Cautious Policy Design Might Open Large Rooftop Solar Market Around The Globe

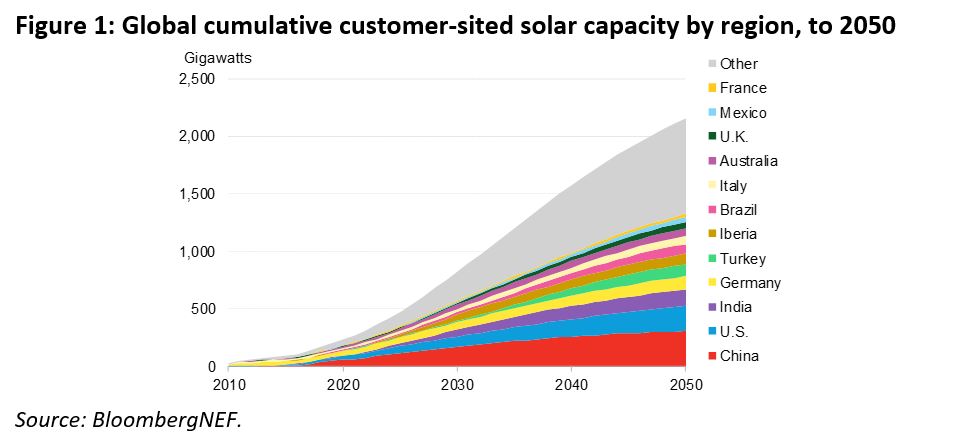

- Customer-sited solar is a significant untapped chance, which might see 167 million households and also 23 million businesses worldwide holding their own tidy power generation by 2050, according to a joint report by research firm BloombergNEF (BNEF) and Schneider Electric. These deployments will certainly unlock major decarbonization benefits, however policy and tariff design will certainly be important to enable them.

The report 'Understanding the Prospective of Customer-Sited Solar' locates that swiftly dropping prices of solar technology have actually currently made it economical for homes and also businesses to generate their own power in some markets. In Australia, as an example, the repayment duration for families buying solar has actually been favorable, at less than 10 years, given that 2013. As a result, fostering has actually currently taken off, with greater than 2.5 gigawatts of property solar included 2020 alone.

These solar installments can generate financial returns for the holding residences as well as organizations, in addition to bigger benefits in terms of carbon discharges reductions, peak tons reductions, and also employment possibility.

" Customer-sited solar is a significant possibility that's commonly totally ignored. Thanks to falling expenses and policy measures, it's currently being rapidly deployed in some markets. Its substantial scale up is most likely," said Vincent Petit, Head of the Schneider Electric TM Sustainability Research Institute, and also SVP of Global Strategy Prospective & External Affairs at Schneider Electric. "This is crucial for decarbonizing the power industry and provides massive extra consumer benefits. It's time to welcome this improvement."

Kick-starting the marketplace

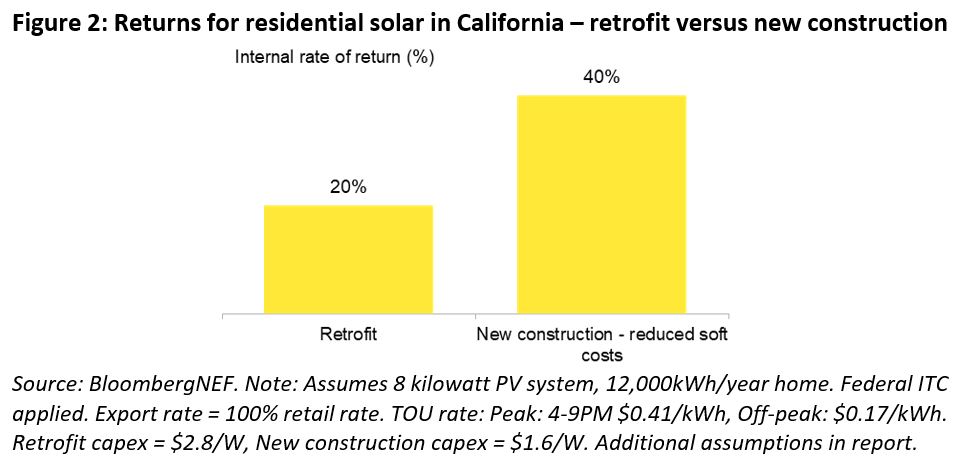

Experience shows that solar adoption mostly happens when there is an economic case for the households as well as services purchasing the technology, usually in the form of high internal rates of return (IRR) or brief repayment durations. In areas where the business economics have actually not yet gotten to such tipping factors, policy makers are presenting targeted motivations to develop beneficial market conditions as well as bring forward release.

One such instance is France, where existing motivations mean that residential solar can make internal rates of return of around 18.5% (a five-year payback), and also business installations attain 10.4% IRR (or a nine-year payback). This has actually boosted gradual growth out there, to about 500 megawatts of installations in 2020.

A key factor to consider at the early stage of market growth is to avoid an unsustainable boom. Policy layouts ought to account for the fact that solar costs will continue to tip over time, and moderate support to mirror these altering characteristics.

Solar for new-build homes as well as organizations

The economic case for adding solar throughout building of brand-new buildings is especially solid. This is because supposed 'soft expenses', such as advertising and marketing as well as sales expenses, as well as labor and building costs, can be reduced, while the benefits remain the exact same. In California, the economic instance for including property solar on existing houses is already good at 20% IRR, yet the new report approximates that this number is twice as high, at 40% IRR, when solar is included at the point of building and construction. In France, the IRR for domestic solar could be enhanced to 28% when added throughout new construction.

Presenting energy storage space as well as flexibility

As solar markets establish and grow, policy manufacturers and also regulatory authorities have to gradually shift their focus toward unlocking flexibility and urging the adoption of energy storage space. This is because high levels of solar fostering can lead to excess energy manufacturing during the day, while also perhaps destabilizing the power grid. At this phase, the enhancement of energy storage space comes to be useful, as it allows the renewable power to be stored for use throughout night hrs.

" The evolution of customer-sited solar is to include some type of flexibility, which has the ability to open a much greater infiltration of solar," claimed Yayoi Sekine, BNEF's Head of Decentralized Energy. "One of the most apparent form of flexibility is batteries, but energy storage space will certainly be available in numerous kinds, consisting of shifting demand and using electric vehicles."

Tools to motivate energy storage space consist of changed export rates (the repayments offered to solar owners when they export energy to the grid), time-of-use retail electrical energy rates (which show the reduced generation prices of solar throughout the daytime), allowing settlements for storage space to give grid solutions (often called gathering repayments), and implementation of demand fees (primarily for company clients). These levers are generally suggested to make prices extra reflective of generation and also grid prices however are likewise most likely to encourage energy storage space.

In California, as an example, minimizing export rates to 35% of retail tariffs, while it would certainly damage the business economics of solar overall, would shift the focus over to planetary systems paired with storage, which would certainly still create a 13% IRR. For industrial and commercial setups, adding so-called gathering settlements for batteries would enhance IRRs to 22.8%, making solar-plus-storage an extra appealing option than solar alone.

Also read

- Poland funds eight energy clusters, thousands of rooftop solar installs

- Agile Energy Secures Equity for 200MW Australian Solar-Plus-Storage

- Bahrain’s Record Rooftop Solar Powers Steel Decarbonization

- New Solar Drain Clip Aims to Improve Panel Efficiency in Humid Climates

- PosiGen bankruptcy spotlights US rooftop solar’s financing and policy fragility