Daqo protects last polysilicon supply deals as practically sold out for following two years

- China-based polysilicon manufacturer, Daqo New Energy Corp has actually protected near-term polysilicon supply deals with SMSL (Solar Module Super League) participant, JA Solar and also an unknown existing client that means it is sold out up until a brand-new polysilicon plant is constructed as well as functional sometime in 2022.

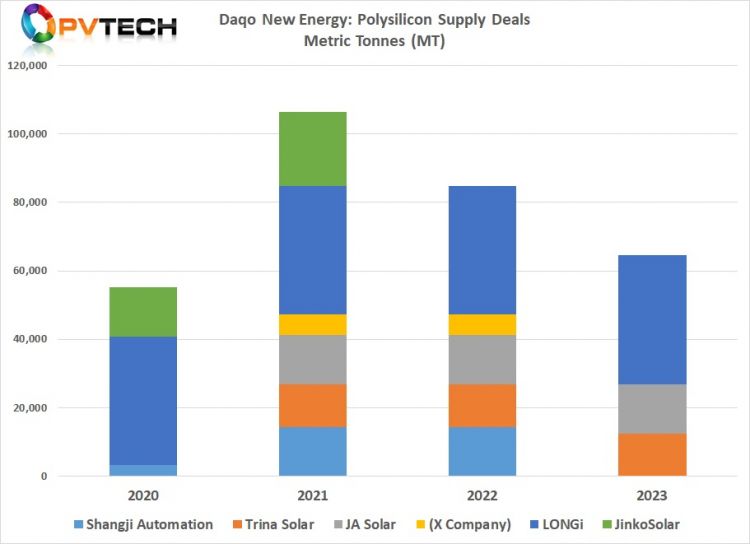

Daqo claimed that JA Solar had secured in between 32,400 MT to 43,200 MT mono-grade polysilicon supply from January 2021 with throughout of 2023.

JA Solar is just one of minority SMSL's that is a completely incorporated PV manufacturer and has enthusiastic capacity expansions prepares over the next couple of years throughout wafer, solar cell as well as module assembly. Securing additional near-term polysilicon agreements was important to these plans.

A 2nd, yet unidentified customer also safeguarded a near-term supply completing 12,000 MT, operating in between January 2021 and December 2022.

Longgen Zhang, Chief Executive Officer of Daqo New Energy stated, "Including the quantity of these 2 agreements, approximate 79,800 MT of our polysilicon has actually already been reserved under lasting supply agreements for 2021."

Nevertheless, Daqo had safeguarded a major handle leading monocrystalline wafer manufacturer, LONGi Green Energy Technology, which was for an overall of 112,800 MT over a three-year period in August 2020.

The polysilicon manufacturer had additionally authorized contracts with SMSL, Trina Solar in November, 2020. This was a three-year agreement, lasting between November 2020 as well as December 2023 for in between 30,000 MT to 37,600 MT of polysilicon supply.

With a number of the contracts having minimum and optimum polysilicon amounts, taking the maximum amount degrees over the gotten timelines has highlighted that Daqo is technically sold out in 2021 and through most of 2022.

At around 80,000 MT of existing polysilicon ability, further debottlenecking of Daqo's centers can increase nameplate capability but need is still overtaking supply.

Daqo has plans to add around 40,000 MT of new capacity from funds increased in an IPO in China for its manufacturing operations subsidiary, which needs approximately capex of around US$ 500 million and also is planned to be operational and also start ramping around mid-2022.

Management had kept in mind in its third quarter incomes phone call that by the end of 2020, China would certainly have around 160GW of mono-wafer capacity but with significant capacity growths under way the mono wafer capability in China might reach around 300GW.

Nonetheless, the background to polysilicon supply is that Daqo thinks extremely little new ability will begin stream in 2021 and also just around 150,000 MT of new capability in China included 2022.

Also read