Counting Cash in Paris Aligned Pathways

- Projected energy financial investment demands under IEA and IPCC de-carbonization scenarios

As policy makers seek to maintain worldwide CO2 emissions in check, discussion swirls over how much resources will certainly be required to shift swiftly however smoothly from fossil fuel dependence to cleaner resources. The financial, service and policy-making communities lack agreement over what energy investment is compatible with 1.5 ° C"paths". This work checks out possibly acceptable buck arrays under 4 of the world's finest publicized Paris-aligned scenarios.

While many have actually prepared lasting scenarios, we focus here on four paths produced or assessed by significant intergovernmental bodies the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC).

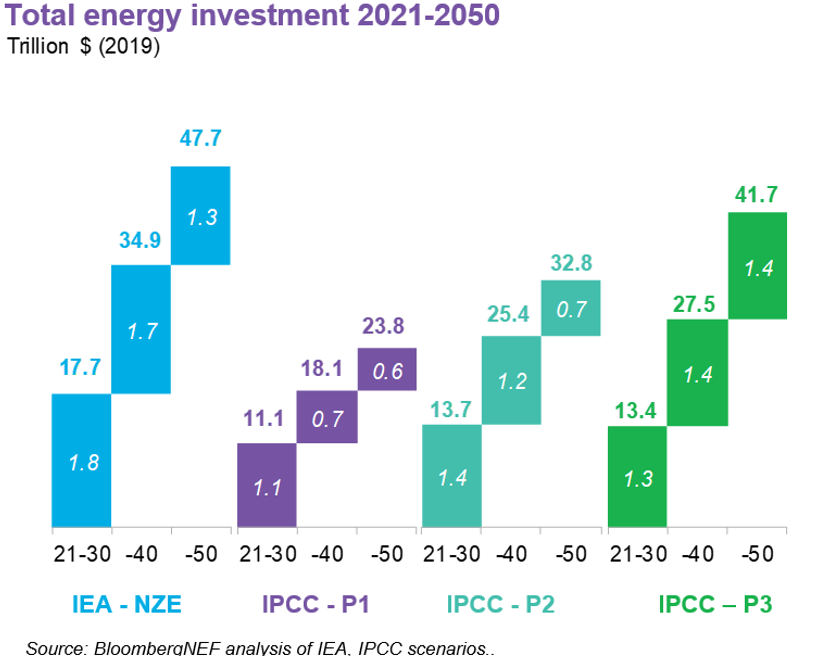

Extrapolating from three IPCC scenarios and also one IEA scenario, BNEF pegs needed investment at $1.1-1.8 trillion per annum through 2030. Via 2050, funding needs vary $0.6-1.7 tr/yr.

Most of fossil financial investment goes to preserving delivery and also usage facilities required to make sure the globe transitions smoothly to cleaner resources. Oil stands to get most investment, followed by natural gas. Coal trails far, much behind falling practically to absolutely no not long after 2030-- essentially quiting except for upkeep of existing facilities.

Renewables investment differs but accounts for around 75% of investment in electrical energy supply. Investments to 2030 array from $0.7-1.0 trillion. To 2050 the range of yearly investment in different scenarios varies from $0.3-1.0 trillion mirroring the different courses each scenario requires to get to 1.5 ° C.

Download report:

BNEF_EIRP-Phase-One-Climate-Scenarios

Also read