucks-- programmers will certainly be tested to successfully satisfy power supply agreement prices dedications.

Nevertheless, RepuTex kept in mind that in spite of reduced power costs, it does not anticipate the medium-term setting to exterminate renewable resource financial investment, especially at the biggest range, with brand-new mega-projects able to contend under AU$ 50/MWh, such as Acciona's 1 GW MacIntyre Wind Farm, which is set up to be completely appointed in 2024. This might ultimately result in a change in financial investment towards a lot more brand-new mega-projects, at the expenditure of smaller sized ability advancements.