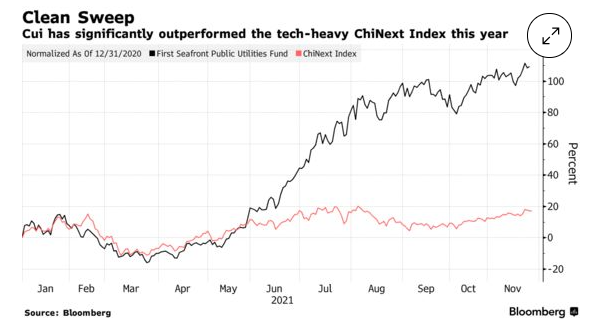

China Fund Manager Gaining 109% Is a Die-Hard Renewables Fan

- Cui Chenlong has been banking on batteries, solar power shares

- Beijing's carbon neutral goals have buoyed belief on industry

Do not let evaluations quit you from going after a rally that can extend 2 to 3 years, claims a top Chinese equity fund manager who is doubling down on China's carbon neutral passions.

Cui Chenlong of Qianhai Kaiyuan Fund Administration Co. said he is sticking to lithium batteries and also the solar power supply chain as Chinese firms in the fields are likely to lead an international race to reduce carbon exhausts. Cui's First Seafront Public Utilities Industry Equity Fund has returned 109% this year via Thursday, making it the top gainer amongst more than 1,000 peers according to Bloomberg-compiled data.

With China increase monetary rewards as well as industrial policy supports for the shift of its economic climate away from nonrenewable fuel sources, renewables shares account for almost half of the top 10 entertainers in the benchmark CSI 300 Index this year.

" The substantial gains in renewables shares are simply the start of their rally," Cui stated. "Every person complains eco-friendly shares are costly, however that feeling is subjective and might not precisely show the field's development capacity."

Battery manufacturer Contemporary Amperex Technology Co. has actually risen 87% this year to trade at 82 times predicted 12-month revenues, exceeding the 17% gain in landmass's Nasdaq-style ChiNext. The rally has coincided with an around the world craze for electrification, which has actually sent Tesla Inc.'s shares up as much as 74% this year as well as seen U.S. electric truck manufacturer Rivian Automotive Inc. pull off the largest initial public offering of 2021.

In just 6 months, possessions under administration for the First Seafront fund broadened nearly 50 times to 16.6 billion yuan ($2.6 billion) since Sept. 30, according to the item's quarterly report. Financier need has been so strong that a daily purchase cap of 30,000 yuan has been implemented since very early September.

Shares of CATL and also peers Eve Energy Co. as well as BYD Co. have actually been among the fund's top bets because April, each increasing a minimum of 81% during the duration. In the 3rd quarter, the fund substantially enhanced holdings of state-owned electrical power manufacturers with strategies to shift to renewable resource, such as China Resources Power Holdings Co., which has leapt 82% considering that the end of June.

Solid profits of CATL, the world's largest electrical vehicle battery maker as well as an essential Tesla vendor, have actually more lifted investor confidence in the industry. Its earnings more than doubled from a year previously in the three months with September, beating market forecasts and also setting off experts to increase their stock cost targets.

Despite the fact that his unwillingness to lose out on the field's boom might place him to the test of volatility, Cui stated he will acquire on any type of dip much like what he did throughout the securities market thrashing in early March. He additionally sees chances in high-end production tools, semiconductors and innovative medications next year.

Also read