China's Solar Giants Try to Dominate Hydrogen Power

- Companies accelerate electrolyzer production, look for to lower rates

- Industry still needs crucial rewards that assisted solar and also wind

Chinese firms spent ten years boldy navigating to end up being the leading players in solar power. Now they're seeking to lead the way in creating the following big thing in clean energy: hydrogen.

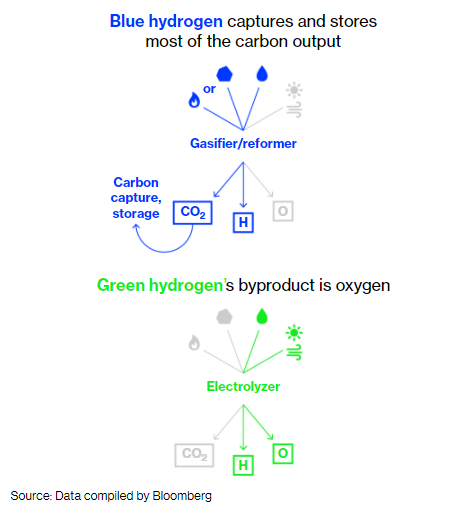

Leading solar producers consisting of Longi Green Energy Technology Co. are ramping up the production of electrolyzers, the tools needed to make green hydrogen, the cleanest form of the fuel. They are accelerating investments on a bet that a market will certainly grow as industries and customers switch over to lower-carbon fuels.

To find out in front in the worldwide hydrogen race, Chinese companies are complying with the exact same playbook used to dominate solar-- slashing costs and also manufacturing costs, considerably raising installments and also increasing the growth of new technologies.

" In the solar supply chain, Longi played the role of leading the industry's progression with technology," stated Wang Yingge, replacement basic manager of Longi's hydrogen energy technology system. "In hydrogen tools, Longi will certainly continue to concentrate on and also invest heavily on research and development."

Longi intends to build 1.5 gigawatts of production capacity of electrolyzers by the end of following year, up from 500 megawatts currently. The world's largest renewable asset proprietor, State Power Investment Corp., aims to build 10 gigawatts of electrolyzer production capacity by 2027.

China will certainly account for more than 60% of international electrolyzer setups worldwide in 2022, with the marketplace enhancing fivefold over this year, according to BloombergNEF. The China Hydrogen Partnership said previously this year that the fuel can compose 20% of the country's energy mix by 2060, the due date that President Xi Jinping has actually established for China to end up being a carbon-neutral nation.

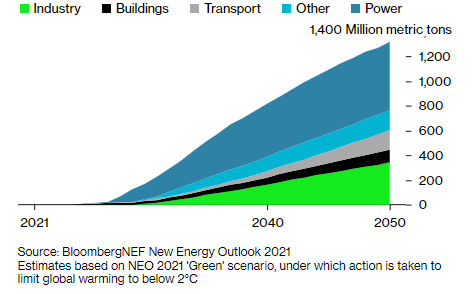

Demand Potential

Power could represent about 42% of clean hydrogen demand by 2050

Yet despite the positive overview, the solar giants deal with high challenges in developing the hydrogen market. The industry still has a long way to go to lower rates, and it is missing the essential federal government motivations that helped light a fire under the solar and wind industries.

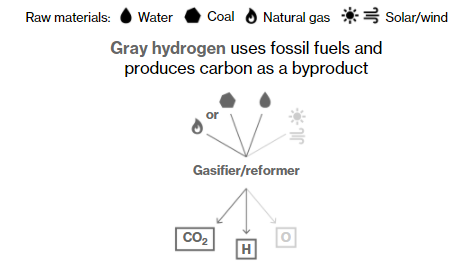

Green hydrogen is much from affordable compared to other fuels. Hydrogen created by renewables currently costs a minimum of $3.22 per kg in China, almost double the price utilizing coal, according to BloombergNEF. And dirtier gray hydrogen, created by nonrenewable fuel sources, makes up the mass of China's hydrogen market. It represented greater than 63% in 2020, compared with only 1.5% for green hydrogen, according to a white paper published by China Hydrogen Partnership.

" The most significant difficulty ahead is the expense," claimed Libby Zhong, co-leader of Ernst & Young's higher China energy and also sources sector. Without plans like those that enhanced solar as well as wind power growth, it will certainly be extremely tough for green hydrogen to obtain adequate support at this early stage, she said.

China has yet to introduce a nationwide hydrogen strategy, as well as the only state-wide subsidy program is limited to sustaining fuel cell batteries, which will directly drive the intake of hydrogen however will not always prefer a clean production procedure or boost electrolyzer growth.

Longi's Wang stated he really hopes the federal government will certainly present subsidy programs that establish benchmark prices for hydrogen created by renewables, as well as expects the rising price of producing carbon in China might improve green hydrogen intake. The company forecasts the rate for electrolyzers will fall more than 30% in the next three to five years.

Xi'an- based Longi climbed as long as 2.8% in Monday trading as of 1:45 p.m. in Beijing.

Another big difference in between the advancement of solar panels as well as hydrogen electrolyzers is the market they're marketing into. While solar customers can plug panels right into existing grids and immediately begin marketing the electrical power, enabling quick fostering, the uses for hydrogen are more minimal and also disjointed.

China's state-owned giants are attempting to close that gap. Sinopec, the leading oil company, has actually begun to build the world's largest green hydrogen project, with a capacity to supply 20,000 tons of the clean fuel yearly beginning in mid-2023.

Over one-third of state-owned business are making prepare for hydrogen production, storage space, circulation as well as utilization, according to China's State-Owned Assets Supervision and also Administration Commission. Much of the excitement is being driven by pressure to cut exhausts to fulfill climate targets and the increasing cost of carbon, claimed Mao Zongqiang, a teacher at the Institute of Nuclear and also New Energy Technology at Tsinghua University in Beijing.

Like the Rainbow

While the state-owned firms are making larger bets across the board on hydrogen, personal firms such as Longi and also Sungrow Power Supply Co. for now are sticking with the more restricted focus on electrolyzer advancement.

Longi hasn't built capacity in downstream applications such as fuel cell batteries or hydrogen production as it "has not seen a clear direction" of where the greatest potential will certainly be, Li Zhenguo, president of Longi, said in a recent meeting.

However, the solar giants anticipate to stay at the forefront of the industry as firms from oil refiners to steel-makers gravitate toward hydrogen.

"Solar mostly addresses the carbon decrease issue in the electrical power area, yet as the commercial sector strengthens exhaust cuts, we see hydrogen as a vital clean additional energy," Longi's Wang said.

Also read