China Installed Record Amount of Roof Solar in 2021

- Bigger scale projects stuttered because of delays and also high costs

- Chinese lenders lowered borrowing costs for a second month

China placed a record variety of photovoltaic panels on roofs last year as growth in suburbs surpassed installations on solar farms.

A total of 53 gigawatts of solar capacity was integrated in 2021, near to the all-time high embed in 2017, with more than half originating from rooftop installments, according to the National Energy Administration.

China currently has 108 GW of roof solar, more than anywhere else, after including 29 GW in 2021, the NEA claimed. The majority of the added capacity was installed in the fourth quarter as developers hurried to meet a subsidy due date.

At the same time, larger scale installments have actually stuttered because of high costs as well as project delays. China's main sector body had approximated earlier in the year that complete enhancements in 2021 can get to as high as 65 GW, before it was required to cut its forecast.

But the solar team expects development to increase in 2022 to more than 75 GW, smashing the previous record. It'll be driven by the production of substantial clean energy centers in the interior of the country along with the federal government's support for residential solar.

Also after the subsidy has actually lapsed, urban installations must remain to reinforce growth. Regional authorities are now enabled to reduce costs by buying wholesale, while a pilot program introduced last year to improve uptake brought in hundreds of cities and also towns. By the end of 2023, individuals will be anticipated to mount panels on 50% of the offered location at federal government buildings, 40% at institutions and healthcare facilities, 30% for industrial structures and 20% for rural homes.

Shandong in eastern China has actually revealed the most enthusiasm for roof solar, including more than 12 GW in the past two years. However the province now has a lot capacity that the authorities are considering reducing supply during periods of low demand over the Lunar New Year, according to local media.

Today's Occasions

( All times Beijing unless noted).

- China farm ministry instruction on 2021 at 15:00.

- Fengkuang Coal Logistics on the internet market workshop at 15:45.

- China's 3rd batch of Dec. trade information, including country breakdowns for energy and commodities.

- China's NEA may release 2021 power industry data.

- USDA regular crop export sales, 08:30 EST

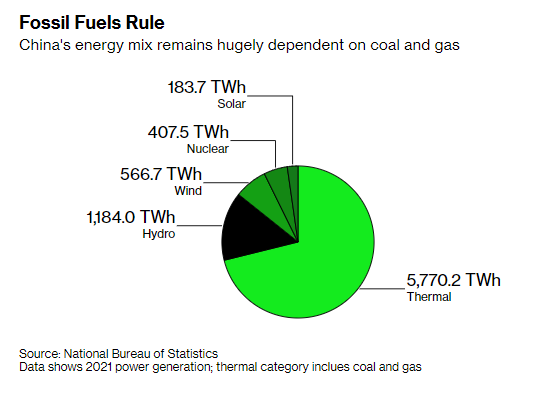

Today's Chart.

China is as reliant as ever before on fossil fuels. Last year, the share of coal and gas in power generation was stuck at 71%, the like 2020. For all of the headway it's made in expanding clean energy, China's expanding economic climate meant that more outcome from all of its energy resources was required to keep the lights on. And coal, the dirtiest fuel, is still the mainstay.

On The Wire.

China is nearing completion of a two-year examination into the oil industry that's resounded throughout the field as it involved the greatest state-run business to a host of smaller independent refiners.

China's central bank established its strongest referral rate for the yuan in three years in a sign it's loosening its grasp on the currency amid an unrelenting rally

China, the world's biggest purchaser of liquefied natural gas, started an extraordinary initiative to market its supply, alleviating worldwide fuel scarcity is afraid that have triggered record costs this winter season.

Chinese banks reduced borrowing costs for a second month after the PBOC cut plan funding rates and vowed more reducing to support the economy.

- China Officially Purchases Iranian Oil for First Time in a Year.

- China Shipping Giant Pays Mega Bonuses 30 Times Worker's Salary.

- Soaring Jet Fuel Costs Pile Pressure on Asia's Hard-Hit Airlines.

- Las Bambas Signs Deal With Some Regional Leaders: Rtrs.

- Mysteel Sees Lower Blast Furnace Use Rates in February as well as March.

- Worst May Be Over for China Builders on Presale-Fund Rule Easing.

- Alcoa Chief Executive Officer Sees Rising Demand, Supply Woes for Red-Hot Aluminum.

- China Carbon Trading Could Be Jackpot for Some Cement Makers.

- China Debt Distress Could Cause Credit Scores Contraction: Economics.

Also read

- RheinEnergie Taps Cologne Rooftops for 18-MW Infineum Solar

- Poland funds eight energy clusters, thousands of rooftop solar installs

- Agile Energy Secures Equity for 200MW Australian Solar-Plus-Storage

- Bahrain’s Record Rooftop Solar Powers Steel Decarbonization

- New Solar Drain Clip Aims to Improve Panel Efficiency in Humid Climates