BNEF: As Much As 194GW of solar could be installed in 2021 as investments rise

- As high as 194GW of solar PV could be set up worldwide this year, new estimates by BloombergNEF have actually anticipated, with the asset course leading a jump in energy transition financial investments throughout 2020.

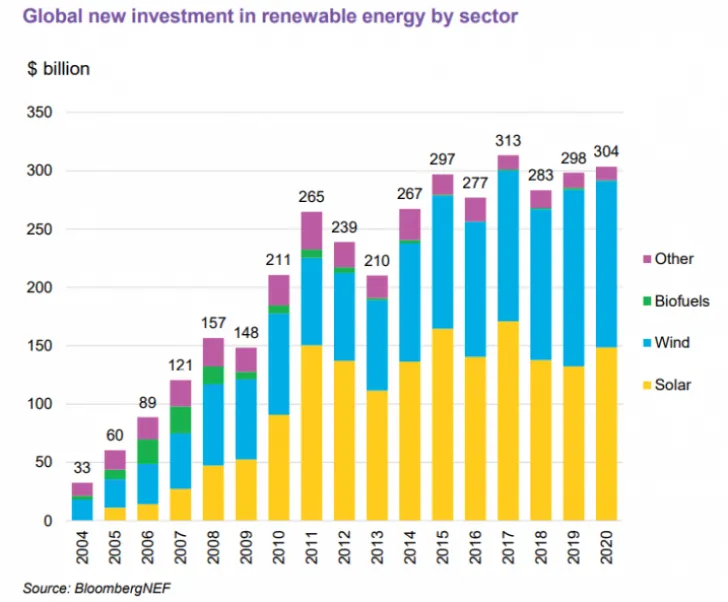

Investments in solar rose by 12% year-on-year to US$ 148.6 billion regardless of the economic slowdown induced by COVID-19, a new report issued by BloombergNEF has actually specified.

The report goes on to declare that approximately half a trillion US bucks were pumped into renewables programmer projects, systems as well as businesses last year as governments laid out new targets to decarbonise energy systems. This was the very first time investment into the energy transition has actually struck $500 billion, BloombergNEF said, with financial investment in renewables particularly rising by 2% year-on-year, it said, with the industry bring in US$ 303.5 billion in funding.

Federal governments as well as households invested an additional US$ 139 billion on EVs and charging ports, standing for a 28% increase compared with 2019. At the same time, financial investment in wind projects decreased 6% to $142.7 billion, although this is largely as a result of a fall in onshore wind dedications, according to the report.

Confidence in the solar field has shown up to rebound after financial investment in brand-new ability fell by 12% in the very first 6 months of 2020 as the pandemic hit project funding and set up public auctions.

BNEF predicts that more than 150GW of solar capability will be set up by the end of the year, greater than 13% greater than the research study company's original estimate. Nevertheless that projection rises to as high as 194GW, a number which would certainly stand for a significant jump in annual solar PV release.

At the same time ordinary module costs, which sat at around US$ 0.20 per Watt last year, could be up to US$ 0.18 in 2021.

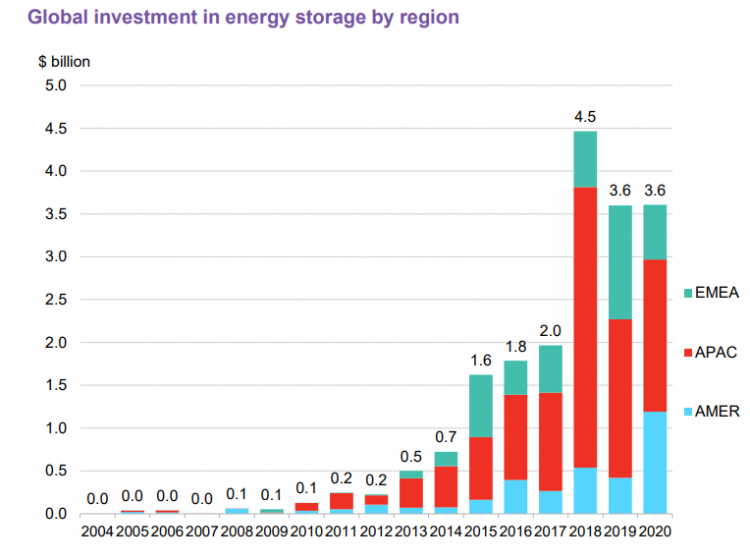

Energy Storage holds consistent

A total amount of US$ 3.6 billion was committed to energy storage projects in 2020, in-line with figures for 2019. This was driven by accelerated growth in the Americas, which saw "record financial investment" in energy storage space last year at a price of US$ 1.2 billion, although the report discovered a marked stagnation in investment in Europe, the Middle East and Africa, where funding stood at US$ 600 million.

The world's largest battery storage system just recently came online in California, while the 200MW/200MWh SPIC Huanghe New Energy Base project in Qinghai Province, China was also finished last year, assisting to counter a slowdown in the larger energy storage industry's growth last year, the report claimed. Nevertheless, it deserves noting that some markets continued to see rapid development in energy storage deployments. China released 533.3 MW of new electrochemical energy storage space projects in the first nine months of 2020, a boost of 157% contrasted to the previous year.

Jon Moore, chief executive of BNEF, said that although the COVID-19 held back development on some projects, investment in wind and solar has actually remained durable, while spending on EVs went beyond expectations.

Moore stated that plan passion is "clearly increasing as even more countries as well as organizations devote to net-zero targets, as well as eco-friendly stimulus programs are beginning to make their presence really felt." Simply over half (54%) of 2016 exhausts are currently under some type of net-zero commitment, he added, which "need to drive raising investment in the coming years."

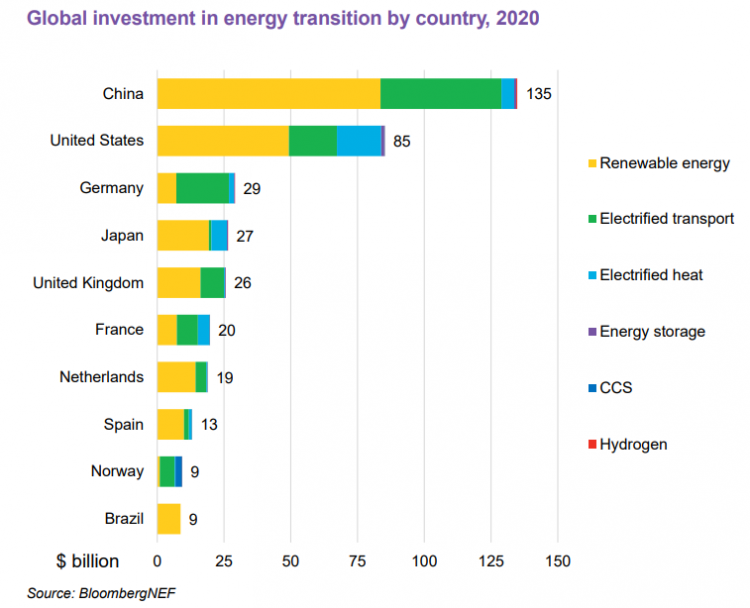

European markets drive growth

Although well-known markets like the US and China stood for the lion's share of renewables investment, BNEF's information recommends that European nations, especially Germany, the UK, France, the Netherlands and also Spain, drove much of the development in energy change financing last year. Investment in European renewables increased 67% last year compared with 2019. Financial investment in renewables capacity also increased 52% in Europe to get to US$ 81.2 billion, its highest rate because 2012.

The figures were released throughout a week of conversations bordering prudent energy policy-making as well as financial investment as part of the International Renewable Energy Agency's 11th assembly, which kept in mind the significant function the personal monetary field has begun to play in renewables deployment. Tomas Anker, Climate Ambassador and also Prime Minister's Climate Envoy for Denmark, informed panellists at the digital event on 19 January that pension funds particularly have actually ended up being "severe companions" to the renewables market in project investment. Danish pension funds had boosted environment-friendly financial investments by 56% throughout last year to around US$ 8 billion, he stated. Around 1GW of solar projects are currently set to be developed by Better Energy in Denmark and also Poland after the team protected both equity as well as long-lasting project funding from Danish fund Industriens Pension at the beginning of December.

However Tareq Emtairah, director of energy for the United Nations Industrial Development Organisation, noted that financiers did not have passion in what he called "frontier markets", which battle with energy deficiencies.

" We do not see enough investment in nations with demand for even more facilities," he said, adding that personal money teams "require to build more capacity with neighborhood money establishments" to expand the renewables field in creating nations where energy infrastructure is already an issue.

Albert Cheung, head of analysis at BNEF, said that both renewable power generation and electric transportation businesses taken advantage of "hefty inflows" last year, but cautioned that they will certainly be reliant on ongoing financial investment development as expenses drop.

" Technologies such as electrical warm, CCS and also hydrogen are just bring in a portion of the investment they will require in the 2020s to aid bring discharges controlled," he stated. "We need to be discussing trillions annually if we are to fulfill climate objectives."

Also read