Business solar financing rebounds in second fifty percent of 2020

- Corporate investment in solar projects got to US$ 10 billion in the 2nd half of last year, recovering from financial shock induced by COVID-19.

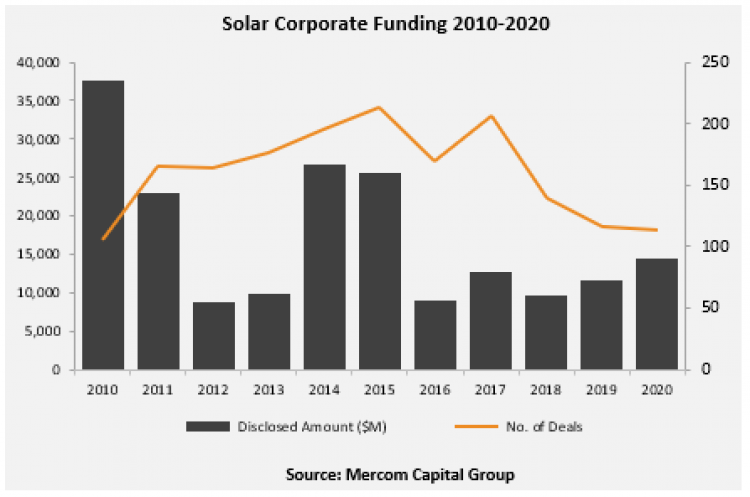

That's according to a new report from study firm Mercom Capital Group, which mentions that corporate funding for the sector increased by US$ 2.8 billion last year, aided by a rise in large-scale project financial investment and also financial debt funding.

The number for 2020 comes six months after Mercom's half-year report, which cautioned that corporate solar financing had fallen to simply US$ 4.5 billion in the first 6 months of the year because of the worldwide wellness situation and also succeeding economic shock.

An overall of 39.5 GW of large-scale solar projects were obtained in 2020, however near to fifty percent of that ability was acquired in the last 3 months of the year, with 15GW of projects purchased in Q4, reflecting a renewed self-confidence in the solar field amongst capitalists.

The rate of investment in solar projects, which in Mercom's report consists of venture capital, exclusive equity, financial debt financing and also public market funding, recoiled significantly in the second fifty percent of the year, and also climbed by near to a quarter (23.9%) throughout the whole of 2020, despite a downturn in VC financial investment.

VC funding took a tiny hit last year as financial disruption made equity capital groups extra cautious over smaller sized range financial investment. A total amount of 41 bargains were struck with VC groups last year amounting to US$ 1.2 billion, roughly US$ 200 million less than the 53 deals signed in 2019.

Although just three Initial Public Offerings (IPOs) happened in the solar market last year, they raised US$ 1.3 billion, equal to the consolidated worth of the 6 IPOs introduced in 2019. Technology designer Array upsized its IPO target in October from US$ 100 million to US$ 1 billion.

The worth of public market financing task last year more than increased last year, with solar business increasing US$ 5.1 billion with 27 deals internationally.

The numbers come after a "difficult very first fifty percent" to 2020, according to Marcom Capital's president Raj Prabhu, who added that publicly traded business in the solar sector saw "extraordinary" financial investment growth. Solar exchange-traded financing rose by 225%, he said, while the share rate of 15 noted solar business increased.

Solar property purchases, Prabhu said, "have actually become even more desired as a financial investment sanctuary, specifically in the unpredictable COVID economy."

Also read