Debt consolidation proceeds for polysilicon makers

- While mono-grade polysilicon prices did not lower much in the very first quarter owing to steady need, multi-grade was up to record lows as its market share reduced. During the 2nd quarter, composes PV InfoLink elderly analyst Cooper Chen, the marketplace saw extreme supply. Monocrystalline makers have been performing at full tilt and also bringing brand-new capabilities online as set up, while the pandemic crazes on overseas.

Down price trends have gotten to the polysilicon sector, dragging down rates for mono-Si wafers to a new low in the second quarter. With downstream need continuing to grow, polysilicon costs for mono- and multi-Si wafers will increase gradually amidst a recurring supply shortage.

Electrical power represents greater than 30% of polysilicon production prices. This has driven producers to broaden ability right into areas of western China where electricity prices can be as low as RMB 0.26/ kWh ($ 0.033/ kWh). China now hosts 85% of global polysilicon capacity.

The past year has seen polysilicon manufacturers in other areas take out from the market as their manufacturing expenses are expensive. Those with multi-grade polysilicon capacities are incapable to update to mono. At present, just a couple of manufacturers run the business, yet at low revenue margins.

TBEA and Daqo New Energy each brought brand-new capacity online in the 2nd half of 2019 and the first 6 months of this year. The money expenses of these new lines range from RMB 35-40/ kg before tax, or even lower. This is 40% to 50% lower than abroad producers.

Industrial crashes

In response to the descending rate spiral in the second quarter, manufacturers prepared lowered outcome as well as equipment upkeep in a bid to stabilize prices, however stopped this strategy after South Korean producer OCI announced the closure of its domestic solar-grade polysilicon plants. Germany's Wacker additionally cut production. Because of this, polysilicon costs continued to pattern downward.

Daqo New Energy came across a crash throughout upkeep at the start of July. That influenced the Phase-1 5,000 MT production line, which is around 400-500 MT of regular monthly production. As the scale of the crash was little, the firm is expected to return to complete manufacturing soon.

A surge happened at GCL Poly's Xinjiang facility in mid-July, as it was undergoing devices upkeep. The manufacturer has suspended manufacturing and is examining the reason for the surge. The accident has actually greatly impacted its capability, as well as there will likely be no manufacturing till the 4th quarter.

The marketplace saw an intensified scarcity of mono-grade polysilicon in the 2nd half, because of the mishaps and also delivery missteps in Xinjiang. With stocks in the upstream and downstream segments still reduced in the second half, and mono-Si wafer manufacturers running at complete clip as well as bringing new capability online, mono-grade costs a little rebounded. Multi-grade also climbed due to growing need, along with diminished supply because of a shift to mono-grade production. Over the past year, Tier-2 and Tier-3 producers focused on multi-grade polysilicon-- consisting of Orisi Silicon, Hoshine Silicon, Dunan, Combo, as well as Jingyang-- have all discontinued production. Foreign manufacturers consisting of Elkem, Hanwha Chemical, and also OCI's facility in South Korea additionally followed suit. Meanwhile, OCI's Malaysia plant has been under maintenance considering that early June and expects to resume production at the end of July. Generally, worldwide polysilicon capacity was 543,000 MT in the second quarter, and will rise 5% to 571,000 MT in the fourth quarter. The additions will mostly originate from GCL Xinjiang and East Hope, which are boosting task on brand-new lines toward the end of the year. Presently, Tier-1 manufacturers such as Yongxiang, Daqo New Energy, TBEA, as well as East Hope represent 52.7% of complete polysilicon capability, as well as their cash money costs are below RMB 45/kg.

Past China

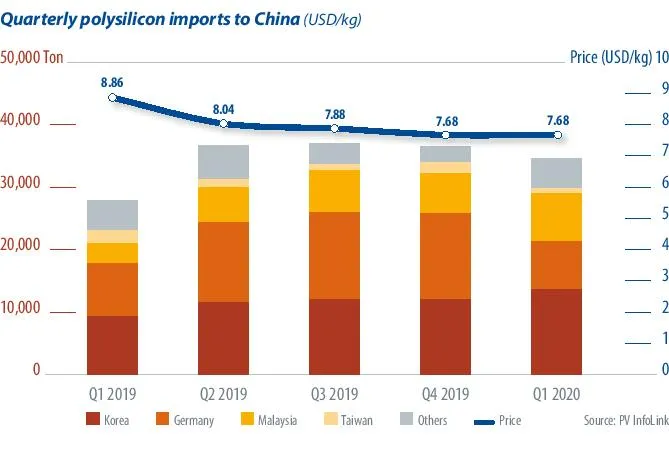

China's Ministry of Commerce claimed at the start of this year that China will certainly keep anti-dumping as well as countervailing duties on solar-grade polysilicon imports from the United States and South Korea. This suggests imports from the U.S. will shrink contrasted to previous years. The tariff rate on polysilicon imports from Korea is much lower than from the United States, however Korean producers have actually still lost their competitive edge in China, as they encountered higher expenses as well as falling polysilicon prices in the 2nd quarter.

Most Chinese manufacturers began to boost mono-grade polysilicon by modifying lines from the second fifty percent of 2019, to line up with steady need for monocrystalline products. Tier-1 suppliers can reach around 90% mono-grade capacity, while Tier-2 as well as Tier-3 players can reach 80%. This has actually made China much less depending on imports, however has actually likewise triggered a multi-grade polysilicon supply scarcity.

In China, Tier-1 manufacturers' older lines will likely end up being a worry on their organisations, and they are likely to reduce or suspend tasks on these, including TBEA's first-phase line, along with Yongxiang Leshan and GCL Jiangsu's lines.

Today, monocrystalline products make up greater than 80% of the marketplace. With a substantial rise in demand for mono-grade polysilicon as well as mono-Si wafers, Tier-1 producers currently aim to bring manufacturing of mono-grade polysilicon to more than 95%. Tier-2 producers that concentrated on multi-grade polysilicon are additionally modifying assembly line to raise mono-grade result. Nonetheless, there is limited room for such upgrades because of technological obstacles as well as product positioning. Just how much mono-grade these producers can accomplish is mostly depending on their total proficiency and also scale of optimization.

PV InfoLink projects that mono-grade polysilicon prices will certainly can be found in at RMB 66 ($9.45)/ kg, while multi-grade will certainly reach RMB 39 ($5.58)/ kg by the end of the year. For now, supplies are low, and also with polysilicon supply running increasingly brief as well as downstream need growing gradually, costs for both mono- and also multi-Si quality polysilicon are most likely to rise.

Also read

- CNNP Optoelectronics brings utility-scale perovskite modules out of the lab

- Sunkind Partners with JA Solar for Major Indian PV Expansion

- Boric-acid interface pushes all-perovskite tandem cell efficiency to 28.5 %

- GCL Fires Up World’s First GW-Scale Perovskite Tandem Line Factory

- LONGi, Pertamina Partner for Indonesian Solar Factory