Chinese developer might shed $140m paid in speculative project advancement civil liberties

- Bailed-out solar project firm Panda Green disclosed it did not set any type of terms for settlement of RMB1 billion paid to 3rd parties in 2017 as down payments to safeguard possible project civil liberties.

State-owned Chinese solar developer exposed in its yearly outcomes that, amongst a multitude of problems write-downs which capsized it to a RMB3.6 billion (US$ 508 million) bottom line in 2019, it is dealing with the loss of greater than a billion renminbi pertaining to project legal rights down payments paid to third-parties for which it put down no methods of remedy if the centers never ever emerged.

In yearly numbers released late last month, the developer-- which considered a HK$ 1.79 billion (US$ 231 million) bail-out from state-owned Beijing Energy Group in February-- introduced greater than RMB4 billion in problems fees for in 2014.

Those write-downs consisted of RMB1.02 billion paid in financial investment down payments to unknown 3rd parties in 2017 to protect prospective future project legal rights. Amazingly, the Panda Green unaudited numbers mention that, after no development was seen: "Management of the team doubted concerning the progression of the projects' purchases or the capacity of reimbursement from these events must the appropriate projects can not [sic] go on." The record takes place to state lawful letters have actually been provided requiring reimbursements yet "monitoring of the team was not hopeful for the team and also the recuperation has actually acknowledged a disability fee on financial investment down payments of about RMB1,022 million throughout the year."

Disabilities

That was simply part of a tale of woes connected to the different problems, that included a RMB1.01 billion appealed solar project advancement civil liberties and also RMB545 million for projects obtained in June 2013 for which the Chinese federal government has actually given that priced estimate a minimized 'criteria' number to assist programmers that will certainly need to bid for the aid degree. An additional RMB200 million was made a note of since the board was "not positive on the recuperation of particular monetary possessions" as well as additional losses were connected with the fire sale of projects Panda Green was pushed into as it rushed to pay for financial debts as well as offload involved resources dedications prior to the Beijing Energy bail-out-- referred in the record as the firm having actually "effectively presented Beijing Energy to be its biggest investor." In addition to all that, the firm approximated it would certainly need to cross out RMB756 million from under-performing solar projects in its profile.

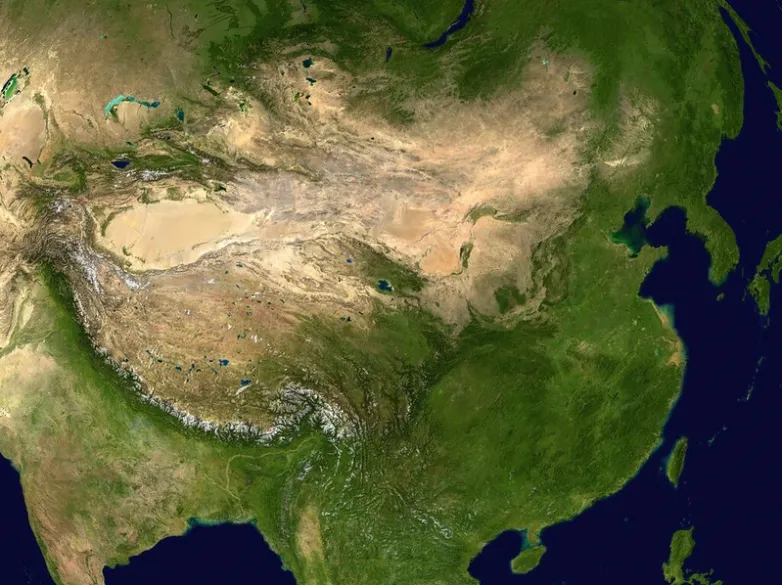

The business's distress pertaining to its essential 75% holding in growth civil liberties to a 5 GW hydropower project which is still waiting for ecological authorization brought much more discomfort in 2014. The federal government of Tibet, which holds the equilibrium of the civil liberties, minimized the potential feed-in toll (FIT) to be spent for the hydroelectricity from RMB0.44/ kWh (US$ 0.062) to RMB0.35 in May 2018 and afterwards modified it down once more in June, to RMB0.341. Although that step is just on a test basis for the remainder of this year, the Panda Green board lugubriously mentioned it had little assumption the FIT would certainly go back to RMB0.44.

Loaning

The Beijing Energy bail-out-- the most recent straight of money shots from Chinese state-owned entities-- allowed the developer to long-lasting financial institution loanings from RMB16.65 billion at the end of 2018 to RMB10.68 billion 4 months earlier as well as has actually considering that seen the significant investor finance US$ 150 countless brand-new lendings from the state-owned China Construction Bank. Nevertheless, the lines of debt Panda Green was compelled to enroll in by the hold-up of the Beijing Energy financial investment saw its present loanings climb from RMB5.42 billion in 2018 to RMB7.58 billion by the end of in 2014.

With mostly all its solar projects in China, state-owned Panda Green's reliance on the authorities in Beijing was once again underscored by the truth 82% of business' receivables were represented by aids owed by the State Grid Corporation of China and also 17.7% by settlements from the Inner Mongolia Power Group Carbon Monoxide Ltd

U.S.-owned expert Wood Mackenzie the other day recommended relocate to decrease renewable resource aids in the Asia-Pacific area need to be stopped due to the fact that the Covid-19-related dive in nonrenewable fuel source rates is holding up grid-parity objectives for tidy power by years. The Panda Green board will certainly be busily wishing the individuals that prepare reward plan in the hallways of power will certainly have born in mind.

Panda Green is readied to release its audited numbers by May 15, after capitalizing on a dispensation to hold off the day as a result of Covid-19 interruption in China.

Also read