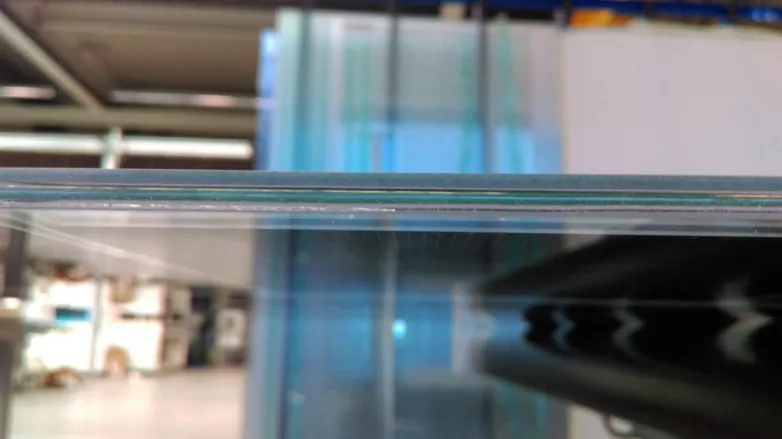

Chinese solar glass company maintains 24-hour heaters running throughout Covid situation

- Xinyi Solar has actually revealed an additional excellent collection of figures and also strategies another 1,000-ton-per-day assembly line this month plus a new mine to source resources in September.

Situation? What dilemma? Chinese solar glass maker Xinyi has actually reported another remarkable collection of first-half figures despite the Covid-19-related shock which impacted the country throughout the first three months of the year.

Whilst confessing a legal holiday period prolonged by the pandemic afflicted processing such as tempering as well as covering of its products, Xinyi Glass reported its solar furnaces continued to operate undisturbed throughout the very first 6 months of the year.

That non-stop manufacturing aided drive glass sales worth HK$ 3.49 billion (US$ 450 million), up from HK$ 2.92 billion in the same period of last year, as the business published complete first-half net profits of HK$ 1.61 billion-- up from HK$ 1.07 billion-- as well as recommended an interim returns be increased from the HK$ 0.055 per share given out in the first 6 months of last year to HK$ 0.085.

Although returns were additionally up in the less important solar project service-- from HK$ 1.02 billion in 1H last year to HK$ 1.1 billion-- and fell in the engineering, procurement as well as building solutions business, from HK$ 47.6 million to HK$ 33.8 million, it was the glass department which caught the eye.

Rising glass rate

A climbing percentage of sales of even more financially rewarding slim glass and also a rising ordinary asking price were just partly counterbalanced by currency exchange rate losses from the renminbi as well as Malaysian ringgit against the U.S. dollar, for a firm with production facilities in China and also Malaysia. Actually, although Covid-19 saw the asking price of solar glass 17% lower at the end of June than at the beginning of the year, the six-month typical rate was still 3-5% more than throughout the same period of last year. That added up to an exceptional gross profit margin increase of 11.6 percentage factors for Xinyi's solar glass, which offered a 38.9% mark-up during the first half.

Although the supplier noted the uncertainties influencing need in a Covid-19 worldwide market, the company is set to press head with strategies to open up a 2nd 1,000 ton/day-melting-capacity solar glass production line in Guangxi self-governing region this month, having actually debuted a facility of the same range there at the end of June. Xinyi said it would certainly open a fresh 1,000-ton line in Anhui in each quarter of next year and also is likewise on the right track to open its very first low-iron silicon sand mine in Guangxi in September, assisting to further bear down on raw material prices.

Solar projects

The business reported it had gotten 190 MW of solar project capacity throughout the very first fifty percent, with the acquisition of 3 project business; had developed 270 MW of capacity in China-- with 100 MW of it of unsubsidized 'grid parity' standing; as well as intends to preserve its generation ability target of including 600 MW of projects this year. The company asserted to have 2,920 MW of solar capability, consisting of 156 MW of PV roofs, at the end of June.

The investment essential to browse the international solar wave has actually seen Xinyi's cash money reserves dwindle from HK$ 4.35 billion at the end of June last year to HK$ 2.79 billion at the halfway point this time around, but the annual report preserves a healthy and balanced look and that investing included HK$ 12.1 million donated to fight the spread of the coronavirus, in addition to the increased reward.

Also read