Climate-Tech VC Investing Tops $17bn in 2020

Mar 18, 2021 06:19 PM ET

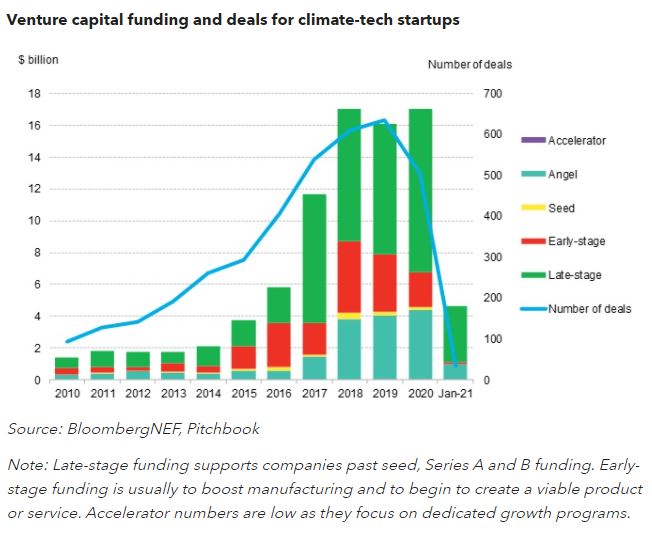

- ' Climate tech 'is a label for the emergence of innovations resolving the climate crisis, generally targeting both mitigation as well as adaptation. With lessons gained from the clean-tech boom as well as bust, investor think climate technology can be rewarding while assisting the atmosphere. A record $17 billion of resources was poured into climate-tech start-ups last year.

BloombergNEF categorizes climate-tech financial investment right into 6 key modern technology motifs: energy change, transport as well as brand-new movement, farming and also land-use, climate and also woodlands, decarbonizing sector and structures, as well as the round economic climate as well as brand-new products.

In this piece we profile Total Carbon Neutrality Ventures, which has changed its financial investment thesis to focus specifically on climate tech as its parent firm Total SE moves a lot more toward sustainability. We likewise include our normal news and VCPE financing areas.

- In January, investments and projects in expert system (AI) remained to grow, from Asia to the Middle East. On January 12, South Korea's ICT ministry claimed it will certainly spend $114 million in AI chips this year as well as set an objective of having 20% of the international AI chip market by 2030. Following this, Unilever and Alibaba revealed a collaboration called the 'waste free globe initiative' that utilizes AI-based maker learning to identify as well as sort waste plastics. On January 31, Saudi Arabia's Ministry of Energy announced that a brand-new AI center will be constructed to assess AI techniques in the energy market.

- Digital market startups raised practically $2 billion in January-- the biggest month because BNEF's records started. Capitalists again compensated AI start-ups and also chip manufacturers, consisting of $700 million to 4Paradigm, $279 million to Enflame and $400 million to Horizon Robotics.

- 2020 was the greatest year on record for climate-tech startup financial investment, with $17 billion spent internationally. Most of this financial investment was in late-stage startups from a selection of brand-new climate-tech funds, resident clean-tech funds and business investor (CVCs). There was a hefty local skew towards the U.S. and also China, both areas with focused resources in the transport/new movement industry: what appears to be one of the most preferred area of climate-tech financial investment throughout funds.

- While climate tech is the brand-new warm topic-- particularly in Silicon Valley-- there have actually been VCs investing in clean energy as well as climate themes for decades. We would certainly specify climate technology as consisting of all significant clean-tech topics while additionally addressing climate adjustment through technologies to attend to mitigation and also adaptation. While both terms include tidy energy (wind, solar, biofuels etc.), and also transport, climate tech also consists of ag technology, carbon capture and also technologies for mapping carbon sinks/forests.

- Mainstream VC/PE companies as well as stars are seeing guarantee in climate tech-- highlighting that the pattern is likewise getting to non-climate or clean energy-focused investors. Three of the biggest VC/PE firms made big announcements in January. In the first week of January, TPG revealed an exclusively climate-related fund, TPG Rise Climate, targeting solar, wheelchair as well as farming. While Union Square Ventures announced the close of its $162 million climate fund, currently having made one investment in a satellite company to boost forests. Elon Musk's $100 million tweet for carbon capture modern technologies made headlines, as well as Robert Downey Jr.'s new FootPrint Coalition Ventures fund was introduced.

- We profile Total Carbon Neutrality Ventures (TCNV), which was relabelled in 2019 from Total Energy Ventures to show the new concentrate on carbon-neutral and also negative emissions innovations. TCNV runs a $400 million evergreen fund, targeting modern technologies that can be made use of for the core organization of Total SE, and that have worth to scale worldwide. The fund's largest investments are in transportation and also new mobility, as well as energy change modern technologies (such as wise energy as well as energy accessibility software program). Its numerous partnerships and ambitions for a $2 billion clean hydrogen fund place it in a strong position for the future of climate-tech financial investment.

Also read

- ARENA Backs Luminous Robots for Solar Innovation Boost

- TotalEnergies Expands Caribbean Renewables, Divests Half Stake of Portuguese Portfolio

- Zelestra Clinches $282m Financing for 220-MW Aurora Solar-Storage Hybrid Project

- Enfinity Boosts US Credit Facility to $245m for Solar Growth

- Ellomay Offloads Nearly Half of Italian Solar Portfolio to Clal