Cost of New Renewables Temporarily Rises as Inflation Begins to Bite

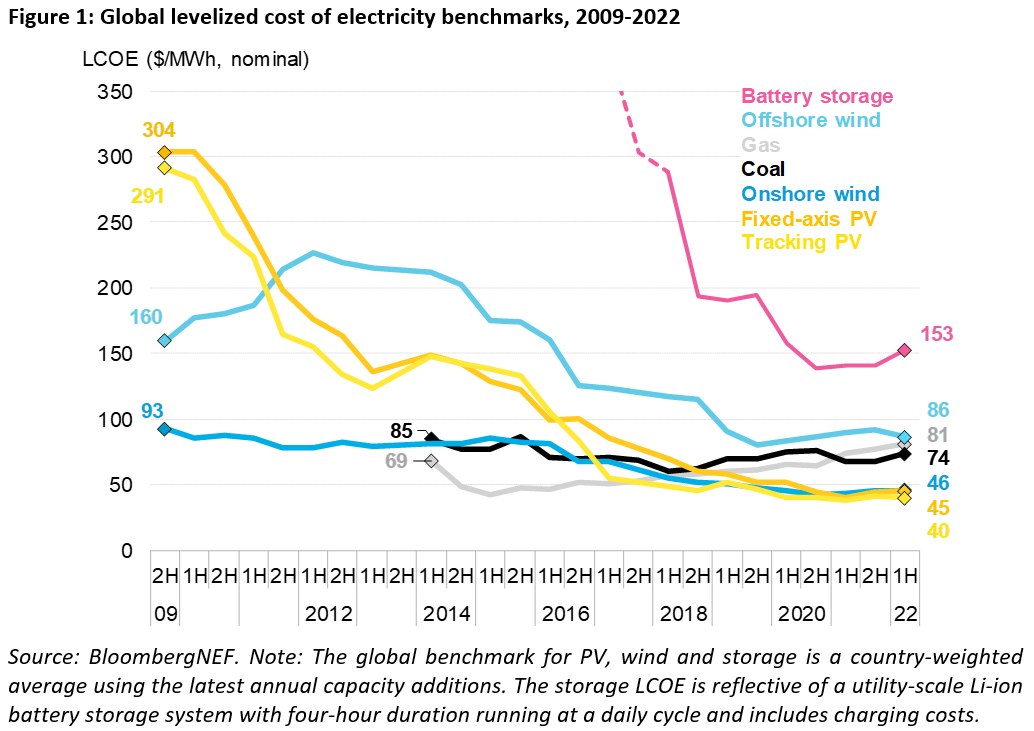

- The cost of new-build onshore wind has actually risen 7% year on year, as well as fixed-axis solar has leapt 14%, according to the current evaluation by study company BloombergNEF (BNEF). The worldwide benchmark levelized cost of power, or LCOE, has actually temporarily pulled away to where it was in 2019. Cost rises are connected to rises in the cost of materials, freight, fuel as well as labor.

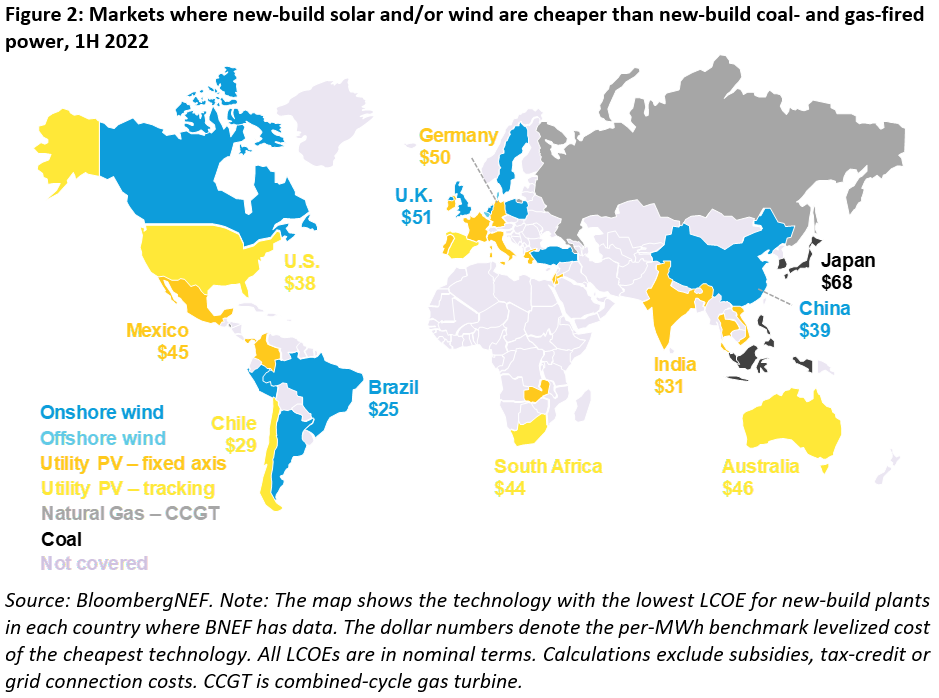

BloombergNEF's estimates for the global LCOE for utility-scale PV as well as onshore wind rose to $45 and $46 per megawatt-hour (MWh), specifically, in the very first half of 2022. In spite of shedding some ground, this still marks an 86% as well as 46% decrease because 2010 in small terms. Worldwide standards hide a series of country-level estimates that vary according to market maturity, resource schedule, project features, regional funding problems as well as labor costs. The most inexpensive renewable power projects in the initial fifty percent of 2022 had the ability to accomplish an LCOE of $19/MWh, as in best-in-class onshore wind farms in Brazil, and also $21/MWh for tracking PV farms in Chile, and also $57/MWh for overseas wind in Denmark. If the offshore transmission costs are omitted, the latter estimate falls to $43/MWh.

In spite of short-lived cost rises for renewables, the void to nonrenewable fuel source power generation continues to widen as a result of fuel and also carbon prices rising even quicker. New-build onshore wind and also solar projects are now around 40% less than BNEF's worldwide criteria for new coal- and also gas-fired power. The latter cost at $74 as well as $81 per MWh, specifically.

While need for low-carbon technologies in the energy market got better highly in the 2nd fifty percent of 2021, supply has actually battled to keep up. International supply chains were damaged by investment deferrals, staff layoffs, early retirement of possessions as well as lockdowns. Profession flows have been disrupted by difficulties in logistics and also transport, profession obstacles, and a re-wiring of partnerships complying with Russia's intrusion of Ukraine.

Shipping rates from Asia have actually fallen from their top in September 2021 but are still five times higher than in 2019. Delivering paths from Asia are essential to supply photovoltaic panels, inverters, batteries as well as other parts. A lot more just recently, labor costs started to rise. In the United States, labor costs 16% greater than 18 months back. Because February 2022, the cost of key steels, including aluminum, copper, cobalt and also molybdenum has gone down, yet continues to be reasonably high.

Amar Vasdev, a co-author of the report at BNEF, commented: "These cost hikes mark a rough spot for renewables, however not an inflection factor. We see a go back to lasting innovation cost decline trajectories as need remains to be solid, supply chain stress simplicity and manufacturing capacity, specifically in China, comes back on the internet."

The battery storage market is particularly conscious commodity rate volatility. Our battery LCOE criteria sits at $153/MWh today, up 8.4% contrasted to 1H 2021. Costs for lithium carbonate, one of the key inputs for lithium-iron-phosphate (LFP) battery systems, rose 379% over the past year. Materials hedging for projects appointed in 1H 2022 is delaying the impact of rising material costs. BNEF's sensitivity evaluation reveals that system costs subject to 2022 commodity costs should be 22% greater year-on-year at $323/kWh in June 2022, compared to $264/kWh in June 2021. Nevertheless, projects commissioned over the last 6 months would certainly have likely hedged their supply during 2021, prior to the steep rise in material costs.

Renewables continue to be the most affordable resource of new bulk power in nations consisting of two-thirds of the world population as well as nine-tenths of electrical energy generation.

David Hostert, global head of business economics as well as modeling at BloombergNEF said: "Low-carbon technologies may be insulated from a financial downturn, yet they are not isolated. There is additionally a danger that lesser-developed economic situations will be disproportionately influenced by price hikes. Leading up to COP27 in Egypt in November, added interest ought to be paid to these markets as it will certainly be essential to make sure they don't fall back as well as shed useful time in the race to net zero."

Also read