Daqo expects polysilicon need to overtake supply for next 18 months

- Major polysilicon manufacturer Daqo New Energy anticipates polysilicon demand to outstrip supply for a minimum of the next 18 months, because of the absence of brand-new polysilicon ability as well as solid demand as a growing number of 'Solar Module Super League' (SMSL) members continue to include in-house monocrystalline ingot and also wafer manufacturing.

Record low polysilicon asking price over the last 2 years have resulted in the closure of production facilities coming from high-cost manufacturers and also significantly restricted the capital investment abilities of others to purchase brand-new, high-purity polysilicon facilities as the PV market remains to transition in the direction of p-type and also n-type mono items.

Longgen Zhang, chief executive officer at Daqo New Energy kept in mind in the business's 2nd quarter 2020 earnings call that several of the major PV module suppliers, such as JinkoSolar were continuing to invest in in-house mono ingot/wafer manufacturing, matching PV module ability development demands. The Daqo executive believes various other significant gamers will certainly follow the same up and down incorporated course, raising need for high-purity polysilicon when just around 100,000 MT of new capability could be onstream not much earlier than the next 18 months.

" As the wafer, cell and also module sections continue to vertically incorporate, I don't think the [ASP] battling will continue. However the situation, I just stated, within [the] following 15 months to 18 months, we do not see any kind of polysilicon production coming, even let's say after 15 months to 18 months, noted Zhang in the incomes phone call. "I think Tongwei's 2 plants plus Asian Silicon's one plant line of product can be found in, still can not meet the demand."

According to Zhang, the estimated need for polysilicon by the end of 2021 is around 800,000 MT, indicating that polysilicon ASPs will certainly remain to boost and could be in the range of US$ 15/kg up until need drops or new ability helps level-out peak pricing. Ordinary ASPs have remained in the range of US$ 12/kg in Q2, after remaining in the US$ 6.0/ kg variety in 2015 as well as throughout Q1 2020, due to weak demand as outcome of COVID-19.

Financial outcomes

As the lowest price polysilicon producer, Daqo reported that its polysilicon average overall manufacturing cost was US$ 5.79/ kg in Q2 2020, compared to US$ 5.86/ kg in Q1 2020. Daqo's polysilicon ASP was US$ 7.04/ kg in Q2 2020, contrasted to US$ 8.79/ kg in Q1 2020.

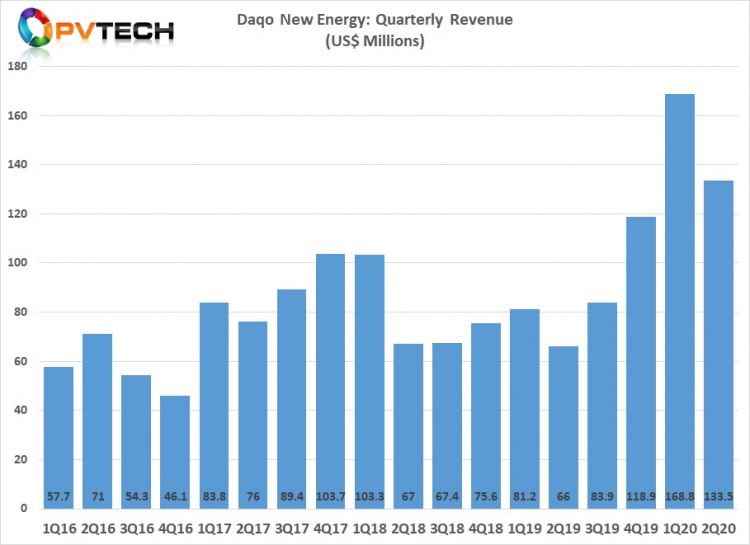

As a result of manufacturing disturbances consisting of upkeep downtime, Daqo reported Q2 2020 earnings of US$ 133.5 million, contrasted to US$ 168.8 million in the previous quarter.

Zhang commented, "The second quarter of 2020 was an especially tough time for the polysilicon market. Starting in late March, the international spread of COVID-19 as well as related lockdowns, particularly in the US, Europe and specific emerging markets, caused significant interruptions to demand for solar PV products. End-market consumers delayed module orders as well as deliveries because of uncertainties about the period and also financial effect of the pandemic, as well as logistical challenges.

" This brought about short-term market unpredictability as well as volatility across the whole solar PV industry during the second quarter. This uncommon market atmosphere, with its sharp and also unexpected decrease in need, caused considerable negative influence to polysilicon rates for the quarter. Luckily, the effect was temporary, as well as the market began to recoup in May with orders and need normalizing in June, sustained by a strong end-market in China as well as abroad. We delight in that despite such difficulties dealt with by the sector throughout the period, Daqo New Energy had the ability to produce positive earnings for the quarter, additional demonstrating the stamina and also strength of our service design and also our tried and tested low cost framework."

Gross profit was US$ 22.7 million in Q2 2020, compared to US$ 56.6 million in Q1 2020. Gross margin was 17.0% in Q2 2020, compared to 33.5% in Q1 2020.

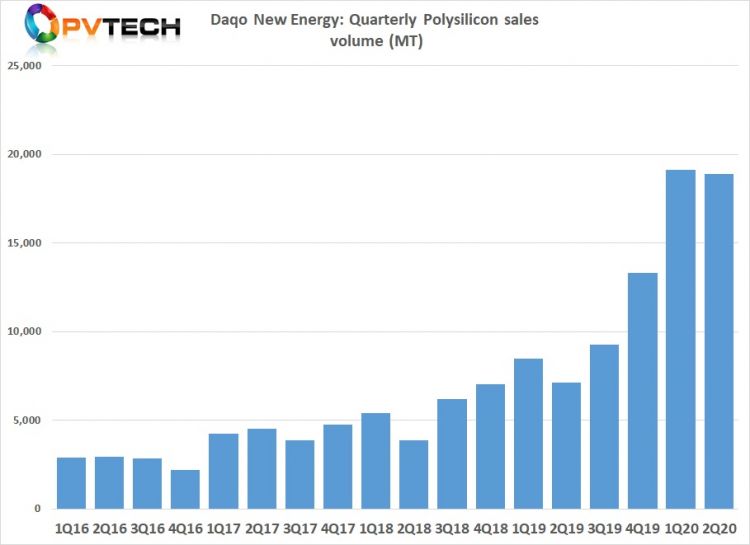

Polysilicon sales quantity was 18,881 MT in Q2 2020, contrasted to 19,101 MT in Q1 2020.

Daqo stated it anticipated to produce roughly 17,500 MT to 18,000 MT of polysilicon as well as sell around 17,000 MT to 17,500 MT of polysilicon during the third quarter of 2020.

For the complete year, production support was the same at roughly 73,000 MT to 75,000 MT of polysilicon.

Also read